Valid Lady Bird Deed Form for the State of Florida

The Florida Lady Bird Deed is a unique estate planning tool that allows property owners to retain control over their real estate while facilitating a seamless transfer of ownership upon death. This deed is particularly beneficial for those who wish to avoid the lengthy and often costly probate process. With a Lady Bird Deed, the original owner, known as the grantor, can transfer property to a beneficiary, typically a family member, while maintaining the right to live in and manage the property during their lifetime. This arrangement ensures that the property automatically passes to the designated beneficiary without the need for court intervention. Importantly, the grantor can also sell, mortgage, or change the beneficiary at any time, providing flexibility and peace of mind. Additionally, the Lady Bird Deed can help protect the property from creditors and may have favorable tax implications, making it an attractive option for many Florida residents. Understanding the nuances of this deed is essential for effective estate planning and can significantly impact how individuals manage their assets and provide for their loved ones in the future.

PDF Specifics

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed is a type of enhanced life estate deed used in Florida to transfer real estate upon death without going through probate. |

| Governing Law | The Lady Bird Deed is governed by Florida Statutes, specifically Section 689.05. |

| Benefits | This deed allows the property owner to retain full control of the property during their lifetime, including the right to sell or mortgage it. |

| Probate Avoidance | One of the key advantages is that the property automatically transfers to the designated beneficiaries upon the owner's death, avoiding the probate process. |

| Tax Implications | The property retains its tax basis, which can be beneficial for the heirs in terms of property taxes. |

| Revocability | Unlike some other estate planning tools, a Lady Bird Deed can be revoked or modified at any time by the property owner. |

| Eligibility | Any Florida resident can create a Lady Bird Deed, provided they own real estate in the state. |

| Transfer on Death | The deed allows for a straightforward transfer of property to the heirs without the need for court intervention. |

| Limitations | While beneficial, a Lady Bird Deed may not be suitable for all situations, especially if the property owner has complex estate planning needs. |

| Legal Assistance | It is advisable to consult with an attorney when creating a Lady Bird Deed to ensure it meets all legal requirements and aligns with personal goals. |

How to Write Florida Lady Bird Deed

After gathering the necessary information, you will proceed to fill out the Florida Lady Bird Deed form. This form requires specific details about the property and the individuals involved. Follow these steps to ensure accurate completion.

- Obtain the Florida Lady Bird Deed form. You can find it online or at your local courthouse.

- Enter the full name of the property owner(s) in the designated section. Ensure the names match legal identification.

- Provide the full address of the property being transferred, including the street address, city, state, and zip code.

- Identify the beneficiaries who will receive the property upon the owner's passing. List their full names and relationship to the owner.

- Clearly state any conditions or limitations regarding the property transfer, if applicable.

- Include the date of signing. This is crucial for legal validity.

- Sign the form in the appropriate section. If there are multiple owners, all must sign.

- Have the form notarized. A notary public must witness the signatures to validate the document.

- Submit the completed form to the county clerk’s office where the property is located for recording.

