Valid Promissory Note Form for the State of Illinois

In Illinois, a Promissory Note is an essential financial document that outlines a borrower's promise to repay a specific amount of money to a lender under agreed-upon terms. This form typically includes key details such as the principal amount, interest rate, payment schedule, and maturity date. It serves as a legal record of the transaction, providing clarity and protection for both parties involved. The Promissory Note may also specify consequences for defaulting on payments, ensuring that the lender has recourse if the borrower fails to meet their obligations. Additionally, the form can be customized to include provisions regarding prepayment and late fees, making it a versatile tool for various lending situations. Understanding the components of this document is crucial for anyone engaging in a loan agreement in Illinois, as it helps establish clear expectations and responsibilities for both the borrower and the lender.

PDF Specifics

| Fact Name | Details |

|---|---|

| Definition | An Illinois Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a determined time. |

| Governing Law | The Illinois Uniform Commercial Code (UCC) governs promissory notes in the state. |

| Parties Involved | The note involves two primary parties: the maker (who promises to pay) and the payee (who receives the payment). |

| Interest Rate | The interest rate can be fixed or variable, and it must be clearly stated in the note. |

| Payment Terms | Payment terms must specify the due date, whether it is a lump sum or installment payments. |

| Signatures | The promissory note must be signed by the maker to be legally binding. |

| Notarization | While notarization is not required, it is recommended for added legal protection. |

| Default Provisions | Provisions for default should be included, outlining the consequences if payment is not made. |

| Transferability | Promissory notes in Illinois are generally negotiable, allowing them to be transferred to another party. |

| Enforcement | If a maker defaults, the payee can pursue legal action to enforce the note and recover the owed amount. |

How to Write Illinois Promissory Note

After obtaining the Illinois Promissory Note form, you will need to complete it accurately to ensure it meets all necessary requirements. Carefully follow the steps outlined below to fill out the form correctly.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Next, provide the name and address of the borrower. This should include the full name and the complete address.

- In the following section, write the name and address of the lender. Ensure all details are accurate and complete.

- Specify the principal amount being borrowed. This is the total amount of money that the borrower is agreeing to repay.

- Indicate the interest rate. This should be a percentage and can be either fixed or variable, depending on your agreement.

- Detail the repayment schedule. This includes how often payments will be made (e.g., monthly, quarterly) and the total duration of the loan.

- Include any additional terms or conditions that are relevant to the agreement. Be specific to avoid misunderstandings.

- Both the borrower and lender should sign and date the form at the designated areas. Make sure to print names below the signatures for clarity.

Once the form is filled out, both parties should keep a copy for their records. It is advisable to review the completed document to ensure all information is correct before finalizing the agreement.

