Valid Deed in Lieu of Foreclosure Form for the State of Florida

In Florida, homeowners facing financial difficulties may find themselves considering various options to avoid foreclosure. One such option is the Deed in Lieu of Foreclosure, a legal document that allows a borrower to voluntarily transfer ownership of their property back to the lender. This process can offer a streamlined alternative to lengthy foreclosure proceedings, potentially minimizing the negative impact on the homeowner's credit score. By executing this deed, the borrower relinquishes all rights to the property, effectively satisfying the mortgage obligation. It's important to understand that while this option can provide relief, it also comes with certain implications, such as the possibility of the lender pursuing a deficiency judgment if the property's value is less than the outstanding mortgage balance. Additionally, the Deed in Lieu of Foreclosure may require the borrower to meet specific conditions set by the lender, including the need for the property to be free of other liens. For those navigating this complex situation, knowing the details of the form and its potential consequences is crucial for making informed decisions about their financial future.

PDF Specifics

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Laws | Florida Statutes, Chapter 697 governs deeds in lieu of foreclosure in Florida. |

| Eligibility | Homeowners must be facing financial hardship and unable to continue mortgage payments to qualify for this option. |

| Process | The borrower must negotiate the terms with the lender, including any potential forgiveness of remaining debt. |

| Benefits | This option can help avoid the lengthy foreclosure process and may have less impact on the borrower's credit score. |

| Risks | Borrowers may still be liable for any deficiency balance unless explicitly forgiven by the lender. |

| Alternatives | Other options include loan modifications, short sales, or traditional foreclosure, depending on the borrower's situation. |

How to Write Florida Deed in Lieu of Foreclosure

Once you have the Florida Deed in Lieu of Foreclosure form ready, you will need to complete it accurately to ensure it is legally binding. After filling out the form, you will typically submit it to your lender for their review and acceptance. This step is crucial as it allows the lender to process the deed and finalize the transfer of property.

- Obtain the Florida Deed in Lieu of Foreclosure form from a reliable source or your lender.

- Fill in the names of all parties involved in the transaction. This includes the current property owner(s) and the lender.

- Provide the property address and legal description. Ensure this information matches public records.

- Specify the date of the transfer. This is typically the date you sign the document.

- Indicate any outstanding amounts owed on the mortgage. Be clear and precise.

- Sign the document in the presence of a notary public. This step is essential for the document's validity.

- Ensure all parties receive a copy of the signed document for their records.

- Submit the completed form to your lender for acceptance.

