Free Deed in Lieu of Foreclosure Document

When facing the possibility of foreclosure, homeowners often seek alternatives that can help them navigate this challenging situation. One such option is the Deed in Lieu of Foreclosure, a legal process that allows a homeowner to voluntarily transfer ownership of their property to the lender in exchange for the cancellation of their mortgage debt. This form serves as a crucial document in this process, outlining the terms and conditions under which the transfer takes place. By utilizing this form, homeowners can potentially avoid the lengthy and stressful foreclosure process, while also protecting their credit score to some extent. It is essential for both parties—the homeowner and the lender—to understand the implications of this agreement, as it may also involve negotiations regarding any outstanding balances or potential tax consequences. The Deed in Lieu of Foreclosure can be a beneficial solution for those looking to alleviate financial burdens, but it is important to approach this option with careful consideration and informed decision-making.

State-specific Guidelines for Deed in Lieu of Foreclosure Documents

PDF Specifics

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal agreement where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Benefits | This option can help homeowners avoid the lengthy and stressful foreclosure process, potentially reducing the impact on their credit score. |

| Eligibility | Typically, lenders will consider a deed in lieu of foreclosure if the homeowner is facing financial hardship and has made a good faith effort to sell the property. |

| Governing Laws | In the United States, laws governing deeds in lieu of foreclosure can vary by state. For example, California follows the California Civil Code, while New York adheres to the New York Real Property Actions and Proceedings Law. |

| Process | The process usually involves submitting a request to the lender, completing necessary paperwork, and ensuring that all liens on the property are addressed before the transfer is finalized. |

How to Write Deed in Lieu of Foreclosure

After completing the Deed in Lieu of Foreclosure form, you will need to take a few additional steps. This may include submitting the form to your lender and ensuring all necessary documents are included. Following these steps carefully will help move the process along smoothly.

- Begin by downloading the Deed in Lieu of Foreclosure form from a reliable source.

- Read the form carefully to understand what information is required.

- Fill in your name and address in the designated sections.

- Provide the name and address of the lender or mortgage company.

- Include details about the property, such as the address and legal description.

- State the reason for the deed in lieu of foreclosure in the appropriate section.

- Sign and date the form in the designated areas.

- Have the form notarized to ensure its validity.

- Make copies of the completed form for your records.

- Submit the original form to your lender along with any required documents.

