Free Employee Loan Agreement Document

The Employee Loan Agreement form serves as a crucial document in the employer-employee relationship, particularly when financial assistance is provided by the employer to the employee. This agreement outlines the specific terms and conditions governing the loan, including the loan amount, interest rate, repayment schedule, and any applicable fees. It also details the consequences of default, ensuring both parties understand their obligations and rights. By clearly defining the parameters of the loan, the form helps to mitigate potential misunderstandings and disputes. Additionally, the agreement may include provisions regarding the use of the loan funds, confidentiality clauses, and the process for addressing any changes in employment status that could affect repayment. Understanding these elements is essential for both employers and employees to foster a transparent and fair lending process.

PDF Specifics

| Fact Name | Description |

|---|---|

| Definition | An Employee Loan Agreement is a contract between an employer and an employee outlining the terms of a loan provided by the employer to the employee. |

| Purpose | This agreement helps clarify the loan amount, repayment terms, and any applicable interest rates. |

| Repayment Terms | Typically, the agreement specifies how and when the employee will repay the loan, including payment schedules. |

| Interest Rates | Some agreements may include interest on the loan, which should be clearly stated in the document. |

| Governing Law | The agreement is often governed by state laws, which can vary. For example, California law may apply if the employer is based there. |

| Default Terms | It is important to include terms regarding what happens if the employee defaults on the loan. |

| Confidentiality | The agreement may include confidentiality clauses to protect sensitive financial information. |

| Signature Requirement | Both parties must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

How to Write Employee Loan Agreement

Completing the Employee Loan Agreement form is a straightforward process. This document outlines the terms of a loan between an employer and an employee. To ensure that all necessary information is captured accurately, follow these steps carefully.

- Begin by entering the date at the top of the form. This helps establish when the agreement is made.

- Fill in the employee's full name. Make sure to use the name as it appears on official documents.

- Provide the employee's job title. This gives context to the agreement.

- Enter the amount of the loan being requested. Be precise to avoid any misunderstandings later.

- Specify the purpose of the loan. Clearly state what the funds will be used for.

- Indicate the repayment terms. This includes how long the employee has to repay the loan and the frequency of payments.

- Include the interest rate, if applicable. This should be clearly stated to ensure transparency.

- Have the employee sign and date the form. This signifies their agreement to the terms outlined.

- Obtain a signature from the employer or authorized representative. This validates the agreement.

Once completed, both parties should retain a copy of the signed agreement for their records. This ensures that everyone is aware of the terms and conditions agreed upon.

Employee Loan Agreement Example

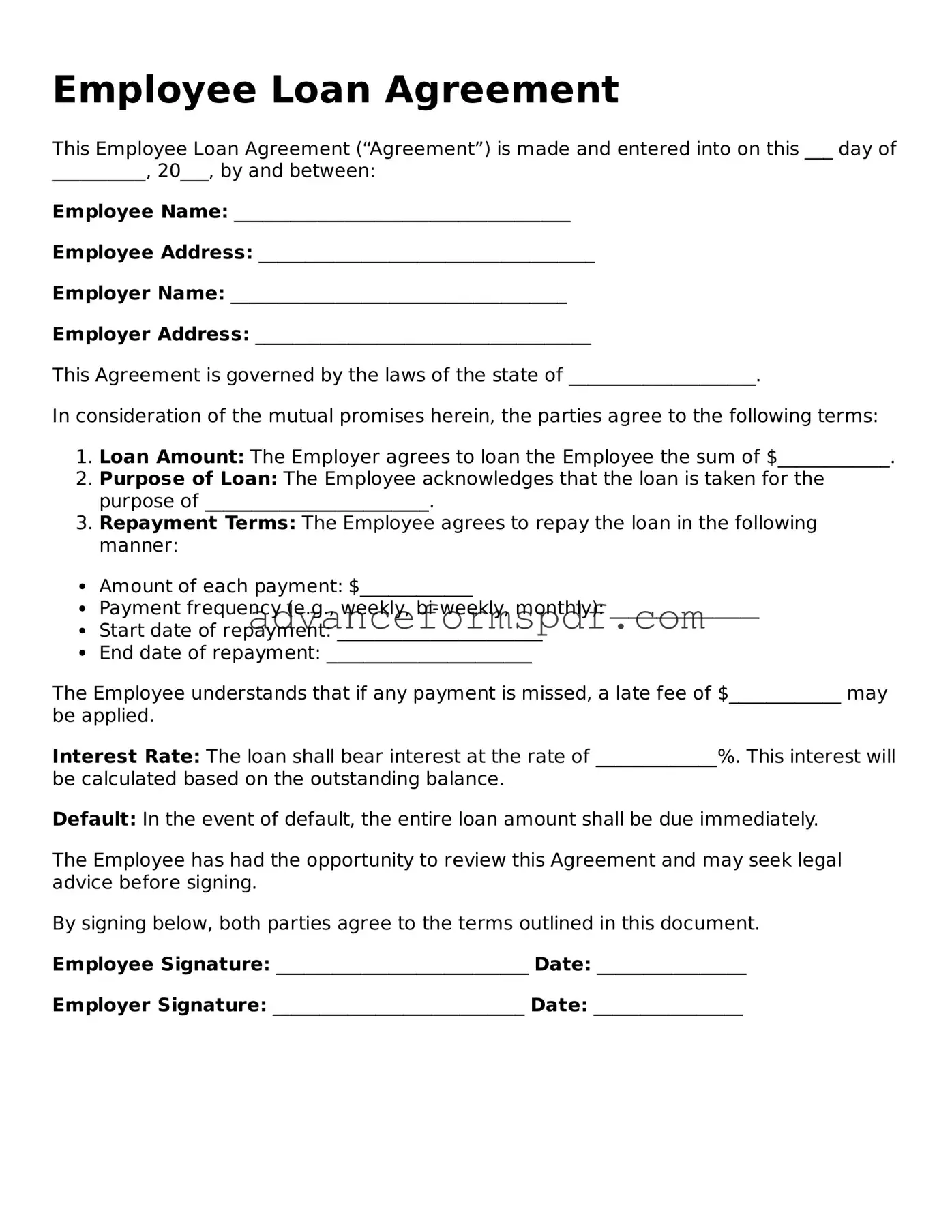

Employee Loan Agreement

This Employee Loan Agreement (“Agreement”) is made and entered into on this ___ day of __________, 20___, by and between:

Employee Name: ____________________________________

Employee Address: ____________________________________

Employer Name: ____________________________________

Employer Address: ____________________________________

This Agreement is governed by the laws of the state of ____________________.

In consideration of the mutual promises herein, the parties agree to the following terms:

- Loan Amount: The Employer agrees to loan the Employee the sum of $____________.

- Purpose of Loan: The Employee acknowledges that the loan is taken for the purpose of ________________________.

- Repayment Terms: The Employee agrees to repay the loan in the following manner:

- Amount of each payment: $____________

- Payment frequency (e.g., weekly, bi-weekly, monthly): ________________

- Start date of repayment: ______________________

- End date of repayment: ______________________

The Employee understands that if any payment is missed, a late fee of $____________ may be applied.

Interest Rate: The loan shall bear interest at the rate of _____________%. This interest will be calculated based on the outstanding balance.

Default: In the event of default, the entire loan amount shall be due immediately.

The Employee has had the opportunity to review this Agreement and may seek legal advice before signing.

By signing below, both parties agree to the terms outlined in this document.

Employee Signature: ___________________________ Date: ________________

Employer Signature: ___________________________ Date: ________________