Florida Deed in Lieu of Foreclosure Example

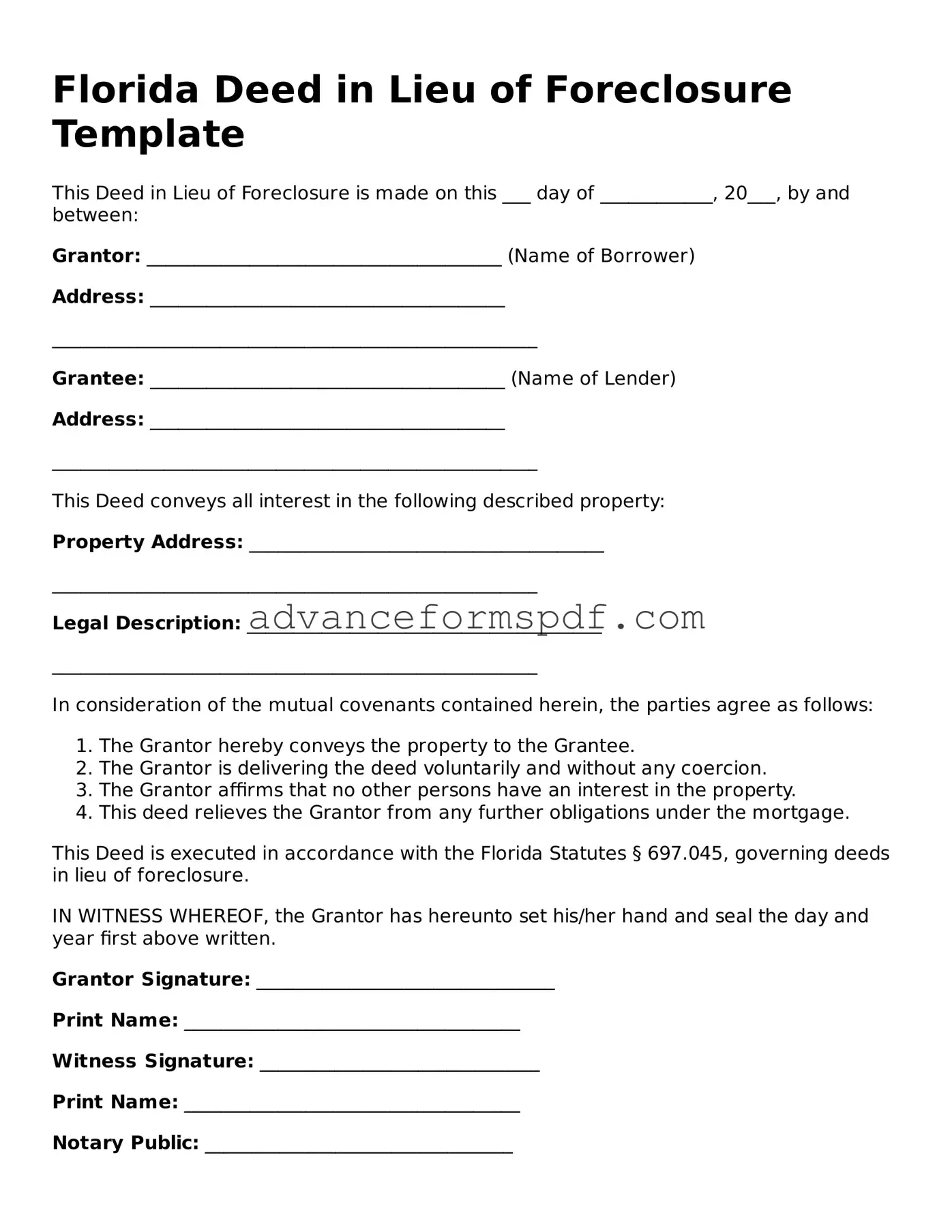

Florida Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made on this ___ day of ____________, 20___, by and between:

Grantor: ______________________________________ (Name of Borrower)

Address: ______________________________________

____________________________________________________

Grantee: ______________________________________ (Name of Lender)

Address: ______________________________________

____________________________________________________

This Deed conveys all interest in the following described property:

Property Address: ______________________________________

____________________________________________________

Legal Description: ______________________________________

____________________________________________________

In consideration of the mutual covenants contained herein, the parties agree as follows:

- The Grantor hereby conveys the property to the Grantee.

- The Grantor is delivering the deed voluntarily and without any coercion.

- The Grantor affirms that no other persons have an interest in the property.

- This deed relieves the Grantor from any further obligations under the mortgage.

This Deed is executed in accordance with the Florida Statutes § 697.045, governing deeds in lieu of foreclosure.

IN WITNESS WHEREOF, the Grantor has hereunto set his/her hand and seal the day and year first above written.

Grantor Signature: ________________________________

Print Name: ____________________________________

Witness Signature: ______________________________

Print Name: ____________________________________

Notary Public: _________________________________

My Commission Expires: _______________________

Other Deed in Lieu of Foreclosure State Forms

California Property Surrender Deed - This arrangement can be a viable alternative for homeowners facing significant financial distress.

Deed in Lieu - Choosing a Deed in Lieu can help maintain dignity in a difficult financial situation.

For those looking to navigate the process of vehicle ownership transfer in Arizona, it is essential to utilize the appropriate documentation, such as the Arizona Motor Vehicle Bill of Sale. This form not only captures vital information about the parties involved but also the specifics of the vehicle being sold. To facilitate this process, you can find the necessary documents by visiting Arizona PDF Forms, helping to ensure that all transactions are completed efficiently and legally.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - Homeowners should research and understand their rights when exploring a Deed in Lieu of Foreclosure, ensuring informed decision-making.