Valid Transfer-on-Death Deed Form for the State of Florida

The Florida Transfer-on-Death Deed form offers a straightforward way for property owners to designate beneficiaries who will inherit real estate upon their death, bypassing the often lengthy probate process. This legal document allows individuals to maintain control of their property during their lifetime while ensuring a seamless transition of ownership to their chosen heirs. The form requires specific information, including the names of the property owner and beneficiaries, a legal description of the property, and the property owner's signature. Importantly, the deed must be recorded with the county clerk’s office to be effective. Additionally, property owners can revoke or modify the deed at any time before their death, providing flexibility and peace of mind. Understanding the nuances of this form is essential for effective estate planning in Florida, as it can significantly simplify the transfer of assets and reduce the burden on loved ones during a difficult time.

PDF Specifics

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Florida to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The use of Transfer-on-Death Deeds in Florida is governed by Florida Statutes, specifically Section 732.4015. |

| Eligibility | Any individual who owns real property in Florida can create a Transfer-on-Death Deed, regardless of age or marital status. |

| Revocation | Property owners can revoke a Transfer-on-Death Deed at any time before their death by executing a new deed or a written revocation. |

| Beneficiaries | Multiple beneficiaries can be named, and the property can be divided among them in specified proportions. |

| Filing Requirements | The deed must be signed, notarized, and recorded with the county clerk's office to be valid and enforceable. |

| Tax Implications | Transfer-on-Death Deeds do not affect property taxes during the owner's lifetime, but beneficiaries may face tax obligations upon transfer. |

How to Write Florida Transfer-on-Death Deed

Filling out the Florida Transfer-on-Death Deed form is a straightforward process that allows you to designate a beneficiary for your property upon your passing. Once the form is completed, it must be properly executed and recorded with the county clerk's office to ensure its validity.

- Obtain the form: You can find the Florida Transfer-on-Death Deed form online or at your local county clerk's office.

- Fill in your information: Provide your full name and address as the owner of the property. Make sure this matches the information on the property deed.

- Describe the property: Clearly identify the property you wish to transfer. Include the legal description, which can usually be found on your current deed.

- Designate your beneficiary: Enter the full name and address of the person or entity you want to inherit the property. Ensure that this information is accurate.

- Include alternative beneficiaries: If desired, you can name alternate beneficiaries in case the primary beneficiary cannot inherit.

- Sign the form: As the property owner, sign the deed in the presence of a notary public. Your signature must be notarized to validate the document.

- Record the deed: Take the completed and notarized form to the county clerk’s office where the property is located. There may be a small fee for recording the document.

After recording the deed, keep a copy for your records. It’s advisable to inform your beneficiary about the deed and its implications to ensure a smooth transfer in the future.

