Valid Promissory Note Form for the State of Florida

When engaging in financial transactions, particularly those involving loans, clarity and security are paramount. In Florida, the Promissory Note form serves as a crucial document that outlines the terms of a loan agreement between a borrower and a lender. This legally binding instrument details essential elements such as the principal amount borrowed, the interest rate, and the repayment schedule. It also addresses the consequences of default, ensuring that both parties understand their rights and obligations. By specifying whether the note is secured or unsecured, the form provides additional layers of protection for the lender. Furthermore, it may include provisions for prepayment and late fees, which can significantly impact the overall cost of borrowing. Understanding the intricacies of the Florida Promissory Note is vital for anyone involved in lending or borrowing, as it not only safeguards financial interests but also fosters trust and transparency in the transaction.

PDF Specifics

| Fact Name | Description |

|---|---|

| Definition | A Florida Promissory Note is a written promise to pay a specific amount of money to a designated person or entity. |

| Governing Law | The Florida Promissory Note is governed by Florida Statutes, specifically Chapter 673, which covers Uniform Commercial Code (UCC) provisions. |

| Parties Involved | The document typically involves a borrower (maker) and a lender (payee). |

| Interest Rates | Interest rates can be fixed or variable and must be clearly stated in the note. |

| Payment Terms | Payment terms, including the due date and frequency of payments, should be specified. |

| Default Clause | A default clause outlines the consequences if the borrower fails to make payments as agreed. |

| Signatures | The note must be signed by the borrower to be legally binding. |

| Witnesses | While not always required, having witnesses or notarization can strengthen the document's validity. |

| Transferability | A Florida Promissory Note can often be transferred to another party, allowing for flexibility in ownership. |

| Legal Enforcement | If the borrower defaults, the lender can pursue legal action to recover the owed amount. |

How to Write Florida Promissory Note

After obtaining the Florida Promissory Note form, you will need to provide specific information. This will ensure that the document is complete and accurately reflects the agreement between the parties involved. Follow these steps carefully to fill out the form correctly.

- Begin by entering the date at the top of the form. Use the format Month/Day/Year.

- Next, write the name of the borrower. Include the full legal name as it appears on identification documents.

- Provide the address of the borrower. This should be the current residential address.

- Then, enter the name of the lender. Again, use the full legal name.

- List the lender's address, ensuring it is accurate and up to date.

- Specify the principal amount being borrowed. This should be a numerical figure followed by the written amount in words.

- Indicate the interest rate, if applicable. Clearly state the percentage.

- Fill in the repayment terms. This includes the schedule for payments and any specific due dates.

- If there are any late fees, include those terms as well.

- Finally, both the borrower and lender should sign and date the form at the bottom. Ensure that all signatures are original.

