Valid Promissory Note Form for the State of California

The California Promissory Note form serves as a crucial document in financial transactions, providing a clear record of a borrower's promise to repay a loan under specified terms. This form outlines essential details such as the principal amount, interest rate, repayment schedule, and any late fees applicable to the loan. It also specifies the consequences of default, ensuring that both parties understand their rights and obligations. The note can be secured or unsecured, depending on whether collateral is involved. Additionally, it may include provisions for prepayment, allowing borrowers the flexibility to pay off the loan early without incurring penalties. Understanding the components of this form is vital for both lenders and borrowers to navigate their financial agreements effectively and to ensure compliance with California laws governing such transactions.

PDF Specifics

| Fact Name | Description |

|---|---|

| Definition | A California Promissory Note is a written promise to pay a specified amount of money to a designated party at a defined time or on demand. |

| Governing Law | The California Civil Code governs promissory notes, specifically sections 3300 to 3400. |

| Types | Promissory notes can be secured or unsecured, with secured notes backed by collateral. |

| Interest Rates | Interest rates on promissory notes must comply with California usury laws, which limit the amount of interest that can be charged. |

| Enforceability | For a promissory note to be enforceable, it must be signed by the borrower and include essential terms such as the amount, interest rate, and repayment schedule. |

How to Write California Promissory Note

Once you have the California Promissory Note form in front of you, it’s time to fill it out. This form is essential for documenting a loan agreement between a borrower and a lender. Follow these steps to ensure you complete it correctly.

- Title the Document: At the top of the form, write "Promissory Note." This clearly identifies the purpose of the document.

- Enter the Date: Fill in the date when the note is being created. Use the format MM/DD/YYYY.

- Identify the Borrower: Write the full name and address of the borrower. Make sure to include any relevant contact information.

- Identify the Lender: Next, provide the full name and address of the lender. Again, include contact details if necessary.

- Loan Amount: Clearly state the total amount of money being borrowed. Use numerals and words for clarity.

- Interest Rate: Specify the interest rate for the loan. Indicate whether it is fixed or variable.

- Payment Terms: Describe how and when the borrower will repay the loan. Include details about the payment schedule.

- Late Fees: If applicable, outline any late fees that will be charged if payments are not made on time.

- Signatures: Both the borrower and lender must sign the document. Include the date of each signature.

- Witness or Notary: If required, have a witness or notary public sign the document to validate it.

After completing the form, keep a copy for your records. The borrower and lender should both have a signed copy to refer to in the future. This helps ensure everyone is on the same page regarding the loan agreement.

California Promissory Note Example

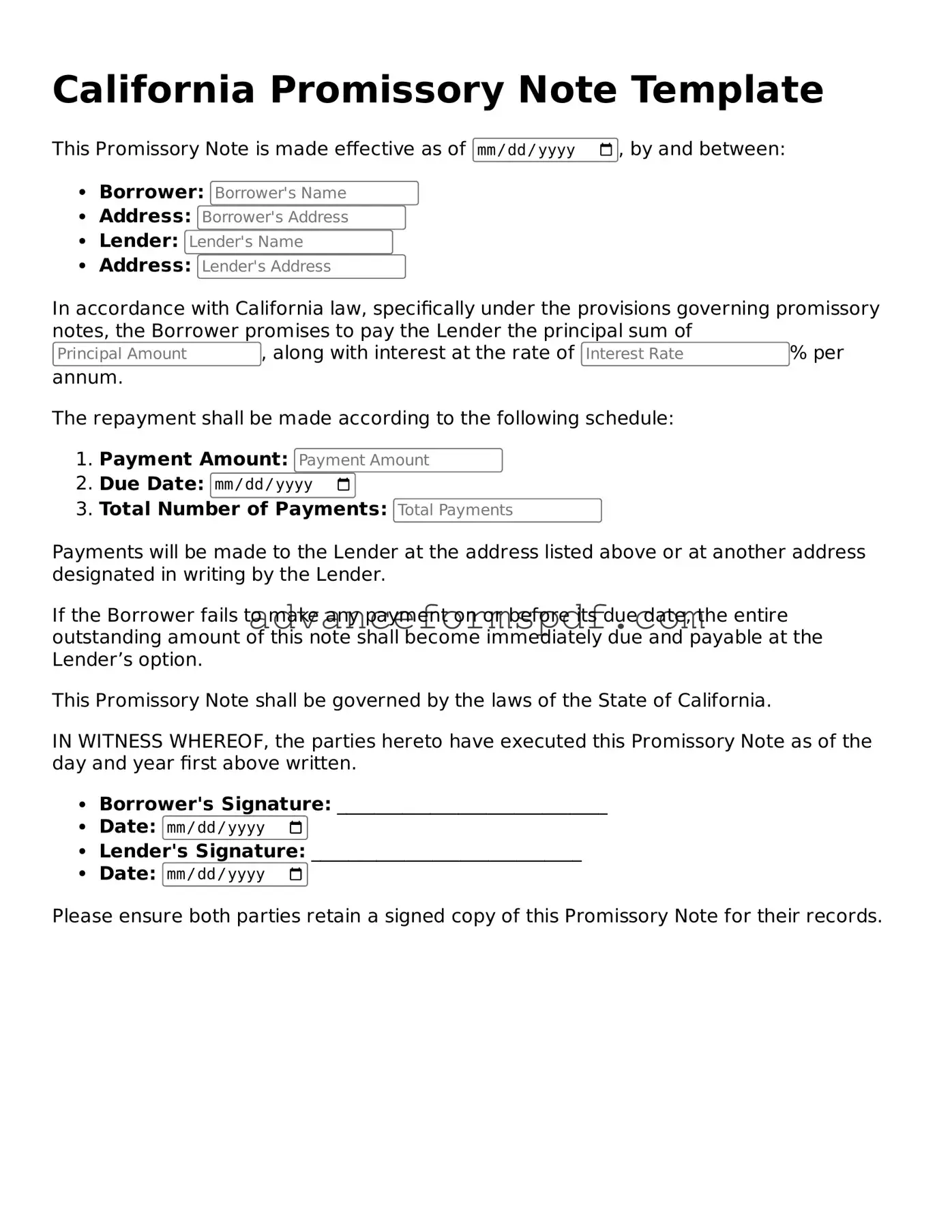

California Promissory Note Template

This Promissory Note is made effective as of , by and between:

- Borrower:

- Address:

- Lender:

- Address:

In accordance with California law, specifically under the provisions governing promissory notes, the Borrower promises to pay the Lender the principal sum of , along with interest at the rate of % per annum.

The repayment shall be made according to the following schedule:

- Payment Amount:

- Due Date:

- Total Number of Payments:

Payments will be made to the Lender at the address listed above or at another address designated in writing by the Lender.

If the Borrower fails to make any payment on or before its due date, the entire outstanding amount of this note shall become immediately due and payable at the Lender’s option.

This Promissory Note shall be governed by the laws of the State of California.

IN WITNESS WHEREOF, the parties hereto have executed this Promissory Note as of the day and year first above written.

- Borrower's Signature: _____________________________

- Date:

- Lender's Signature: _____________________________

- Date:

Please ensure both parties retain a signed copy of this Promissory Note for their records.

Other Promissory Note State Forms

Promissory Notes for Personal Loans - A Promissory Note can be a positive step toward financial management and planning.

Filing a Florida Durable Power of Attorney form is crucial for anyone looking to ensure their financial decisions are managed by a trusted individual. It's important to understand the implications of this document for future circumstances, especially when it comes to health emergencies or incapacitation. For those seeking a guide, the necessary Durable Power of Attorney resources can provide valuable insights.