Valid Deed in Lieu of Foreclosure Form for the State of California

In California, homeowners facing financial hardship and the possibility of foreclosure may consider a deed in lieu of foreclosure as a viable alternative. This legal process allows a homeowner to voluntarily transfer the ownership of their property back to the lender, effectively settling their mortgage debt without the lengthy and often stressful foreclosure process. By signing this form, the homeowner relinquishes their rights to the property, and in return, the lender typically agrees to forgive any remaining mortgage balance. This arrangement can benefit both parties: the homeowner avoids the negative impact of foreclosure on their credit report, while the lender can expedite the recovery of the property and reduce associated costs. The deed in lieu of foreclosure form must be carefully completed and executed to ensure that all legal requirements are met, and it is essential for homeowners to understand the implications of this decision, including potential tax consequences and the effect on their credit score. With the right guidance and information, this option can provide a fresh start for those in financial distress.

PDF Specifics

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is an agreement where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | This form is governed by California Civil Code Section 2938. |

| Eligibility | Borrowers must be in default on their mortgage to qualify for a deed in lieu of foreclosure. |

| Process | The borrower submits a request to the lender, who reviews the financial situation and property condition. |

| Benefits | It can help avoid the lengthy foreclosure process and may minimize damage to the borrower's credit score. |

| Risks | The borrower may still be liable for any remaining mortgage debt after the deed transfer. |

| Property Condition | The lender typically requires the property to be in good condition before accepting the deed. |

| Tax Implications | Borrowers may face tax consequences, as forgiven debt can be considered taxable income. |

| Legal Advice | It is advisable for borrowers to seek legal counsel before proceeding with a deed in lieu of foreclosure. |

How to Write California Deed in Lieu of Foreclosure

After completing the California Deed in Lieu of Foreclosure form, the next steps involve submitting the document to the appropriate parties, including your lender. Ensure that you keep copies for your records. Following submission, it is advisable to confirm receipt and track the status of your request.

- Obtain the California Deed in Lieu of Foreclosure form. This can be found online or through your lender.

- Fill in the Grantor section with your name and address. This is the individual or entity transferring the property.

- In the Grantee section, enter the name and address of the lender or financial institution receiving the property.

- Provide a description of the property in the designated area. Include the full address and any relevant details.

- Indicate the date of the transfer. This is the date you are signing the document.

- Sign the form in the Grantor’s Signature section. If there are multiple grantors, each must sign.

- Have the signature notarized. This step is crucial for the document to be legally binding.

- Make copies of the completed form for your records.

- Submit the original form to the lender and keep a record of the submission.