Florida Promissory Note Example

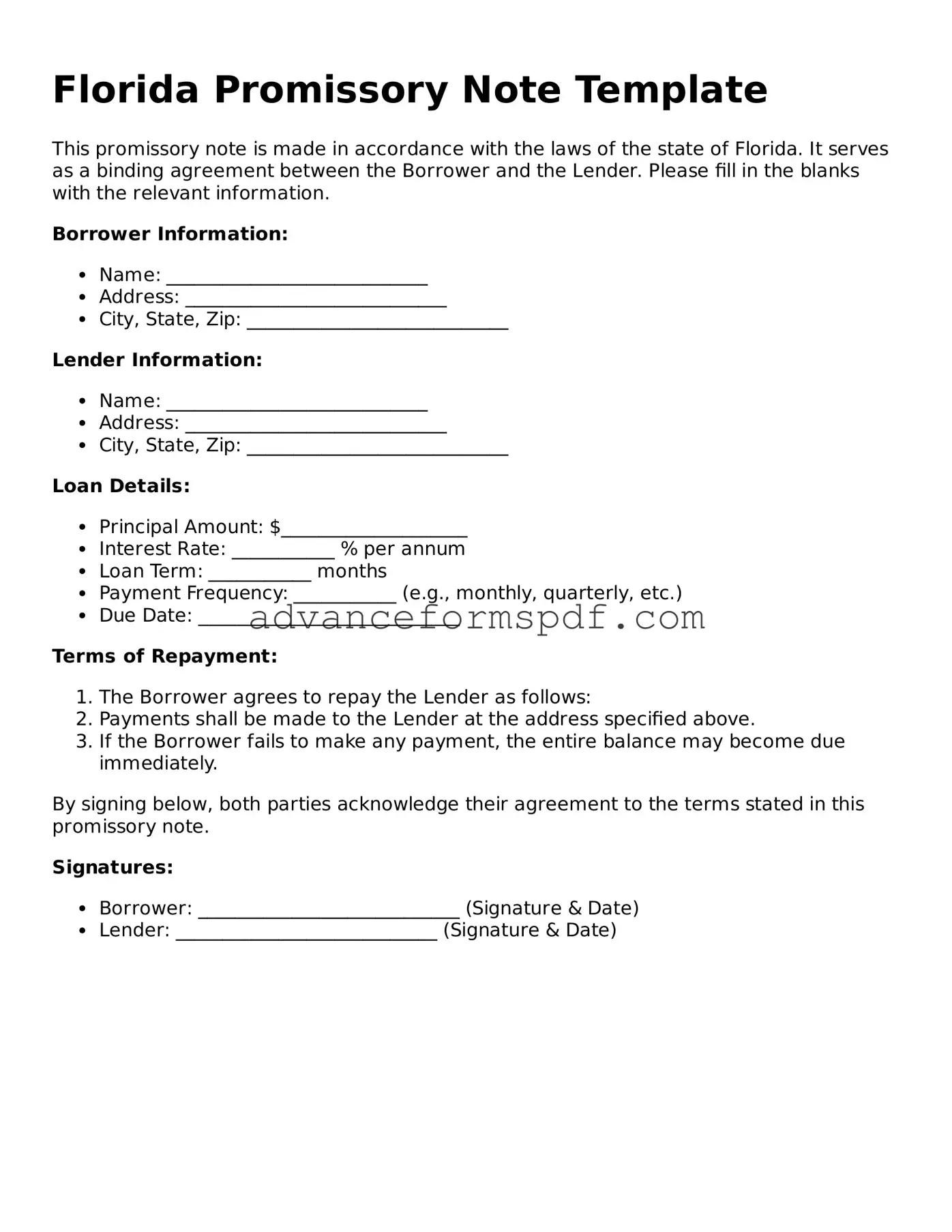

Florida Promissory Note Template

This promissory note is made in accordance with the laws of the state of Florida. It serves as a binding agreement between the Borrower and the Lender. Please fill in the blanks with the relevant information.

Borrower Information:

- Name: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

Lender Information:

- Name: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

Loan Details:

- Principal Amount: $____________________

- Interest Rate: ___________ % per annum

- Loan Term: ___________ months

- Payment Frequency: ___________ (e.g., monthly, quarterly, etc.)

- Due Date: ____________________________

Terms of Repayment:

- The Borrower agrees to repay the Lender as follows:

- Payments shall be made to the Lender at the address specified above.

- If the Borrower fails to make any payment, the entire balance may become due immediately.

By signing below, both parties acknowledge their agreement to the terms stated in this promissory note.

Signatures:

- Borrower: ____________________________ (Signature & Date)

- Lender: ____________________________ (Signature & Date)

Other Promissory Note State Forms

Illinois Promissory Note - It can also be useful for individuals or businesses looking to lend money responsibly.

Filling out a Power of Attorney form in Arizona is crucial for effectively managing your affairs, especially when you are unable to make decisions on your own. Utilizing resources such as Arizona PDF Forms can simplify the process, ensuring that you clearly outline your wishes and designate trustworthy individuals to act on your behalf, thereby providing peace of mind for you and your family.

Promissory Notes for Personal Loans - In many cases, it also requires the witness or a notary to enhance its legitimacy.