Valid Transfer-on-Death Deed Form for the State of Illinois

The Illinois Transfer-on-Death Deed form serves as a valuable tool for property owners looking to simplify the transfer of their real estate upon death. This legal instrument allows individuals to designate beneficiaries who will inherit their property without the need for probate, which can often be a lengthy and costly process. By completing this form, property owners can maintain full control over their property during their lifetime while ensuring a smooth transition to their chosen heirs. The form requires specific information, including the names of the beneficiaries and a clear description of the property being transferred. Additionally, it must be signed, notarized, and recorded with the appropriate county office to be legally effective. Understanding the nuances of the Transfer-on-Death Deed can help individuals make informed decisions about their estate planning and ensure their wishes are honored after they pass away.

PDF Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Illinois Transfer-on-Death Deed allows property owners to transfer their real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005. |

| Eligibility | Any individual who owns real estate in Illinois can create a Transfer-on-Death Deed, provided they are of sound mind and at least 18 years old. |

| Revocation | The deed can be revoked at any time by the property owner, allowing for flexibility in estate planning. |

| Filing Requirements | To be effective, the Transfer-on-Death Deed must be signed, notarized, and recorded with the county recorder's office where the property is located. |

How to Write Illinois Transfer-on-Death Deed

Filling out the Illinois Transfer-on-Death Deed form is a straightforward process that ensures your property will be transferred to your designated beneficiaries upon your passing. After completing the form, you will need to file it with the appropriate county recorder's office to make it legally effective.

- Obtain the Illinois Transfer-on-Death Deed form from a reliable source, such as the Illinois Secretary of State website or your local county recorder's office.

- Fill in your name as the owner of the property in the designated section. Ensure that the name matches the title of the property.

- Provide the legal description of the property. This can usually be found on your property tax bill or deed. Make sure it is accurate and complete.

- Identify the beneficiaries by entering their full names and addresses. You can designate multiple beneficiaries if desired.

- Include your signature at the bottom of the form. This signature must be witnessed by at least two individuals who are not beneficiaries.

- Have the witnesses sign the form, including their names and addresses. Their signatures confirm that they witnessed your signing of the deed.

- Notarize the document. A notary public will verify your identity and witness your signature, adding an official seal to the document.

- Make copies of the completed and notarized form for your records before filing.

- File the original Transfer-on-Death Deed with the county recorder's office where the property is located. Pay any applicable filing fees.

Illinois Transfer-on-Death Deed Example

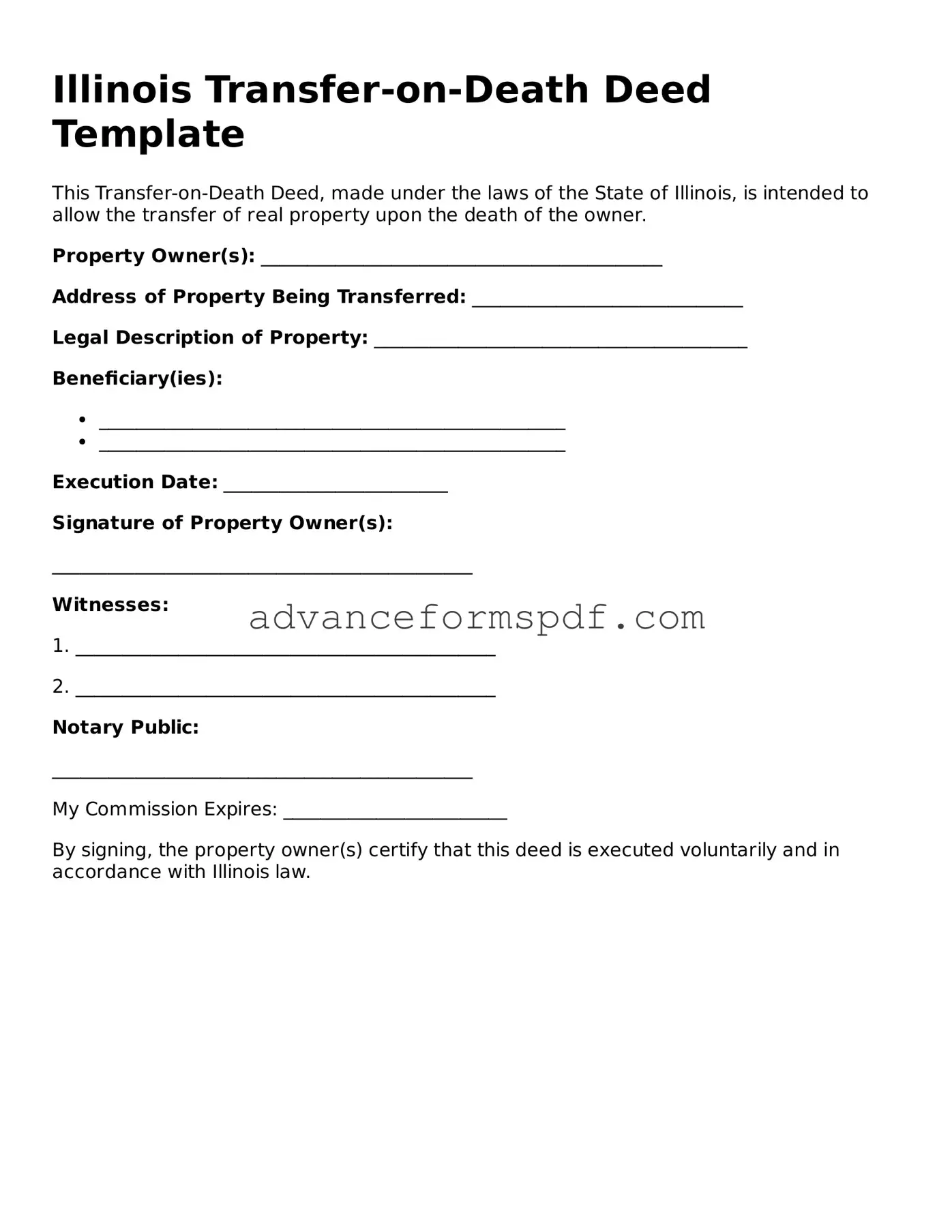

Illinois Transfer-on-Death Deed Template

This Transfer-on-Death Deed, made under the laws of the State of Illinois, is intended to allow the transfer of real property upon the death of the owner.

Property Owner(s): ___________________________________________

Address of Property Being Transferred: _____________________________

Legal Description of Property: ________________________________________

Beneficiary(ies):

- __________________________________________________

- __________________________________________________

Execution Date: ________________________

Signature of Property Owner(s):

_____________________________________________

Witnesses:

1. _____________________________________________

2. _____________________________________________

Notary Public:

_____________________________________________

My Commission Expires: ________________________

By signing, the property owner(s) certify that this deed is executed voluntarily and in accordance with Illinois law.

Other Transfer-on-Death Deed State Forms

Transfer on Death Deed Form Florida - A Transfer-on-Death Deed allows property owners to pass their property directly to beneficiaries upon their death.

It is important to familiarize yourself with the Florida Do Not Resuscitate Order form guidelines to ensure your wishes are respected. This critical document serves as a directive for healthcare providers, detailing your preferences regarding life-saving measures. To learn more about this document, please refer to the key aspects of the Do Not Resuscitate Order.