California Deed in Lieu of Foreclosure Example

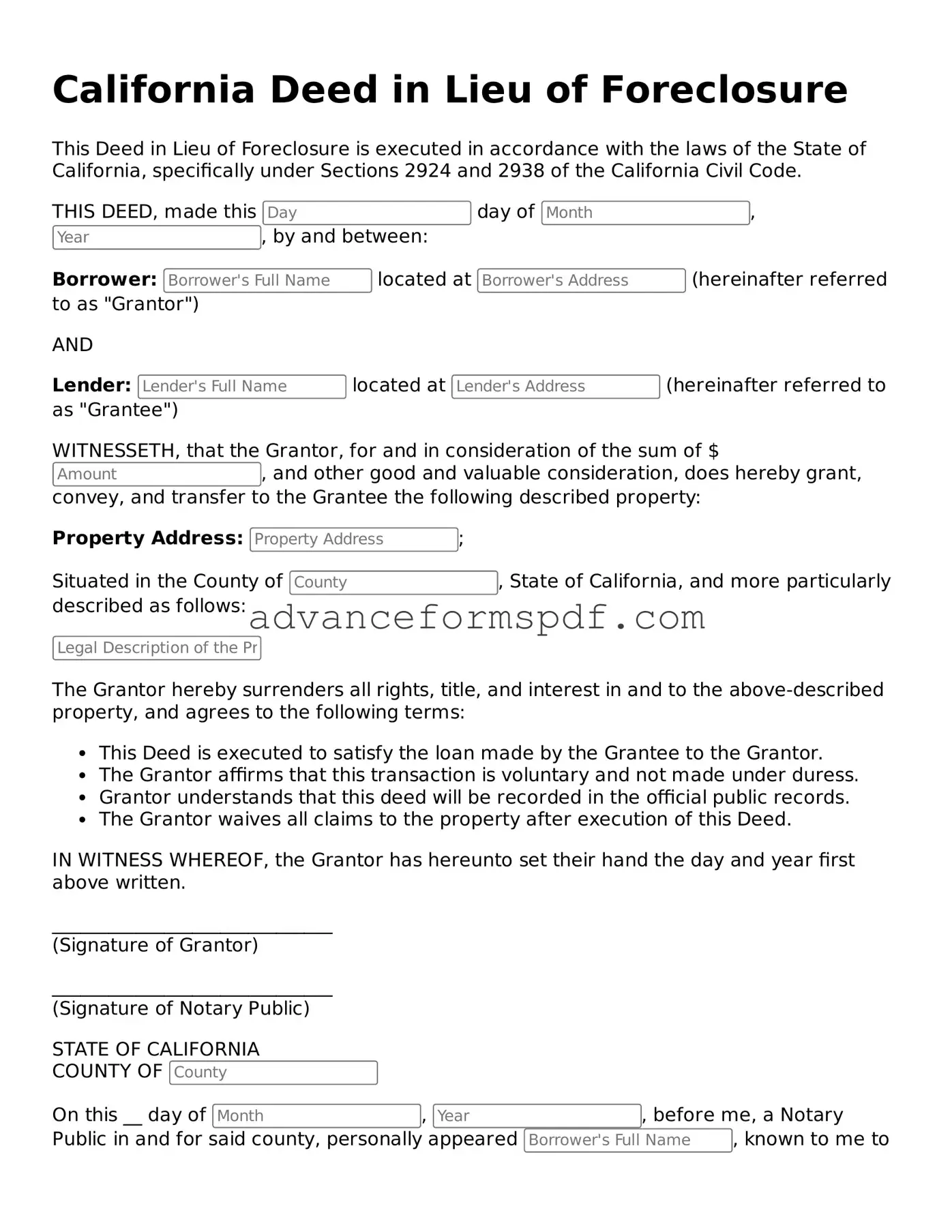

California Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is executed in accordance with the laws of the State of California, specifically under Sections 2924 and 2938 of the California Civil Code.

THIS DEED, made this day of , , by and between:

Borrower: located at (hereinafter referred to as "Grantor")

AND

Lender: located at (hereinafter referred to as "Grantee")

WITNESSETH, that the Grantor, for and in consideration of the sum of $, and other good and valuable consideration, does hereby grant, convey, and transfer to the Grantee the following described property:

Property Address: ;

Situated in the County of , State of California, and more particularly described as follows:

The Grantor hereby surrenders all rights, title, and interest in and to the above-described property, and agrees to the following terms:

- This Deed is executed to satisfy the loan made by the Grantee to the Grantor.

- The Grantor affirms that this transaction is voluntary and not made under duress.

- Grantor understands that this deed will be recorded in the official public records.

- The Grantor waives all claims to the property after execution of this Deed.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand the day and year first above written.

______________________________

(Signature of Grantor)

______________________________

(Signature of Notary Public)

STATE OF CALIFORNIA

COUNTY OF

On this __ day of , , before me, a Notary Public in and for said county, personally appeared , known to me to be the person whose name is subscribed to the within instrument and acknowledged that they executed the same.

WITNESS my hand and official seal.

______________________________

(Notary Public Seal)

Other Deed in Lieu of Foreclosure State Forms

Deed in Lieu of Foreclosure Template - By using this form, the homeowner can avoid the stress of court proceedings.

A Medical Power of Attorney form in Arizona allows individuals to designate a trusted person to make healthcare decisions on their behalf if they become unable to do so. This legal document ensures that your medical preferences are honored, even when you cannot communicate them yourself. Understanding how to create and use this form, including obtaining the necessary templates from Arizona PDF Forms, is essential for anyone looking to safeguard their healthcare choices.