Free Business Bill of Sale Document

When it comes to transferring ownership of a business or its assets, the Business Bill of Sale form plays a crucial role in ensuring a smooth and legally binding transaction. This document serves as a receipt that outlines the specifics of the sale, including details about the buyer, seller, and the items or assets being transferred. It typically includes important information such as the purchase price, the date of the transaction, and any warranties or representations made by the seller. By clearly delineating the terms of the sale, the form protects both parties and helps prevent misunderstandings down the line. Additionally, it may include provisions regarding liabilities, ensuring that the buyer is aware of any obligations that may come with the purchase. Understanding how to properly complete this form is essential for anyone involved in buying or selling a business, as it lays the foundation for a successful transfer of ownership.

PDF Specifics

| Fact Name | Description |

|---|---|

| Definition | A Business Bill of Sale is a legal document that transfers ownership of a business or its assets from one party to another. |

| Purpose | This document serves to protect both the buyer and the seller by providing a clear record of the transaction. |

| Components | Typically includes details such as the names of the parties, the date of sale, and a description of the business or assets sold. |

| Consideration | The document must state the price or consideration paid for the business or assets. |

| State-Specific Forms | Some states may have specific requirements for the Bill of Sale, including additional disclosures or forms. |

| Governing Law | The laws governing the Bill of Sale can vary by state. For example, California Civil Code Section 1624 outlines certain requirements. |

| Notarization | In some states, notarization may be required to validate the document. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records, as it may be needed for tax purposes or future disputes. |

| Tax Implications | Transferring ownership may have tax implications, so consulting a tax professional is advisable. |

| Legal Advice | It is often beneficial to seek legal advice when drafting or signing a Business Bill of Sale to ensure all legal requirements are met. |

How to Write Business Bill of Sale

After obtaining the Business Bill of Sale form, you are ready to proceed with filling it out. This document will require specific information about the transaction, including details about the buyer, seller, and the business being sold. Ensuring accuracy is crucial, as this form serves as a legal record of the sale.

- Start with the date: Write the date on which the sale is taking place at the top of the form.

- Enter seller information: Fill in the full name and address of the seller. This should include the street address, city, state, and zip code.

- Provide buyer information: Similarly, include the full name and address of the buyer, ensuring all details are accurate and complete.

- Describe the business: Clearly outline the name of the business being sold. Include any relevant identifiers, such as a business license number or tax identification number.

- Detail the terms of sale: Specify the purchase price and any payment terms. If there are any conditions attached to the sale, include those as well.

- Include any warranties: If applicable, state any warranties or guarantees that the seller is providing regarding the business.

- Signatures: Both the seller and buyer must sign and date the form to validate the transaction. Ensure that all signatures are legible.

Once the form is completed, it is advisable to keep copies for both parties. This will help maintain a clear record of the transaction for future reference.

