Valid Loan Agreement Form for the State of Florida

When navigating the financial landscape in Florida, understanding the Florida Loan Agreement form is essential for both lenders and borrowers. This document serves as a binding contract that outlines the terms of a loan, ensuring that both parties are clear about their obligations. Key elements of the form include the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, the agreement specifies the rights and responsibilities of each party, helping to mitigate misunderstandings and disputes. It also addresses what happens in the event of default, providing a clear framework for resolution. By familiarizing themselves with this important form, individuals can better protect their interests and foster transparent financial transactions.

PDF Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Florida Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Florida, specifically under Florida Statutes. |

| Parties Involved | The form identifies the lender and the borrower, including their legal names and contact information. |

| Loan Amount | The agreement specifies the total amount of money being loaned to the borrower. |

| Repayment Terms | Details regarding the repayment schedule, interest rates, and any fees associated with the loan are included in the form. |

| Signatures | Both parties must sign the agreement to indicate their acceptance of the terms outlined in the document. |

How to Write Florida Loan Agreement

Completing the Florida Loan Agreement form is an essential step in formalizing a loan. Once you have filled out the form accurately, it will need to be reviewed and signed by all parties involved. Ensure that all information is correct to avoid any potential disputes later.

- Begin by entering the date at the top of the form.

- Fill in the names and addresses of both the lender and the borrower.

- Specify the loan amount clearly in the designated section.

- Indicate the interest rate, if applicable, and any terms related to repayment.

- Detail the payment schedule, including due dates and amounts.

- Include any additional terms or conditions that are relevant to the loan.

- Review the completed form for accuracy and completeness.

- Sign and date the form where indicated. Ensure both parties do the same.

Florida Loan Agreement Example

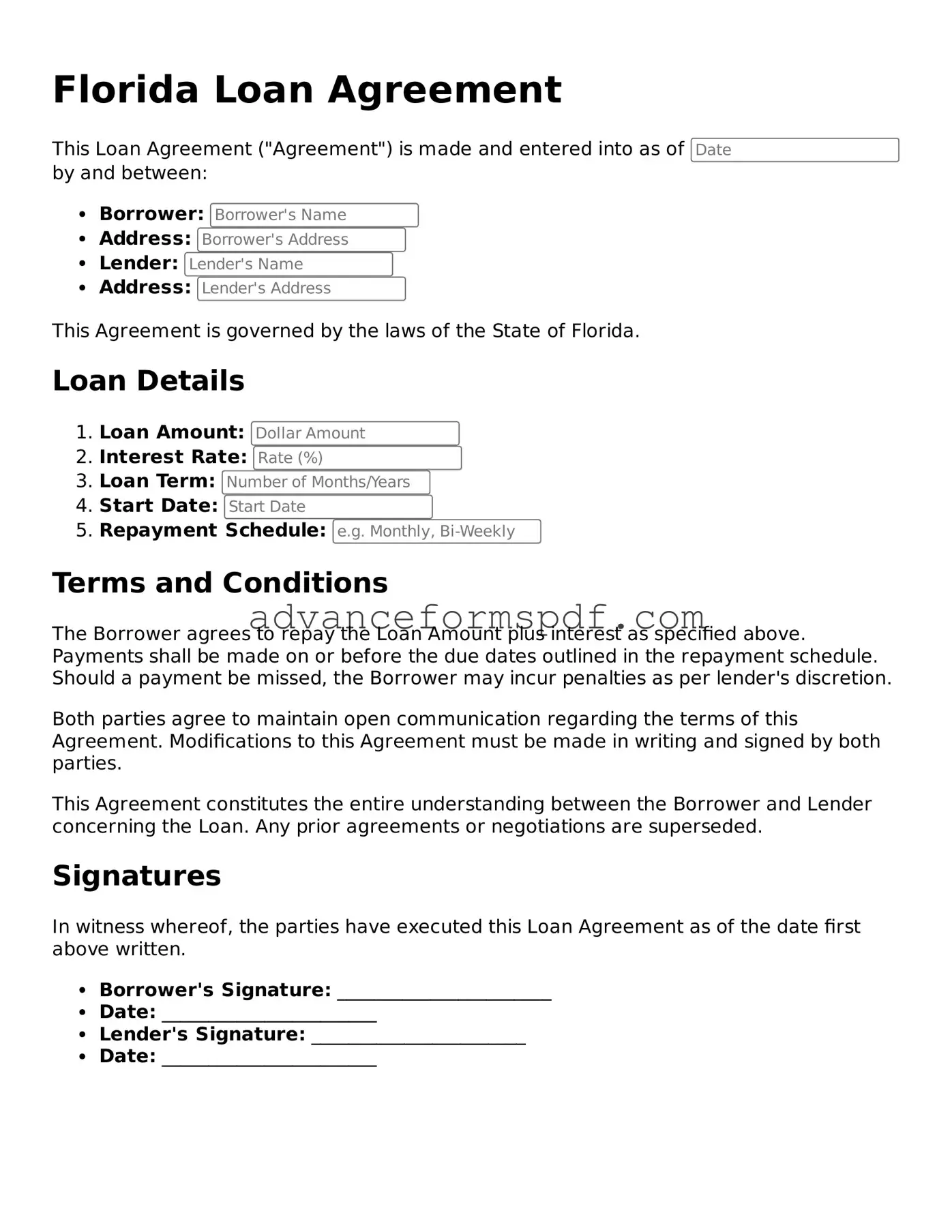

Florida Loan Agreement

This Loan Agreement ("Agreement") is made and entered into as of by and between:

- Borrower:

- Address:

- Lender:

- Address:

This Agreement is governed by the laws of the State of Florida.

Loan Details

- Loan Amount:

- Interest Rate:

- Loan Term:

- Start Date:

- Repayment Schedule:

Terms and Conditions

The Borrower agrees to repay the Loan Amount plus interest as specified above. Payments shall be made on or before the due dates outlined in the repayment schedule. Should a payment be missed, the Borrower may incur penalties as per lender's discretion.

Both parties agree to maintain open communication regarding the terms of this Agreement. Modifications to this Agreement must be made in writing and signed by both parties.

This Agreement constitutes the entire understanding between the Borrower and Lender concerning the Loan. Any prior agreements or negotiations are superseded.

Signatures

In witness whereof, the parties have executed this Loan Agreement as of the date first above written.

- Borrower's Signature: _______________________

- Date: _______________________

- Lender's Signature: _______________________

- Date: _______________________

Other Loan Agreement State Forms

Illinois Promissory Note - The document generally encompasses the total loan cost over the repayment period.

Promissory Note New York - Includes terms regarding late payments and any applicable fees.

A Non-disclosure Agreement (NDA) is a legal contract that establishes a confidential relationship between parties, ensuring that sensitive information remains protected. In Arizona, this form is essential for businesses and individuals who wish to share proprietary information without the risk of it being disclosed to unauthorized entities. For more information, you can visit Arizona PDF Forms. Understanding the nuances of the Arizona Non-disclosure Agreement can help safeguard your intellectual property and maintain your competitive edge.

California Promissory Note - This document can be a key tool in managing the relationship between lenders and borrowers.