Valid Tractor Bill of Sale Form for the State of California

When it comes to buying or selling a tractor in California, a crucial document that often comes into play is the Tractor Bill of Sale form. This form serves as a written record of the transaction, detailing essential information about the parties involved, the tractor itself, and the terms of the sale. It typically includes the names and addresses of both the buyer and seller, the tractor's make, model, year, and Vehicle Identification Number (VIN), as well as the purchase price. Beyond simply documenting the sale, this form can also provide legal protection for both parties by establishing proof of ownership and the conditions of the sale. Additionally, it may include sections for any warranties or representations made by the seller, ensuring transparency in the transaction. Understanding the importance of this document is vital for anyone engaged in the agricultural industry or simply looking to buy or sell a tractor, as it not only facilitates a smooth exchange but also helps prevent potential disputes down the line.

PDF Specifics

| Fact Name | Description |

|---|---|

| Purpose | The California Tractor Bill of Sale form serves as a legal document to transfer ownership of a tractor from one party to another. |

| Governing Law | This form is governed by California Vehicle Code Section 5901, which outlines the requirements for vehicle sales. |

| Required Information | Both the buyer and seller must provide their names, addresses, and signatures on the form. |

| Vehicle Details | The form requires specific details about the tractor, including the make, model, year, and Vehicle Identification Number (VIN). |

| As-Is Clause | Typically, the form includes an "as-is" clause, indicating that the buyer accepts the tractor in its current condition without warranties. |

| Notarization | While notarization is not mandatory, having the document notarized can add an extra layer of legitimacy to the sale. |

| Sales Tax | In California, sales tax may apply to the sale of a tractor, and it is the buyer's responsibility to report and pay this tax. |

| Record Keeping | Both parties should keep a copy of the signed Bill of Sale for their records, as it can serve as proof of the transaction. |

| Transfer of Title | Completing the Bill of Sale does not automatically transfer the title; additional steps must be taken to update the title with the DMV. |

| Legal Protection | A properly completed Bill of Sale can protect both the buyer and seller in case of future disputes regarding the sale. |

How to Write California Tractor Bill of Sale

After obtaining the California Tractor Bill of Sale form, it is essential to complete it accurately. This document serves as a record of the transaction between the buyer and the seller. Properly filling out the form ensures both parties have a clear understanding of the sale details.

- Begin by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller. Ensure that all information is accurate.

- Next, enter the buyer's full name and address in the designated section.

- Describe the tractor being sold. Include details such as the make, model, year, and Vehicle Identification Number (VIN).

- Indicate the sale price of the tractor clearly. This should be the agreed-upon amount between the buyer and seller.

- Both the buyer and seller must sign and date the form to validate the transaction.

- If applicable, include any additional terms or conditions of the sale in the designated area.

Once the form is completed, both parties should retain a copy for their records. This ensures that each party has proof of the transaction and the details surrounding it.

