Download Employee Advance Form in PDF

The Employee Advance form serves a crucial function in the workplace, allowing employees to request financial assistance from their employer for various purposes. This form typically includes sections for the employee's personal information, the amount of money requested, and the reason for the advance. Employers often require detailed justifications to ensure that the funds are used appropriately and responsibly. Additionally, the form may outline the repayment terms, including any deductions from future paychecks. By streamlining the process for requesting advances, this form helps maintain clear communication between employees and management. Furthermore, it establishes a formal record of the transaction, which can be important for both financial accountability and compliance with company policies. Understanding the nuances of the Employee Advance form can empower employees to navigate their financial needs effectively while also adhering to company guidelines.

Document Data

| Fact Name | Description |

|---|---|

| Purpose | The Employee Advance form is used to request funds from an employer to cover anticipated expenses. |

| Eligibility | Typically, all employees may request an advance, but specific policies may vary by employer. |

| Amount Limits | Employers often set a maximum limit on the amount that can be requested through this form. |

| Repayment Terms | Repayment terms are usually outlined by the employer, specifying how and when the advance must be paid back. |

| Governing Laws | In some states, such as California, the governing laws include the California Labor Code, which addresses wage advances. |

| Documentation | Employees may need to provide receipts or proof of expenses when submitting the form or repaying the advance. |

| Approval Process | Typically, the form must be approved by a supervisor or HR before the advance is disbursed. |

| Tax Implications | Advances may have tax implications, and employees should consult with a tax professional regarding their specific situation. |

| State Variations | Each state may have different regulations regarding employee advances, so it’s important to check local laws. |

| Record Keeping | Employers should maintain records of all advances issued and repayments made for accounting purposes. |

How to Write Employee Advance

Once you have the Employee Advance form, it's important to fill it out accurately to ensure a smooth process. Follow these steps to complete the form correctly.

- Start by entering your full name in the designated field at the top of the form.

- Provide your employee identification number. This helps the HR department verify your employment status.

- Fill in the date of the request. Use the format MM/DD/YYYY for clarity.

- In the next section, specify the amount you are requesting as an advance.

- Clearly state the purpose of the advance. Be concise but thorough in your explanation.

- If applicable, include any supporting documentation. Attach copies, not originals.

- Sign and date the form at the bottom. Your signature confirms your request.

- Submit the completed form to your supervisor or HR department as directed.

