Valid Loan Agreement Form for the State of Illinois

In the realm of personal and business finance, a well-structured loan agreement is essential for establishing clear terms between lenders and borrowers. The Illinois Loan Agreement form serves as a vital tool in this process, outlining the key elements that govern the borrowing relationship. This form typically includes important details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, it addresses the rights and responsibilities of both parties, ensuring that everyone understands their obligations. By delineating the terms of the loan, this agreement minimizes the potential for disputes and fosters transparency. Furthermore, the Illinois Loan Agreement may also incorporate provisions related to default, prepayment, and applicable laws, thereby providing a comprehensive framework for the transaction. Understanding these components is crucial for anyone involved in lending or borrowing in Illinois, as it not only protects the interests of both parties but also contributes to a more stable financial environment.

PDF Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Illinois Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This form is governed by the laws of the State of Illinois, specifically under the Illinois Uniform Commercial Code. |

| Key Components | It typically includes details such as loan amount, interest rate, repayment schedule, and any collateral involved. |

| Signatures Required | Both parties must sign the agreement to make it legally binding, indicating their acceptance of the terms. |

How to Write Illinois Loan Agreement

To complete the Illinois Loan Agreement form, follow these straightforward steps. Each section of the form requires specific information. Ensure all details are accurate to avoid delays.

- Begin by entering the date at the top of the form.

- Fill in the names and addresses of both the borrower and the lender in the designated fields.

- Specify the loan amount clearly in the appropriate section.

- Indicate the interest rate, if applicable, and ensure it is expressed as a percentage.

- Detail the repayment schedule, including the frequency of payments (e.g., monthly, quarterly).

- Provide the start date for the loan repayment period.

- Include any additional terms or conditions that both parties have agreed upon.

- Both the borrower and lender should sign and date the form at the bottom.

Once the form is filled out, review it for accuracy. Both parties should keep a copy for their records. This ensures clarity and accountability throughout the loan process.

Illinois Loan Agreement Example

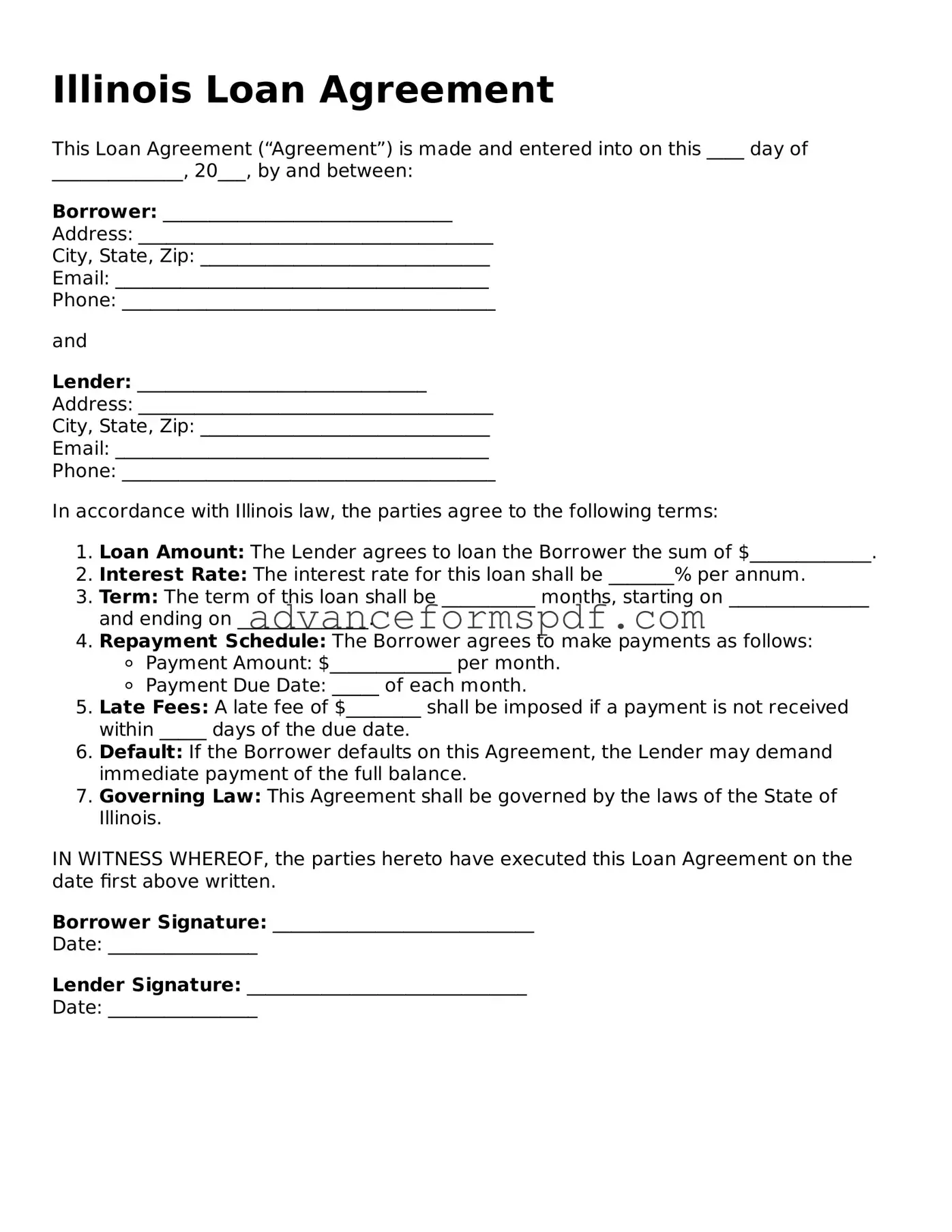

Illinois Loan Agreement

This Loan Agreement (“Agreement”) is made and entered into on this ____ day of ______________, 20___, by and between:

Borrower: _______________________________

Address: ______________________________________

City, State, Zip: _______________________________

Email: ________________________________________

Phone: ________________________________________

and

Lender: _______________________________

Address: ______________________________________

City, State, Zip: _______________________________

Email: ________________________________________

Phone: ________________________________________

In accordance with Illinois law, the parties agree to the following terms:

- Loan Amount: The Lender agrees to loan the Borrower the sum of $_____________.

- Interest Rate: The interest rate for this loan shall be _______% per annum.

- Term: The term of this loan shall be __________ months, starting on _______________ and ending on ______________.

- Repayment Schedule: The Borrower agrees to make payments as follows:

- Payment Amount: $_____________ per month.

- Payment Due Date: _____ of each month.

- Late Fees: A late fee of $________ shall be imposed if a payment is not received within _____ days of the due date.

- Default: If the Borrower defaults on this Agreement, the Lender may demand immediate payment of the full balance.

- Governing Law: This Agreement shall be governed by the laws of the State of Illinois.

IN WITNESS WHEREOF, the parties hereto have executed this Loan Agreement on the date first above written.

Borrower Signature: ____________________________

Date: ________________

Lender Signature: ______________________________

Date: ________________

Other Loan Agreement State Forms

Free Promissory Note Template Florida - It provides a framework for a professional relationship between borrower and lender.

Promissory Note New York - Indicates whether the loan agreement is binding on heirs or successors.

The Texas Affidavit of Gift form is essential for anyone wishing to transfer ownership of a motor vehicle as a gift, ensuring clarity and legality in the process. By filling out this document, you can confirm that the transfer is not a sale, thus exempting it from sales tax. For easy access to the necessary form, visit txtemplate.com/affidavit-of-gift-pdf-template/ and complete your transaction smoothly.

California Promissory Note - The agreement may include provisions for interest rate adjustments over time.