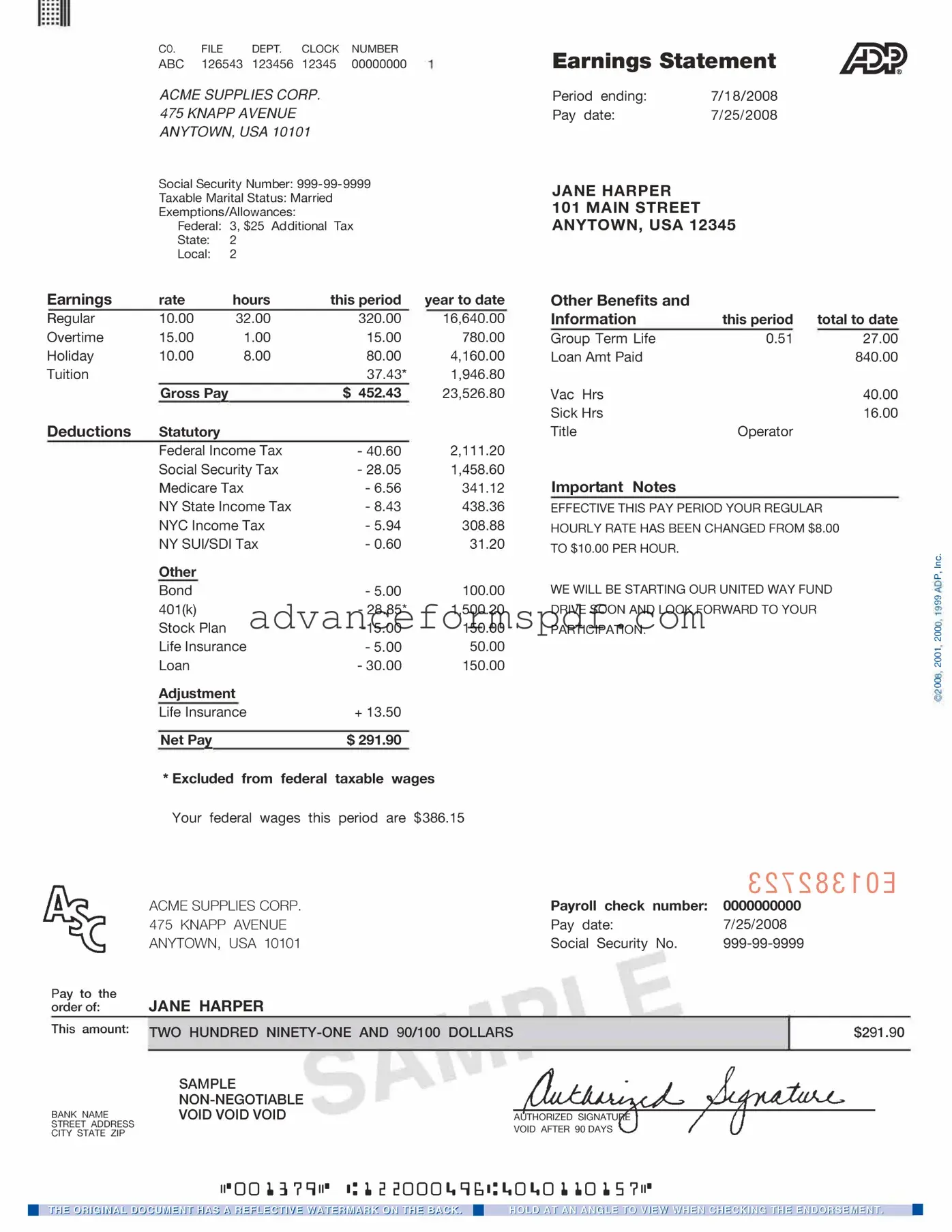

Download Adp Pay Stub Form in PDF

The ADP Pay Stub form is an essential document for employees, providing a detailed breakdown of their earnings and deductions for each pay period. It typically includes key information such as the employee's gross pay, net pay, and various deductions like taxes, health insurance, and retirement contributions. Understanding this form is crucial for employees to ensure they are being compensated correctly and to help them manage their personal finances effectively. Additionally, the pay stub often highlights year-to-date earnings and deductions, allowing employees to track their financial progress over time. By reviewing their pay stubs regularly, employees can identify any discrepancies or errors, making it easier to address issues with their employer. This form not only serves as a record of income but also plays a significant role in financial planning, tax preparation, and understanding benefits. For anyone navigating their employment compensation, familiarity with the ADP Pay Stub form is invaluable.

Document Data

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed summary of their earnings and deductions for each pay period. |

| Components | The form typically includes information such as gross pay, net pay, taxes withheld, and other deductions like health insurance and retirement contributions. |

| State-Specific Requirements | Some states have specific laws governing the information that must be included on pay stubs, such as California's Labor Code Section 226. |

| Access | Employees can usually access their pay stubs online through the ADP portal or receive them via email, depending on employer preferences. |

| Importance | Understanding the pay stub is crucial for employees to verify their earnings and ensure correct tax withholding. |

How to Write Adp Pay Stub

Filling out the ADP Pay Stub form is a straightforward process that ensures you have accurate records of your earnings and deductions. By following the steps below, you will be able to complete the form efficiently and with confidence.

- Begin by entering your personal information at the top of the form. This includes your full name, employee ID, and the pay period dates.

- Next, locate the section for your earnings. Fill in the total hours worked during the pay period and the corresponding pay rate.

- In the deductions section, list any withholdings such as taxes, health insurance, or retirement contributions. Ensure that the amounts are correct and match your records.

- After entering all the necessary information, double-check each section for accuracy. Make sure there are no typos or incorrect figures.

- Finally, sign and date the form at the bottom to certify that the information provided is true and complete.

Once you have completed these steps, your ADP Pay Stub form will be ready for submission or record-keeping. Keeping a copy for your records is always a good practice.

Adp Pay Stub Example

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90

Common PDF Documents

What Is Joint Tenancy in California - Essential for the settlement of real estate after a co-owner's death.

Simple Shared Well Agreement Form - Any changes or improvements to the water system require prior consent from both parties.

A California Bill of Sale form serves as a written document that outlines the transfer of ownership of personal property from one party to another. This form is crucial for ensuring that the buyer receives clear title and for providing the seller with proof of the transaction. You can easily access and prepare this document by visiting Documents PDF Online, which can help individuals navigate property transfers smoothly and securely.

Cash Receipt Voucher - Helps in identifying discrepancies in cash flow.