Business Bill of Sale Example

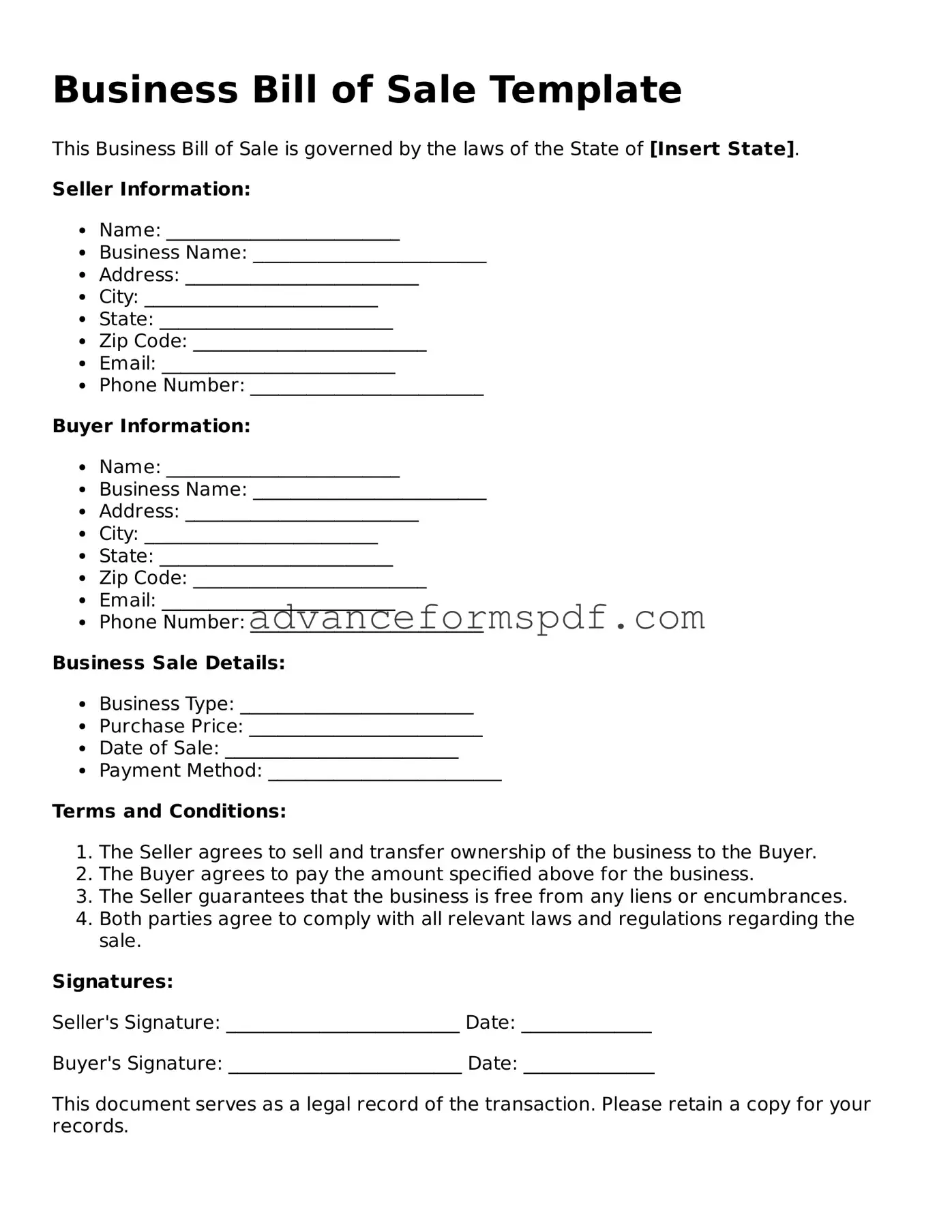

Business Bill of Sale Template

This Business Bill of Sale is governed by the laws of the State of [Insert State].

Seller Information:

- Name: _________________________

- Business Name: _________________________

- Address: _________________________

- City: _________________________

- State: _________________________

- Zip Code: _________________________

- Email: _________________________

- Phone Number: _________________________

Buyer Information:

- Name: _________________________

- Business Name: _________________________

- Address: _________________________

- City: _________________________

- State: _________________________

- Zip Code: _________________________

- Email: _________________________

- Phone Number: _________________________

Business Sale Details:

- Business Type: _________________________

- Purchase Price: _________________________

- Date of Sale: _________________________

- Payment Method: _________________________

Terms and Conditions:

- The Seller agrees to sell and transfer ownership of the business to the Buyer.

- The Buyer agrees to pay the amount specified above for the business.

- The Seller guarantees that the business is free from any liens or encumbrances.

- Both parties agree to comply with all relevant laws and regulations regarding the sale.

Signatures:

Seller's Signature: _________________________ Date: ______________

Buyer's Signature: _________________________ Date: ______________

This document serves as a legal record of the transaction. Please retain a copy for your records.

Discover Common Types of Business Bill of Sale Forms

Free Printable Bill of Sale for Trailer - Can assist in tracking ownership history of the trailer.

By utilizing the Florida PDF Forms, you can easily access and complete the necessary documentation required for a Bill of Sale, ensuring that all pertinent information is accurately captured for a seamless transfer of ownership.

Bill of Sale Template for Motorcycle - A valuable tool for private parties engaged in motorcycle transactions.

Bill of Sale Dmv California - The Bill of Sale may act as a receipt for the payment made for the vehicle.