Valid Loan Agreement Form for the State of California

In California, a Loan Agreement form serves as a crucial document for individuals and businesses seeking to outline the terms of a loan. This form typically includes essential components such as the names and contact information of the lender and borrower, the principal amount being loaned, and the interest rate applicable to the loan. It also details the repayment schedule, specifying when payments are due and the total duration of the loan. Additionally, the form addresses any collateral that secures the loan, providing protection for the lender in case of default. Importantly, it outlines the consequences of non-payment, ensuring that both parties understand their rights and obligations. By clearly defining these terms, the Loan Agreement helps to prevent misunderstandings and disputes, fostering a transparent relationship between the lender and borrower. Overall, this form is an indispensable tool in the lending process, promoting clarity and accountability for all involved parties.

PDF Specifics

| Fact Name | Details |

|---|---|

| Purpose | The California Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of California, specifically under the California Civil Code. |

| Loan Amount | The form specifies the total amount of money being loaned, which is crucial for both parties to understand their financial obligations. |

| Interest Rate | The agreement details the interest rate applied to the loan, which can be fixed or variable, affecting the total repayment amount. |

| Repayment Terms | Repayment terms, including the payment schedule and duration, are clearly defined to ensure both parties are on the same page. |

| Default Clause | A default clause outlines the consequences if the borrower fails to make timely payments, protecting the lender's interests. |

| Signatures | Both parties must sign the agreement to indicate their acceptance of the terms, making it a legally binding document. |

| Amendments | The form may include provisions for amendments, allowing for changes to be made if both parties agree to the new terms. |

How to Write California Loan Agreement

Once you have the California Loan Agreement form in hand, it’s time to fill it out carefully. Ensure you have all necessary information at your fingertips to avoid delays. Follow these steps to complete the form accurately.

- Read the Instructions: Before starting, review any instructions provided with the form to understand what information is needed.

- Enter the Date: Write the date on which you are completing the form at the top of the document.

- Fill in Borrower Information: Provide the full name, address, and contact information of the borrower.

- Provide Lender Information: Enter the full name, address, and contact information of the lender.

- Specify Loan Amount: Clearly state the total amount of the loan being agreed upon.

- Detail Interest Rate: Indicate the interest rate applicable to the loan.

- Set Payment Terms: Outline the repayment schedule, including the frequency and amount of payments.

- Include Loan Purpose: Briefly describe the purpose of the loan.

- Signatures: Both the borrower and lender must sign the form to make it legally binding.

- Keep Copies: Make copies of the signed agreement for both parties' records.