California Tractor Bill of Sale Example

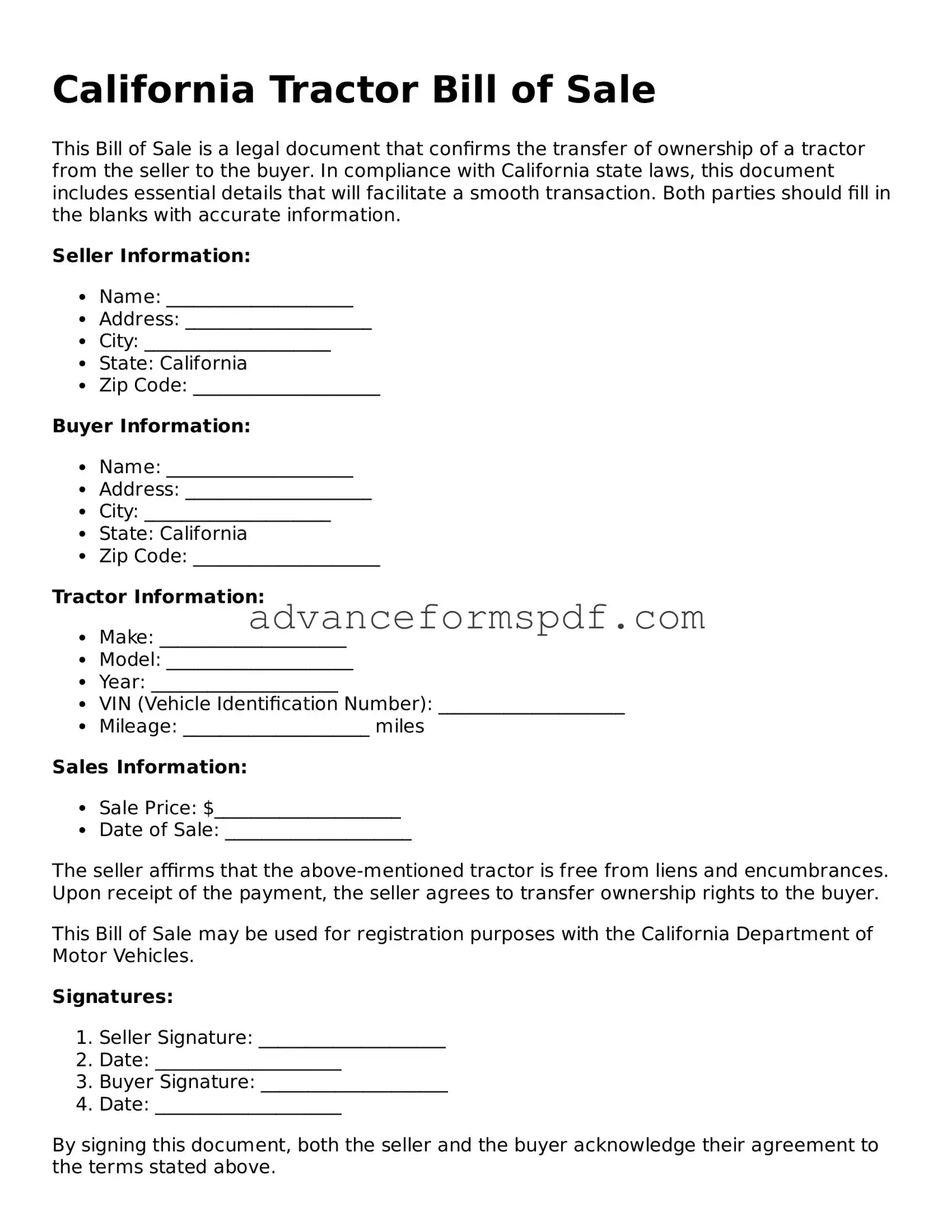

California Tractor Bill of Sale

This Bill of Sale is a legal document that confirms the transfer of ownership of a tractor from the seller to the buyer. In compliance with California state laws, this document includes essential details that will facilitate a smooth transaction. Both parties should fill in the blanks with accurate information.

Seller Information:

- Name: ____________________

- Address: ____________________

- City: ____________________

- State: California

- Zip Code: ____________________

Buyer Information:

- Name: ____________________

- Address: ____________________

- City: ____________________

- State: California

- Zip Code: ____________________

Tractor Information:

- Make: ____________________

- Model: ____________________

- Year: ____________________

- VIN (Vehicle Identification Number): ____________________

- Mileage: ____________________ miles

Sales Information:

- Sale Price: $____________________

- Date of Sale: ____________________

The seller affirms that the above-mentioned tractor is free from liens and encumbrances. Upon receipt of the payment, the seller agrees to transfer ownership rights to the buyer.

This Bill of Sale may be used for registration purposes with the California Department of Motor Vehicles.

Signatures:

- Seller Signature: ____________________

- Date: ____________________

- Buyer Signature: ____________________

- Date: ____________________

By signing this document, both the seller and the buyer acknowledge their agreement to the terms stated above.

Other Tractor Bill of Sale State Forms

Do Tractors Need to Be Registered - Capture essential details of the tractor sale for both buyer and seller.

When engaging in the purchase or sale of a motorcycle, it is crucial to utilize the appropriate legal documentation, as highlighted by the importance of the Arizona Motorcycle Bill of Sale form. This form, which ensures the proper transfer of ownership in the state, acts as a safeguard for both the buyer and seller by documenting the transaction details. For those seeking a reliable source for this essential paperwork, the Arizona PDF Forms website provides access to the form and other valuable resources, helping to streamline the process and eliminate potential disputes in the future.