Valid Transfer-on-Death Deed Form for the State of California

The California Transfer-on-Death Deed (TOD) form offers a straightforward way for property owners to transfer real estate to beneficiaries upon their death, avoiding the complexities of probate. This legal document allows individuals to maintain full control over their property during their lifetime, with the transfer occurring automatically without court intervention after their passing. By filling out and recording the TOD deed, property owners can designate one or more beneficiaries, ensuring that their wishes are honored. Importantly, the form can be revoked or modified at any time before the owner's death, providing flexibility as circumstances change. Additionally, the TOD deed is particularly beneficial for those looking to streamline the inheritance process, making it easier for loved ones to receive property without unnecessary delays or expenses. Understanding the key elements of this form is essential for anyone considering estate planning in California.

PDF Specifics

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed (TODD) allows property owners in California to designate a beneficiary to receive their real property upon their death, without the need for probate. |

| Governing Law | The California Transfer-on-Death Deed is governed by California Probate Code Sections 5600-5695. |

| Form Requirements | The deed must be in writing, signed by the property owner, and recorded with the county recorder’s office to be effective. |

| Revocation | Property owners can revoke a TODD at any time before their death by recording a new deed or a revocation form. |

| Beneficiary Rights | Beneficiaries do not have any rights to the property until the death of the property owner, which means they cannot sell or manage the property during the owner's lifetime. |

| Tax Implications | Transfer-on-Death Deeds may have tax implications for beneficiaries, including potential reassessment of property taxes upon transfer. |

How to Write California Transfer-on-Death Deed

After obtaining the California Transfer-on-Death Deed form, you are ready to begin filling it out. This form allows you to designate a beneficiary who will receive your property upon your passing, without the need for probate. Follow these steps carefully to ensure that the form is completed accurately.

- Provide your information: At the top of the form, enter your full name and address. This information identifies you as the current property owner.

- Describe the property: Clearly describe the property you wish to transfer. Include the address, and if applicable, the parcel number or legal description.

- Designate your beneficiary: Write the full name and address of the person you want to inherit the property. Make sure this information is accurate to avoid any issues later on.

- Include alternate beneficiaries: If desired, you can name an alternate beneficiary in case the primary beneficiary cannot inherit the property. Fill in their name and address as well.

- Sign the form: As the property owner, you must sign the form in the designated area. Your signature indicates your intention to transfer the property upon your death.

- Have the form notarized: Take the signed form to a notary public. They will verify your identity and witness your signature, which is required for the deed to be valid.

- Record the deed: Finally, submit the notarized form to the county recorder's office where the property is located. Recording the deed makes it official and ensures that your wishes are recognized.