Illinois Promissory Note Example

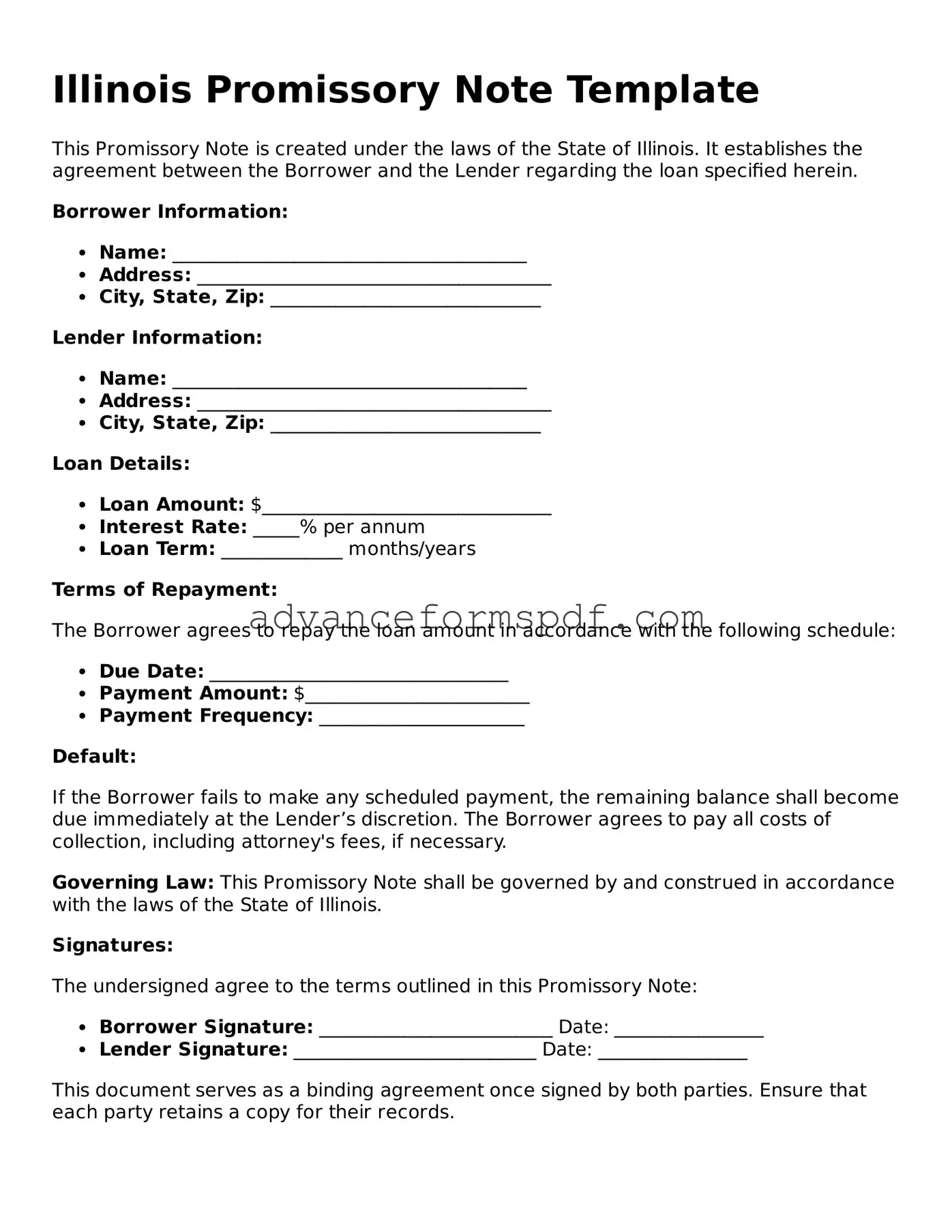

Illinois Promissory Note Template

This Promissory Note is created under the laws of the State of Illinois. It establishes the agreement between the Borrower and the Lender regarding the loan specified herein.

Borrower Information:

- Name: ______________________________________

- Address: ______________________________________

- City, State, Zip: _____________________________

Lender Information:

- Name: ______________________________________

- Address: ______________________________________

- City, State, Zip: _____________________________

Loan Details:

- Loan Amount: $_______________________________

- Interest Rate: _____% per annum

- Loan Term: _____________ months/years

Terms of Repayment:

The Borrower agrees to repay the loan amount in accordance with the following schedule:

- Due Date: ________________________________

- Payment Amount: $________________________

- Payment Frequency: ______________________

Default:

If the Borrower fails to make any scheduled payment, the remaining balance shall become due immediately at the Lender’s discretion. The Borrower agrees to pay all costs of collection, including attorney's fees, if necessary.

Governing Law: This Promissory Note shall be governed by and construed in accordance with the laws of the State of Illinois.

Signatures:

The undersigned agree to the terms outlined in this Promissory Note:

- Borrower Signature: _________________________ Date: ________________

- Lender Signature: __________________________ Date: ________________

This document serves as a binding agreement once signed by both parties. Ensure that each party retains a copy for their records.

Other Promissory Note State Forms

Loan Note Template - The document may also include late fees if payments are not made on time.

In addition to understanding the importance of the Arizona Motor Vehicle Bill of Sale, individuals can find the necessary documentation and templates to assist in the process through resources like Arizona PDF Forms, which simplifies the task of preparing for a vehicle transfer.

Promissory Note Form California - It helps protect both parties by having a clear outline of the loan terms.