Download Gift Letter Form in PDF

When it comes to purchasing a home, many buyers rely on financial assistance from family members or friends. This is where the Gift Letter form plays a crucial role. This document serves as a formal declaration that a monetary gift has been provided to the buyer, outlining the relationship between the giver and the recipient, as well as the amount of the gift. Lenders often require this form to ensure that the funds are indeed a gift and not a loan that needs to be repaid. By clearly stating that the funds are a gift, the form helps to clarify the buyer's financial situation, making the mortgage approval process smoother. Additionally, the Gift Letter typically includes the date the gift was given, and may require the giver's signature, reinforcing the legitimacy of the transaction. Understanding the importance of this form can significantly impact the home-buying experience, ensuring that buyers can secure the necessary funding without complications.

Document Data

| Fact Name | Description |

|---|---|

| Definition | A Gift Letter is a document that outlines the details of a monetary gift, typically used in real estate transactions to verify the source of funds. |

| Purpose | The primary purpose of a Gift Letter is to assure lenders that the funds are indeed a gift and do not require repayment, thus preventing potential fraud. |

| Common Use | Gift Letters are often used in home buying scenarios, particularly for down payments, to help buyers qualify for loans. |

| Required Information | Typically, a Gift Letter includes the donor's name, the recipient's name, the amount of the gift, and a statement confirming that the funds are a gift. |

| State-Specific Requirements | Some states may have specific requirements for Gift Letters. For example, in California, it must comply with the California Civil Code. |

| Tax Implications | While gifts under a certain amount may not be taxable, donors should be aware of the IRS gift tax limits and reporting requirements. |

| Signature Requirement | Most lenders require the Gift Letter to be signed by both the donor and the recipient to validate the transaction. |

| Format | Gift Letters can be formatted as a simple letter or a form, but they must be clear and include all necessary details to be accepted by lenders. |

How to Write Gift Letter

When preparing to fill out the Gift Letter form, it's important to ensure that all necessary information is accurate and complete. This form will help facilitate the process of documenting a gift, which may be needed for various financial or legal purposes. Follow these steps carefully to ensure you fill out the form correctly.

- Begin by entering the date at the top of the form. This should be the date you are completing the letter.

- Next, provide the name of the donor, the person giving the gift. Include their full name as it appears on official documents.

- Below the donor's name, write their address. This should include the street address, city, state, and ZIP code.

- In the next section, indicate the recipient's name, the person receiving the gift. Again, use the full name as it appears on official documents.

- Then, provide the recipient's address, including the street address, city, state, and ZIP code.

- Next, specify the amount of the gift. Clearly state the dollar amount being gifted.

- In the designated area, describe the nature of the gift. This could include details such as whether it is cash, property, or another type of asset.

- After that, both the donor and recipient should sign the form. Make sure the signatures are dated appropriately.

- Finally, review the entire form for accuracy. Ensure that all information is correct and legible before submitting it.

Once you have completed the Gift Letter form, it may need to be submitted to a lender or financial institution as part of a larger application process. Be sure to keep a copy for your records, and check if there are any additional requirements from the receiving party.

Gift Letter Example

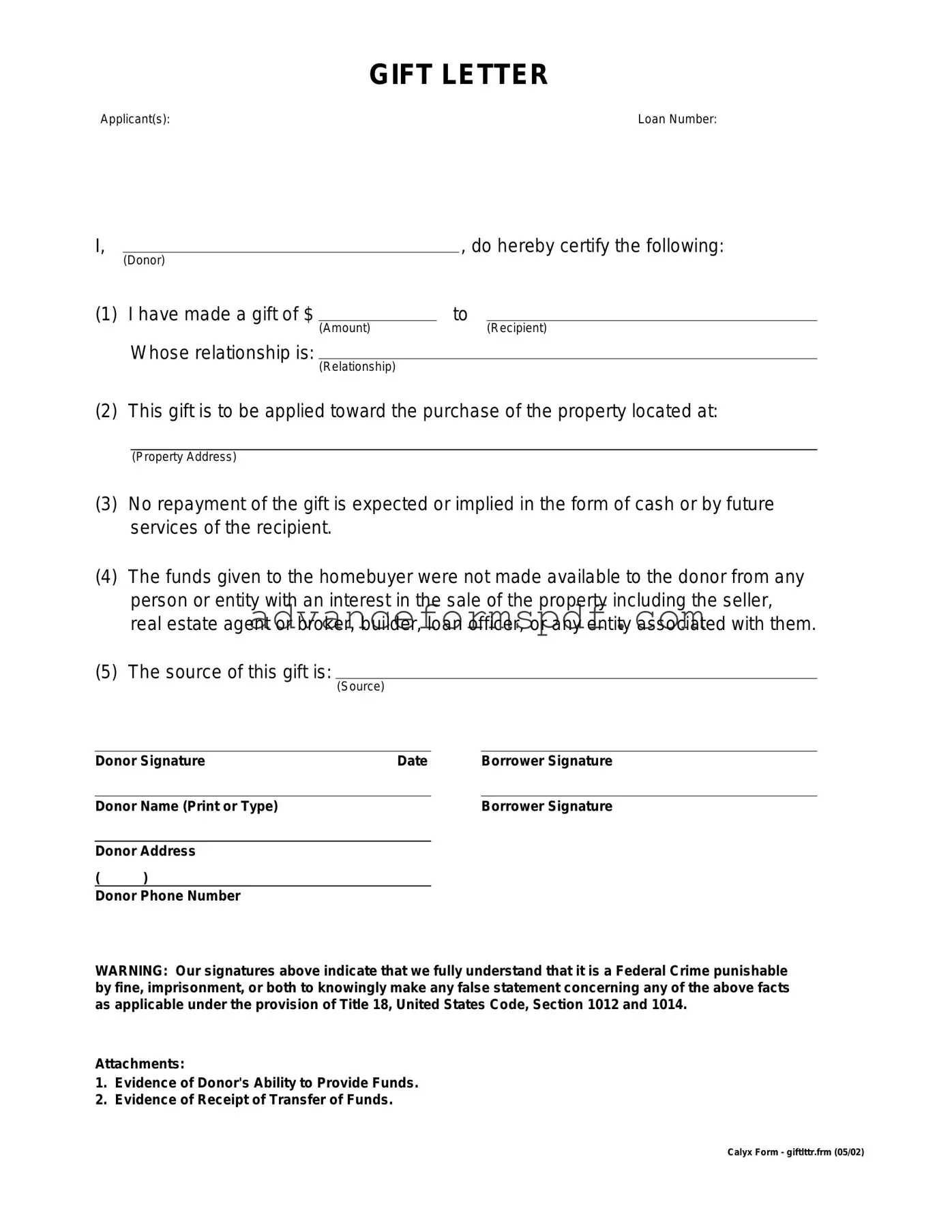

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)

Common PDF Documents

Notarized Consent Form - Royal Caribbean may provide guidelines on how to properly fill out the Parental Consent form.

The Florida Employment Verification process is vital for ensuring that employment records are precise and reliable. For those needing to navigate this paperwork, understanding the details involved is crucial. You can find helpful resources, such as the important Employment Verification form details, that outline its significance in various applications like loans and benefits.

Home Daycare Child Care Receipt Template - The form is a straightforward tool for tracking child care expenses over time.

Texas Odometer Disclosure Statement - The mileage statement reflects the actual mileage unless otherwise noted by the seller.