California Transfer-on-Death Deed Example

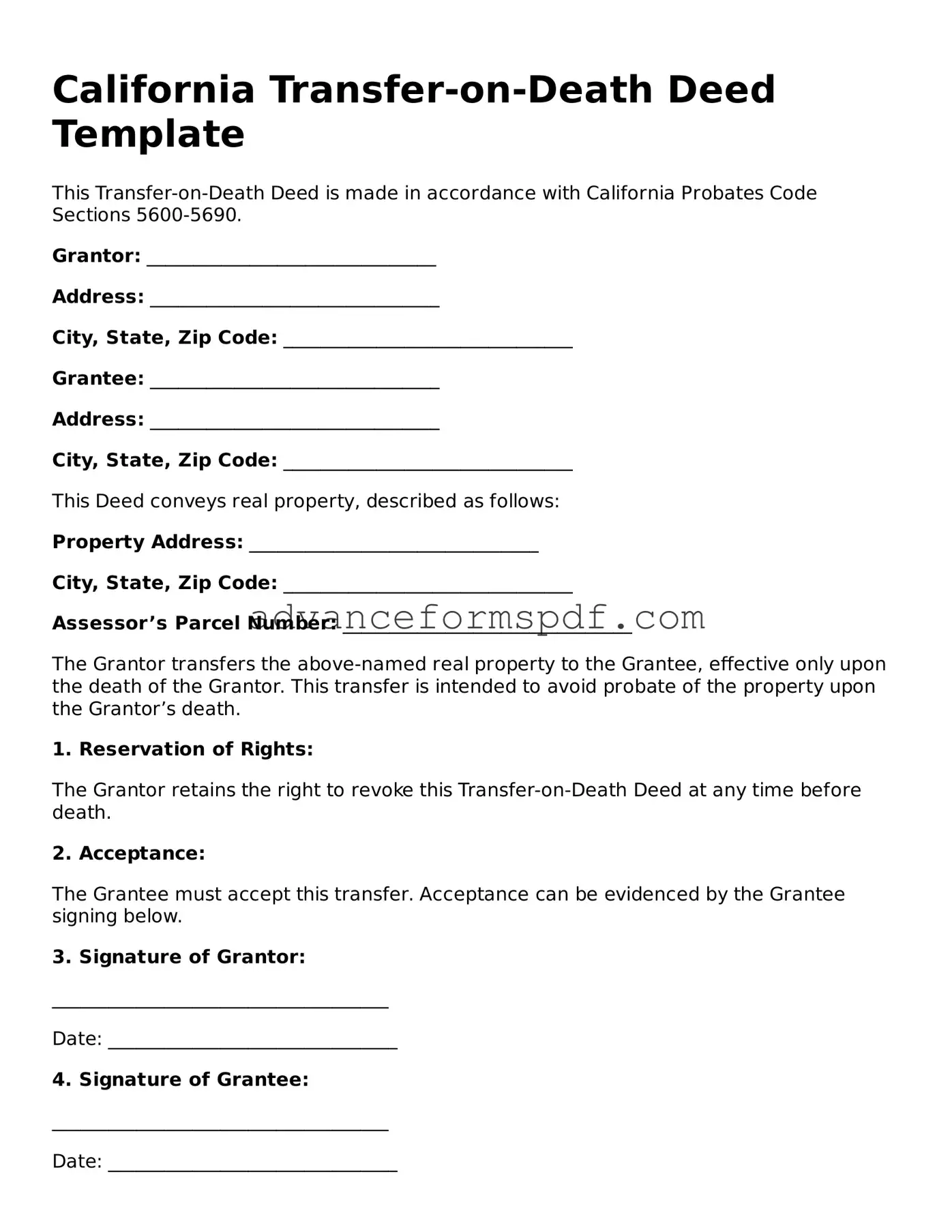

California Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made in accordance with California Probates Code Sections 5600-5690.

Grantor: _______________________________

Address: _______________________________

City, State, Zip Code: _______________________________

Grantee: _______________________________

Address: _______________________________

City, State, Zip Code: _______________________________

This Deed conveys real property, described as follows:

Property Address: _______________________________

City, State, Zip Code: _______________________________

Assessor’s Parcel Number: _______________________________

The Grantor transfers the above-named real property to the Grantee, effective only upon the death of the Grantor. This transfer is intended to avoid probate of the property upon the Grantor’s death.

1. Reservation of Rights:

The Grantor retains the right to revoke this Transfer-on-Death Deed at any time before death.

2. Acceptance:

The Grantee must accept this transfer. Acceptance can be evidenced by the Grantee signing below.

3. Signature of Grantor:

____________________________________

Date: _______________________________

4. Signature of Grantee:

____________________________________

Date: _______________________________

This document should be recorded with the applicable county recorder’s office in California to complete the transfer process.

Witness my hand this _____ day of __________, 20___.

____________________________________

(Notary Public or other authorized officer)

Note: This template should be adapted as necessary to meet specific needs and circumstances.

Other Transfer-on-Death Deed State Forms

Transfer on Death Deed Form Florida - Different states may have varying requirements for the deed, so it’s essential to check local laws.

The process of incorporating a business in Texas not only provides legal recognition but also establishes a framework for governance and operations. The Texas Articles of Incorporation form contains vital information including the corporation's name, purpose, and details about its directors and registered agent. For those interested in obtaining a ready-made template to assist with this process, you can find a helpful resource at txtemplate.com/articles-of-incorporation-pdf-template/. This can streamline your preparation and ensure that you have all necessary details correctly outlined.

Where Can I Get a Tod Form - This form does not require the property owner to give up control of the property during their lifetime.

Transfer on Death Instrument - This deed only takes effect after your passing, ensuring your wishes are respected without immediate changes.