Employee Advance Example

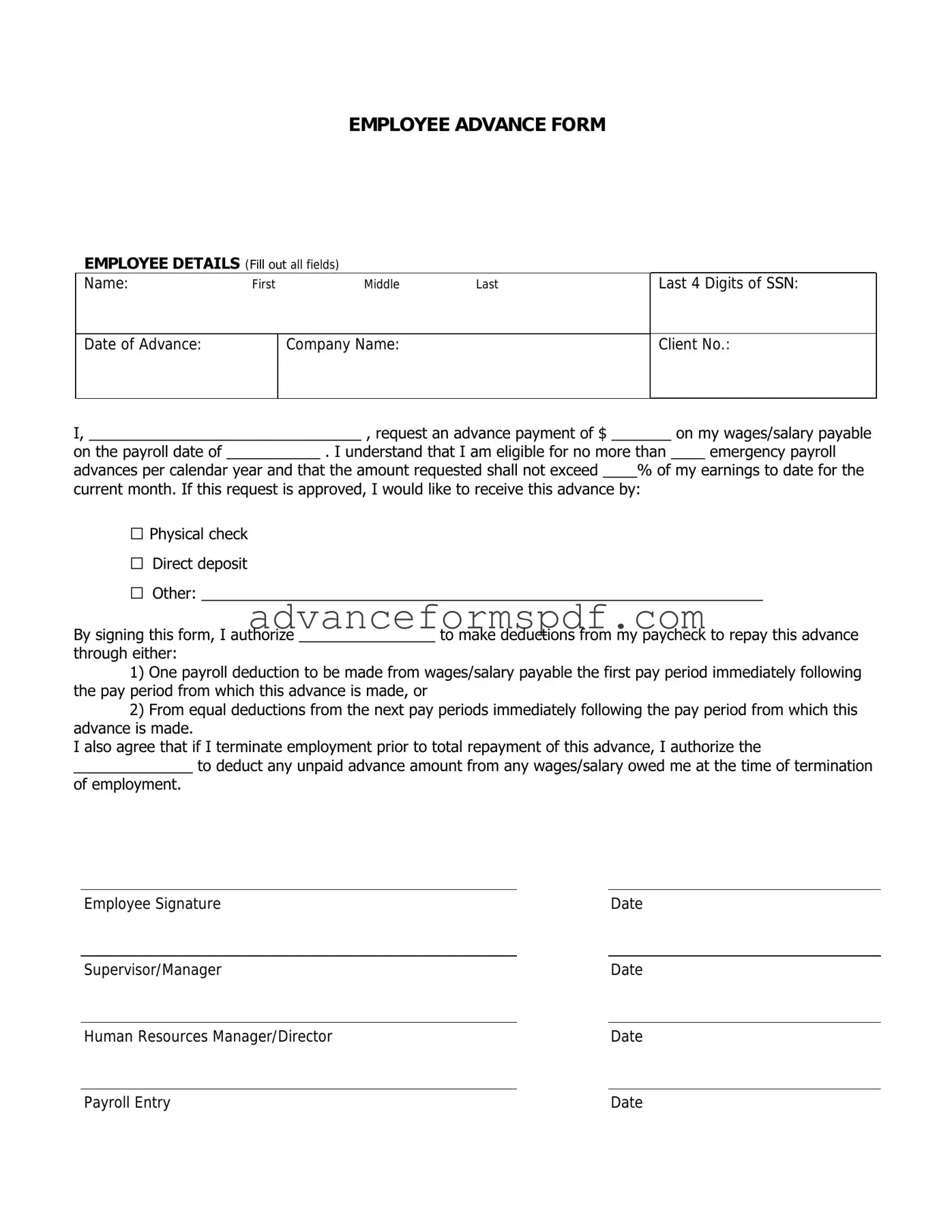

EMPLOYEE ADVANCE FORM

EMPLOYEE DETAILS (Fill out all fields)

Name: |

First |

Middle |

Last |

|

|

|

|

Date of Advance: |

|

Company Name: |

|

|

|

|

|

Last 4 Digits of SSN:

Client No.:

I, ________________________________ , request an advance payment of $ _______ on my wages/salary payable

on the payroll date of ___________ . I understand that I am eligible for no more than ____ emergency payroll

advances per calendar year and that the amount requested shall not exceed ____% of my earnings to date for the

current month. If this request is approved, I would like to receive this advance by:

□Physical check

□Direct deposit

□Other: __________________________________________________________________

By signing this form, I authorize ________________ to make deductions from my paycheck to repay this advance

through either:

1)One payroll deduction to be made from wages/salary payable the first pay period immediately following the pay period from which this advance is made, or

2)From equal deductions from the next pay periods immediately following the pay period from which this advance is made.

I also agree that if I terminate employment prior to total repayment of this advance, I authorize the

______________ to deduct any unpaid advance amount from any wages/salary owed me at the time of termination of employment.

Employee Signature |

|

Date |

|

|

|

Supervisor/Manager |

|

Date |

|

|

|

Human Resources Manager/Director |

|

Date |

Payroll Entry |

Date |

Common PDF Documents

Business Bureau Complaint - File a complaint about unfair contract practices here.

Understanding the importance of a clear transaction, the Arizona Motorcycle Bill of Sale form not only serves as a record of the sale but also protects both the buyer and seller. For those seeking to create this document, resources like Arizona PDF Forms can be invaluable in ensuring all necessary details are accurately captured, thereby facilitating a smooth registration and title transfer process.

Temporary Guardianship Form California Pdf - The requirements for completing the form vary by state, reflecting local judicial preferences.