Download Business Credit Application Form in PDF

When starting or expanding a business, securing credit can be a crucial step toward growth. The Business Credit Application form plays a key role in this process. This form typically gathers essential information about your business, including its legal structure, ownership details, and financial history. It often requires you to provide your business’s tax identification number and contact information. Additionally, many forms ask for references from suppliers or other creditors, which can help establish your credibility. Understanding each section of the application is vital, as it not only reflects your business's financial health but also influences the lender's decision. Completing the form accurately and thoroughly can set a positive tone for your credit request, so it’s important to pay attention to the details.

Document Data

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is designed to assess a business's creditworthiness before extending credit or loans. |

| Information Required | Typically, the form requires basic business information, including the legal name, address, and type of business entity. |

| Financial Details | Applicants often need to provide financial statements, tax returns, and other relevant financial information to support their application. |

| Credit History | The form may ask for details about the business's credit history, including previous loans and payment records. |

| Personal Guarantee | In many cases, a personal guarantee from the business owner is required, ensuring accountability for the debt incurred. |

| State-Specific Forms | Some states have specific requirements; for example, California's governing law includes the California Commercial Code. |

| Submission Process | Businesses must submit the completed form to the lender or credit provider, often accompanied by supporting documents. |

| Review Period | After submission, the lender typically reviews the application within a specified timeframe, which can vary by institution. |

| Approval Criteria | Approval depends on various factors, including credit score, business history, and overall financial health. |

How to Write Business Credit Application

Once you have the Business Credit Application form in front of you, it’s important to approach it methodically. Completing this form accurately will help establish your business's creditworthiness with potential lenders or suppliers. Follow these steps to ensure you fill it out correctly.

- Read the Instructions: Before you begin, take a moment to read any instructions that accompany the form. Understanding what is required can save you time.

- Provide Basic Information: Fill in your business name, address, and contact information. Ensure that this information is accurate and up-to-date.

- Business Structure: Indicate your business structure, such as sole proprietorship, partnership, or corporation. This helps lenders understand your business model.

- Ownership Details: List the names and addresses of all owners or partners. Include their percentage of ownership in the business.

- Financial Information: Provide details about your business's financial status. This may include annual revenue, number of employees, and any existing debts.

- Bank References: Include the name and contact information for your business bank. This helps lenders verify your financial stability.

- Trade References: List several suppliers or vendors you work with. Include their contact information and your payment history with them.

- Signature: Don’t forget to sign and date the application. An unsigned form may be considered incomplete.

- Review: Before submitting, double-check all entries for accuracy and completeness. Mistakes can delay the processing of your application.

After completing the form, you can submit it according to the instructions provided. This might involve mailing it, emailing it, or submitting it online, depending on the lender's preferences. Keep a copy for your records, as it can be useful for future applications or discussions.

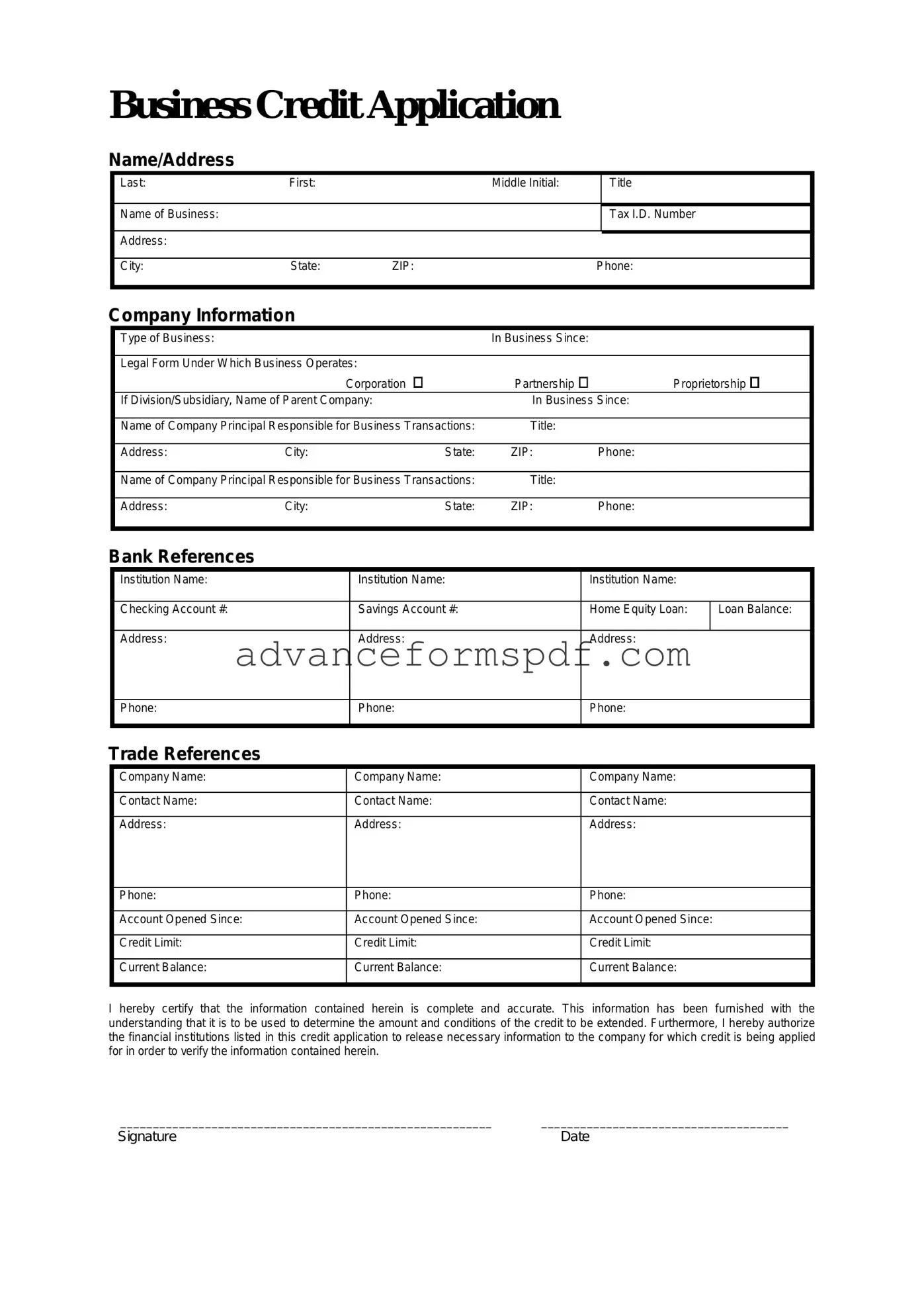

Business Credit Application Example

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |

Common PDF Documents

Puppy Health Record - Allows tracking of dental health with details on tooth eruption.

When completing the RV transaction in Arizona, it is important to utilize the Arizona RV Bill of Sale form, as it is a legal document that serves as proof of the sale and transfer of ownership of a recreational vehicle in the state of Arizona. For additional resources regarding this form, you can visit Arizona PDF Forms, which outlines essential details such as the buyer and seller's information, vehicle specifications, and the sale price. Understanding this document is crucial for both parties to ensure a smooth transaction and to comply with state regulations.

Medicare Notice of Non Coverage - Patients are advised to consult with Medicare representatives if they have questions about the notice.

Tractor Trailer Pre Trip Inspection Diagram - This form is essential for drivers prioritizing vehicle safety.