Deed in Lieu of Foreclosure Example

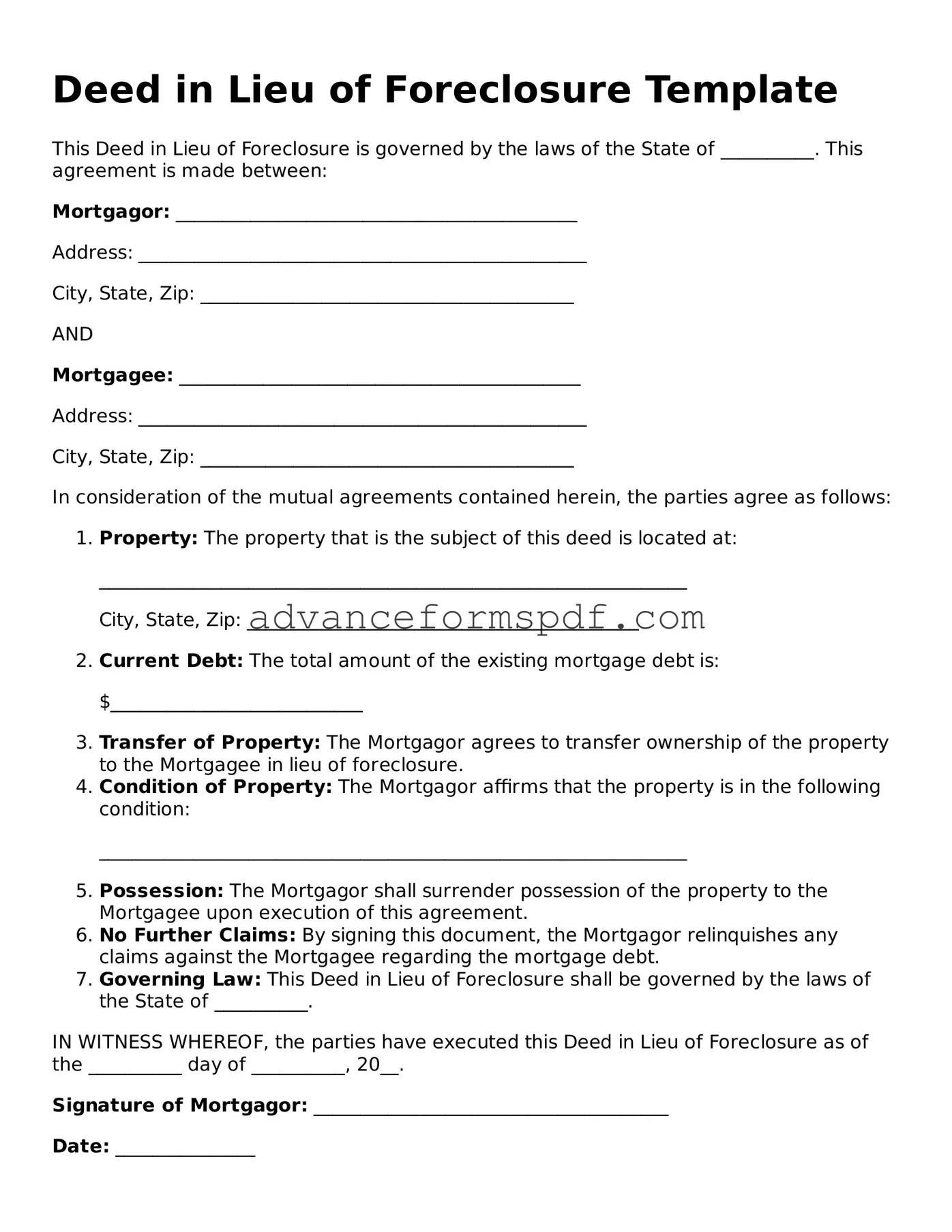

Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is governed by the laws of the State of __________. This agreement is made between:

Mortgagor: ___________________________________________

Address: ________________________________________________

City, State, Zip: ________________________________________

AND

Mortgagee: ___________________________________________

Address: ________________________________________________

City, State, Zip: ________________________________________

In consideration of the mutual agreements contained herein, the parties agree as follows:

- Property: The property that is the subject of this deed is located at:

- Current Debt: The total amount of the existing mortgage debt is:

- Transfer of Property: The Mortgagor agrees to transfer ownership of the property to the Mortgagee in lieu of foreclosure.

- Condition of Property: The Mortgagor affirms that the property is in the following condition:

- Possession: The Mortgagor shall surrender possession of the property to the Mortgagee upon execution of this agreement.

- No Further Claims: By signing this document, the Mortgagor relinquishes any claims against the Mortgagee regarding the mortgage debt.

- Governing Law: This Deed in Lieu of Foreclosure shall be governed by the laws of the State of __________.

_______________________________________________________________

City, State, Zip: __________________________________________

$___________________________

_______________________________________________________________

IN WITNESS WHEREOF, the parties have executed this Deed in Lieu of Foreclosure as of the __________ day of __________, 20__.

Signature of Mortgagor: ______________________________________

Date: _______________

Signature of Mortgagee: ______________________________________

Date: _______________

NOTARY PUBLIC:

State of ____________

County of ___________

On this __________ day of __________, 20__, before me, a Notary Public in and for said State, personally appeared ___________, known to me to be the person who executed the within instrument.

Given under my hand and official seal.

_______________________________

Notary Public

My Commission Expires: _______________

Discover Common Types of Deed in Lieu of Foreclosure Forms

Problems With Transfer on Death Deeds California - A Transfer-on-Death Deed can be revoked or changed at any time during your lifetime.

A Non-disclosure Agreement (NDA) is a legal contract that establishes a confidential relationship between parties, ensuring that sensitive information remains protected. In Arizona, this form is essential for businesses and individuals who wish to share proprietary information without the risk of it being disclosed to unauthorized entities. For more details, you can refer to the Arizona PDF Forms, which can help you understand the nuances of the Arizona Non-disclosure Agreement and safeguard your intellectual property to maintain your competitive edge.