Florida Transfer-on-Death Deed Example

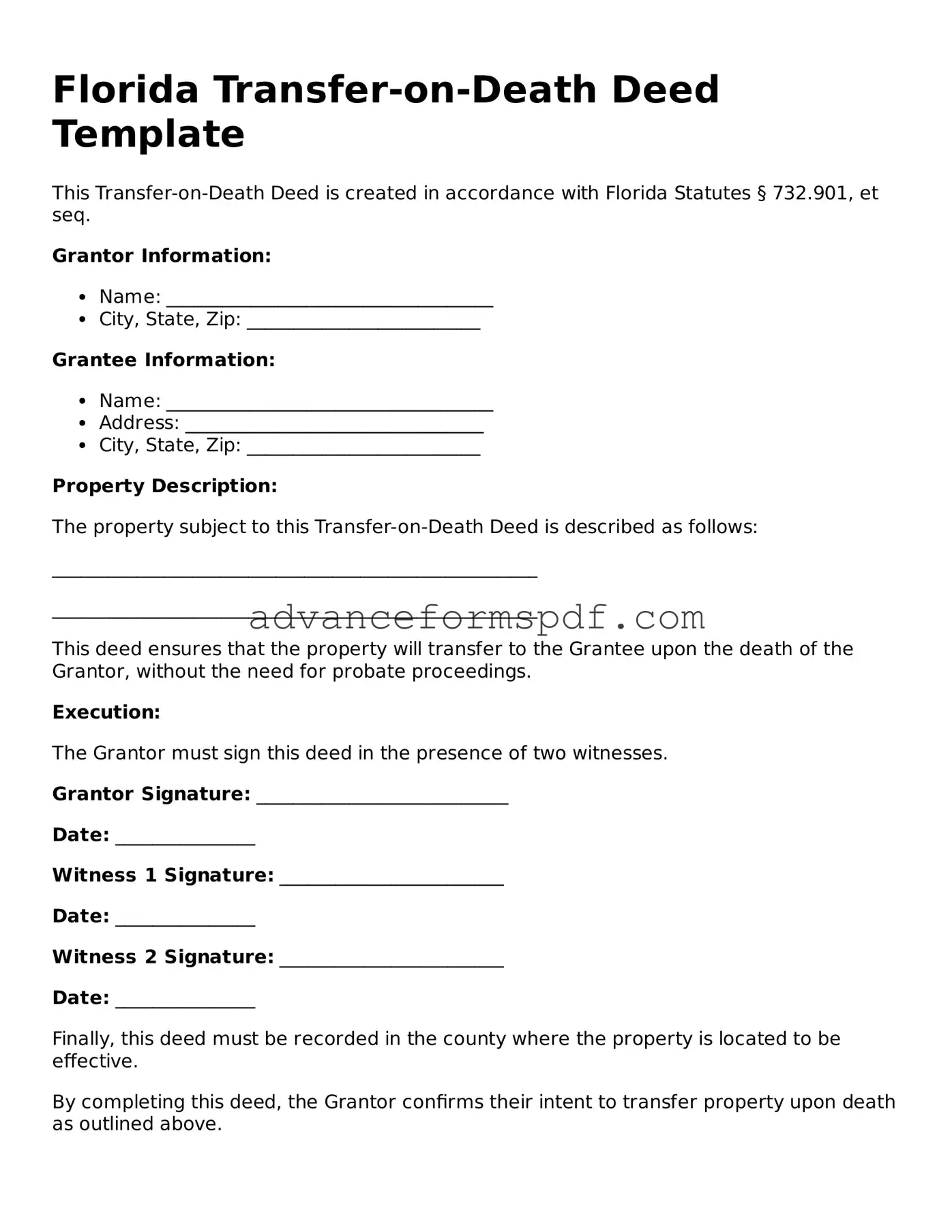

Florida Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created in accordance with Florida Statutes § 732.901, et seq.

Grantor Information:

- Name: ___________________________________

- City, State, Zip: _________________________

Grantee Information:

- Name: ___________________________________

- Address: ________________________________

- City, State, Zip: _________________________

Property Description:

The property subject to this Transfer-on-Death Deed is described as follows:

____________________________________________________

____________________________________________________

This deed ensures that the property will transfer to the Grantee upon the death of the Grantor, without the need for probate proceedings.

Execution:

The Grantor must sign this deed in the presence of two witnesses.

Grantor Signature: ___________________________

Date: _______________

Witness 1 Signature: ________________________

Date: _______________

Witness 2 Signature: ________________________

Date: _______________

Finally, this deed must be recorded in the county where the property is located to be effective.

By completing this deed, the Grantor confirms their intent to transfer property upon death as outlined above.

Other Transfer-on-Death Deed State Forms

How to File a Transfer on Death Deed - The Transfer-on-Death Deed can help simplify estate planning for property owners.

By filling out a Medical Power of Attorney form, individuals can rest assured that their healthcare decisions will be managed according to their wishes, even in times of incapacitation. For those in Arizona, accessing templates and guidelines can simplify the process, making resources like Arizona PDF Forms invaluable in ensuring that your medical preferences are respected.