Florida Lady Bird Deed Example

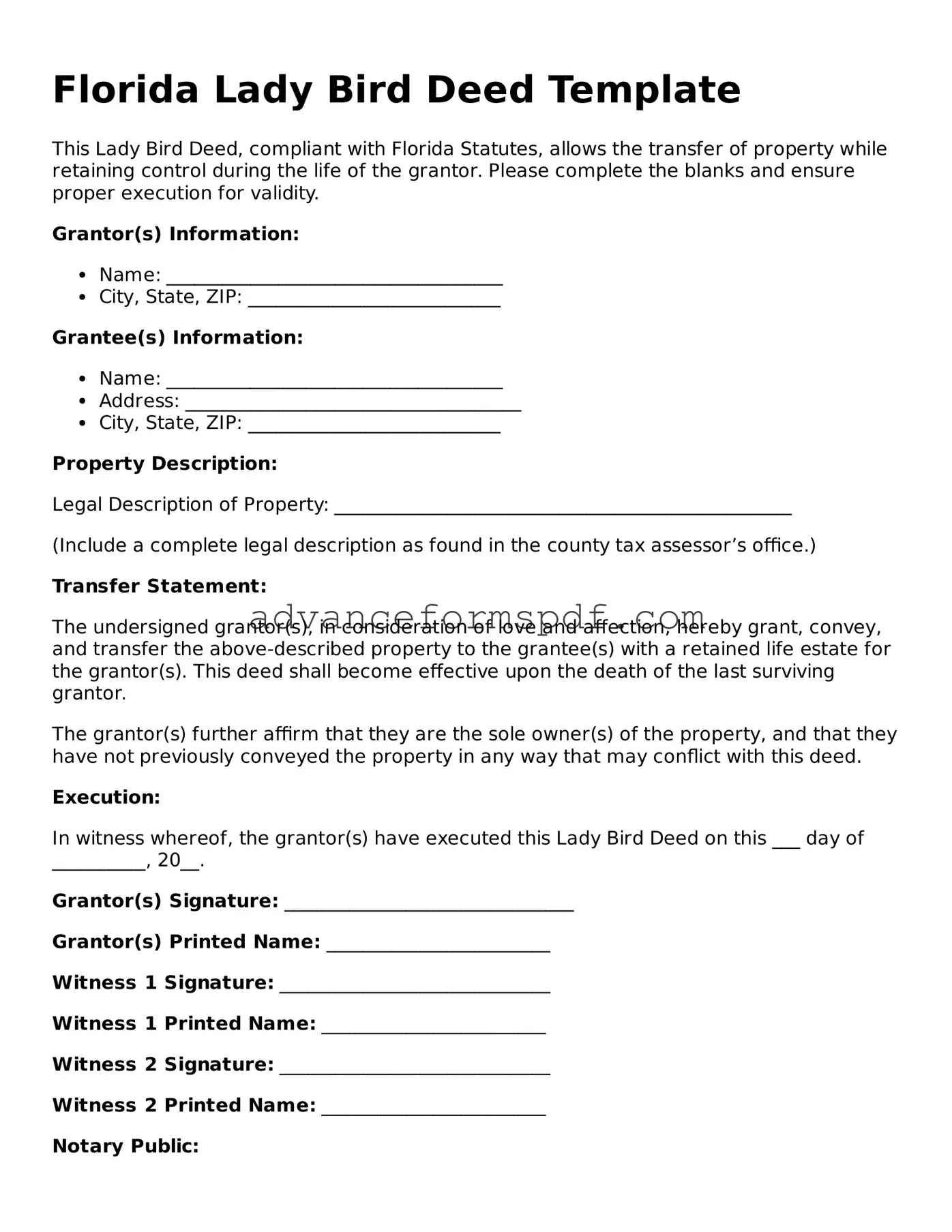

Florida Lady Bird Deed Template

This Lady Bird Deed, compliant with Florida Statutes, allows the transfer of property while retaining control during the life of the grantor. Please complete the blanks and ensure proper execution for validity.

Grantor(s) Information:

- Name: ____________________________________

- City, State, ZIP: ___________________________

Grantee(s) Information:

- Name: ____________________________________

- Address: ____________________________________

- City, State, ZIP: ___________________________

Property Description:

Legal Description of Property: _________________________________________________

(Include a complete legal description as found in the county tax assessor’s office.)

Transfer Statement:

The undersigned grantor(s), in consideration of love and affection, hereby grant, convey, and transfer the above-described property to the grantee(s) with a retained life estate for the grantor(s). This deed shall become effective upon the death of the last surviving grantor.

The grantor(s) further affirm that they are the sole owner(s) of the property, and that they have not previously conveyed the property in any way that may conflict with this deed.

Execution:

In witness whereof, the grantor(s) have executed this Lady Bird Deed on this ___ day of __________, 20__.

Grantor(s) Signature: _______________________________

Grantor(s) Printed Name: ________________________

Witness 1 Signature: _____________________________

Witness 1 Printed Name: ________________________

Witness 2 Signature: _____________________________

Witness 2 Printed Name: ________________________

Notary Public:

State of Florida

County of ________________

Sworn and subscribed before me this ___ day of __________, 20__.

Notary Public Signature: ______________________

Printed Name: ________________________________

My Commission Expires: ______________________

This document should be recorded in the county property records for it to take effect and for proper consideration to be given during property transactions.