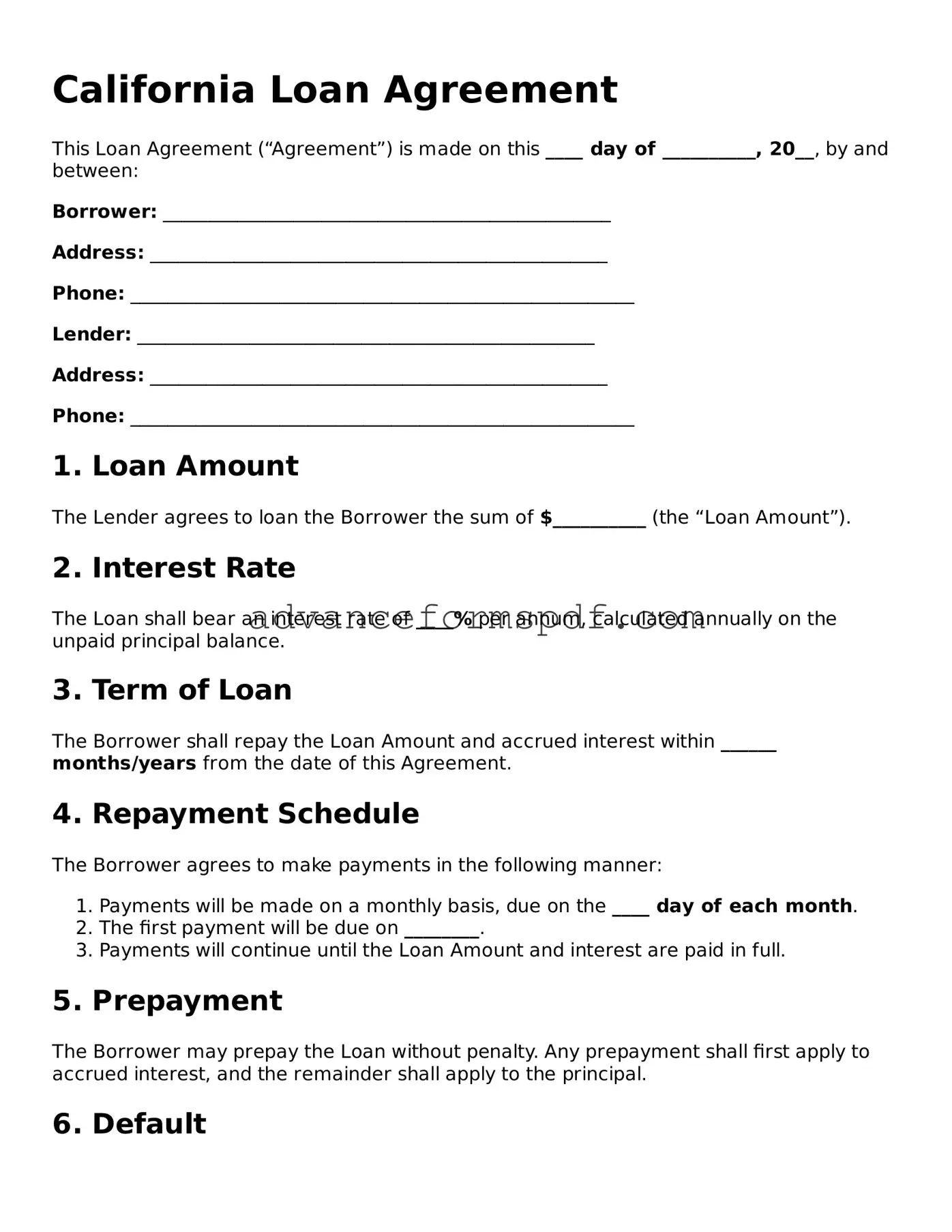

California Loan Agreement Example

California Loan Agreement

This Loan Agreement (“Agreement”) is made on this ____ day of __________, 20__, by and between:

Borrower: ________________________________________________

Address: _________________________________________________

Phone: ______________________________________________________

Lender: _________________________________________________

Address: _________________________________________________

Phone: ______________________________________________________

1. Loan Amount

The Lender agrees to loan the Borrower the sum of $__________ (the “Loan Amount”).

2. Interest Rate

The Loan shall bear an interest rate of ____% per annum, calculated annually on the unpaid principal balance.

3. Term of Loan

The Borrower shall repay the Loan Amount and accrued interest within ______ months/years from the date of this Agreement.

4. Repayment Schedule

The Borrower agrees to make payments in the following manner:

- Payments will be made on a monthly basis, due on the ____ day of each month.

- The first payment will be due on ________.

- Payments will continue until the Loan Amount and interest are paid in full.

5. Prepayment

The Borrower may prepay the Loan without penalty. Any prepayment shall first apply to accrued interest, and the remainder shall apply to the principal.

6. Default

If the Borrower fails to make any payment when due, the Lender may declare the entire Loan Amount and accrued interest immediately due and payable. The Lender may pursue any legal action necessary to recover the debt.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of California.

8. Miscellaneous

- This Agreement may be amended only by written consent of both parties.

- If any provision of this Agreement is found to be invalid, the remaining provisions shall remain in effect.

- Both parties acknowledge that they have read and understood this Agreement.

Signatures

By signing below, the Borrower and Lender agree to the terms outlined in this Loan Agreement.

Borrower Signature: ______________________ Date: _______________

Lender Signature: ______________________ Date: _______________

Other Loan Agreement State Forms

Free Promissory Note Template Florida - It's important for both parties to keep a copy of the signed agreement for their records.

Incorporating in Texas is a significant move for business owners, as it not only provides legal recognition but also safeguards personal assets. Completing the Texas Articles of Incorporation form is paramount, and for those interested in streamlining this process, further guidance can be found at https://txtemplate.com/articles-of-incorporation-pdf-template. By taking this pivotal step, entrepreneurs can lay a solid foundation for their corporate ventures.

Illinois Promissory Note - It helps create a formal understanding which can be referred to if disputes arise.

Promissory Note New York - Details the repayment schedule, including due dates and payment amounts.