Download Cash Receipt Form in PDF

In the world of finance and accounting, the Cash Receipt form serves as a vital tool for businesses and organizations to document incoming payments. This form captures essential details such as the date of the transaction, the amount received, and the method of payment, whether it be cash, check, or electronic transfer. It also includes fields for the name of the payer and the purpose of the payment, providing clarity and accountability. By maintaining a clear record of cash inflows, businesses can effectively track their revenue and ensure accurate financial reporting. Additionally, the Cash Receipt form can help in reconciling bank statements and serves as proof of payment for both the payer and the recipient. This straightforward yet powerful document not only aids in financial management but also fosters trust and transparency in financial dealings.

Document Data

| Fact Name | Description |

|---|---|

| Purpose | The Cash Receipt form is used to document the receipt of cash payments for goods or services. |

| Record Keeping | It serves as a crucial record for accounting purposes, ensuring transparency in financial transactions. |

| Required Information | The form typically includes details such as the date of receipt, amount received, payer's name, and purpose of payment. |

| Legal Compliance | In many states, maintaining accurate cash receipt records is mandated by state accounting laws. |

| Signature | A signature from the person receiving the cash is often required to validate the transaction. |

| Format | The form can be printed or created electronically, depending on the organization's preference. |

| Retention Period | Organizations are typically required to retain cash receipt records for a specific period, often ranging from three to seven years. |

| Audit Trail | Cash Receipt forms contribute to an audit trail, which is essential for internal and external audits. |

| Variations | Some organizations may have customized cash receipt forms tailored to their specific needs, while others may use standard templates. |

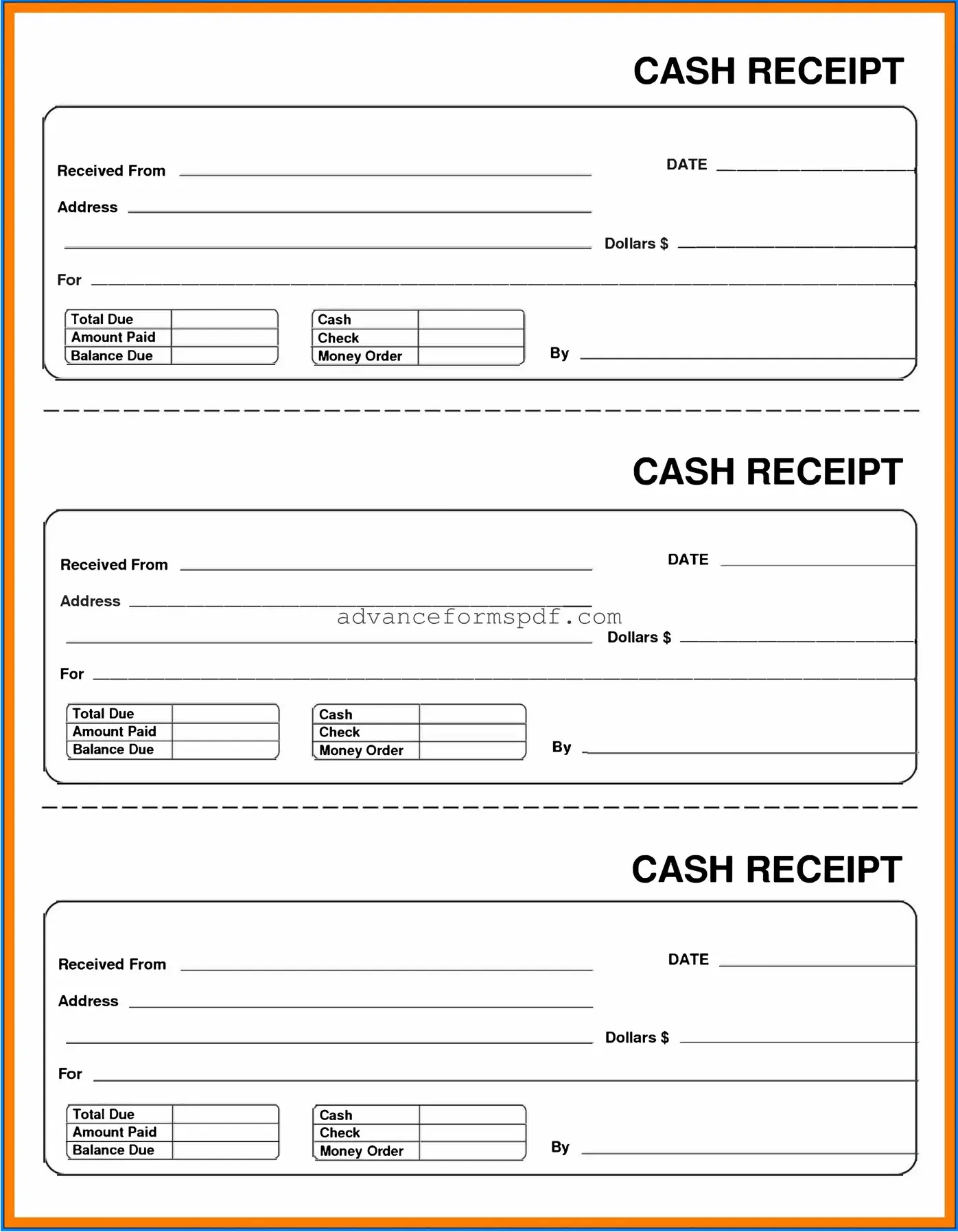

How to Write Cash Receipt

Once you have the Cash Receipt form in front of you, it’s important to fill it out accurately. This will ensure that all transactions are properly recorded and tracked. Follow these steps carefully to complete the form.

- Start by entering the Date at the top of the form. Use the format MM/DD/YYYY.

- In the Received From section, write the name of the individual or organization making the payment.

- Fill in the Amount Received box with the total payment amount. Make sure to include the currency symbol.

- In the Payment Method section, indicate how the payment was made (e.g., cash, check, credit card).

- If applicable, include a Check Number or transaction ID for reference.

- In the Purpose of Payment area, briefly describe what the payment is for.

- Sign the form in the Authorized Signature field to validate the receipt.

- Finally, make a copy of the completed form for your records before submitting it.

Cash Receipt Example

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

Common PDF Documents

Certificate of Stillbirth - This certification helps with navigating end-of-life decisions for a fetus.

Lyft Inspection Form Pdf - Inspection results help maintain high safety standards for riders.

For those seeking clarity in legal decisions, the effective Durable Power of Attorney document is crucial in ensuring that your financial affairs are managed as per your wishes, even during incapacitation.

Print Payroll Checks - Each entry on the form tells a part of an employee’s financial story.