Download Independent Contractor Pay Stub Form in PDF

The Independent Contractor Pay Stub form serves as a crucial document for both contractors and the businesses that engage their services. This form provides a detailed breakdown of payments made to independent contractors, ensuring transparency in financial transactions. Key components typically included in the pay stub are the contractor's name, the payment period, the total amount earned, and any deductions that may apply. Additionally, it may outline the nature of the work performed, the rate of pay, and any applicable taxes or withholdings. By offering a clear record of earnings, the pay stub not only aids contractors in tracking their income but also assists businesses in maintaining accurate financial records for accounting and tax purposes. Understanding the structure and significance of this form is essential for both parties to uphold their financial obligations and ensure compliance with applicable regulations.

Document Data

| Fact Name | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub form is a document that outlines the earnings and deductions for independent contractors. |

| Purpose | This form provides a record of payments made to independent contractors, ensuring transparency and clarity in financial transactions. |

| Components | Typically includes contractor's name, payment period, gross earnings, deductions, and net pay. |

| Tax Implications | Independent contractors are responsible for their own taxes, and the pay stub may assist in tracking income for tax purposes. |

| State-Specific Forms | Some states may have specific requirements for pay stubs; for example, California requires detailed itemization of deductions under Labor Code § 226. |

| Legal Compliance | Using a pay stub form helps businesses comply with state and federal regulations regarding payment documentation. |

| Record Keeping | Both contractors and businesses should retain copies of pay stubs for their records, typically for at least three years. |

How to Write Independent Contractor Pay Stub

Completing the Independent Contractor Pay Stub form is a straightforward process. By following the steps outlined below, you can ensure that all necessary information is accurately captured. This will help in maintaining clear records for both you and the contractor.

- Gather Necessary Information: Collect all relevant details such as the contractor's name, address, and Social Security number. Ensure you have the payment period and the total amount paid ready.

- Fill in Contractor Information: Start by entering the contractor's name in the designated field. Next, input their address and Social Security number in the appropriate sections.

- Specify Payment Details: Indicate the payment period by entering the start and end dates. Then, write the total amount paid to the contractor for that period.

- Include Deductions: If applicable, list any deductions taken from the payment, such as taxes or fees. Clearly state the amount of each deduction.

- Calculate Net Pay: Subtract any deductions from the total amount paid to determine the net pay. Write this amount in the designated field.

- Review for Accuracy: Double-check all entered information for correctness. Ensure that names, amounts, and dates are accurate to avoid any discrepancies.

- Sign and Date: Finally, sign the form and include the date of completion. This adds authenticity and confirms that the information provided is accurate.

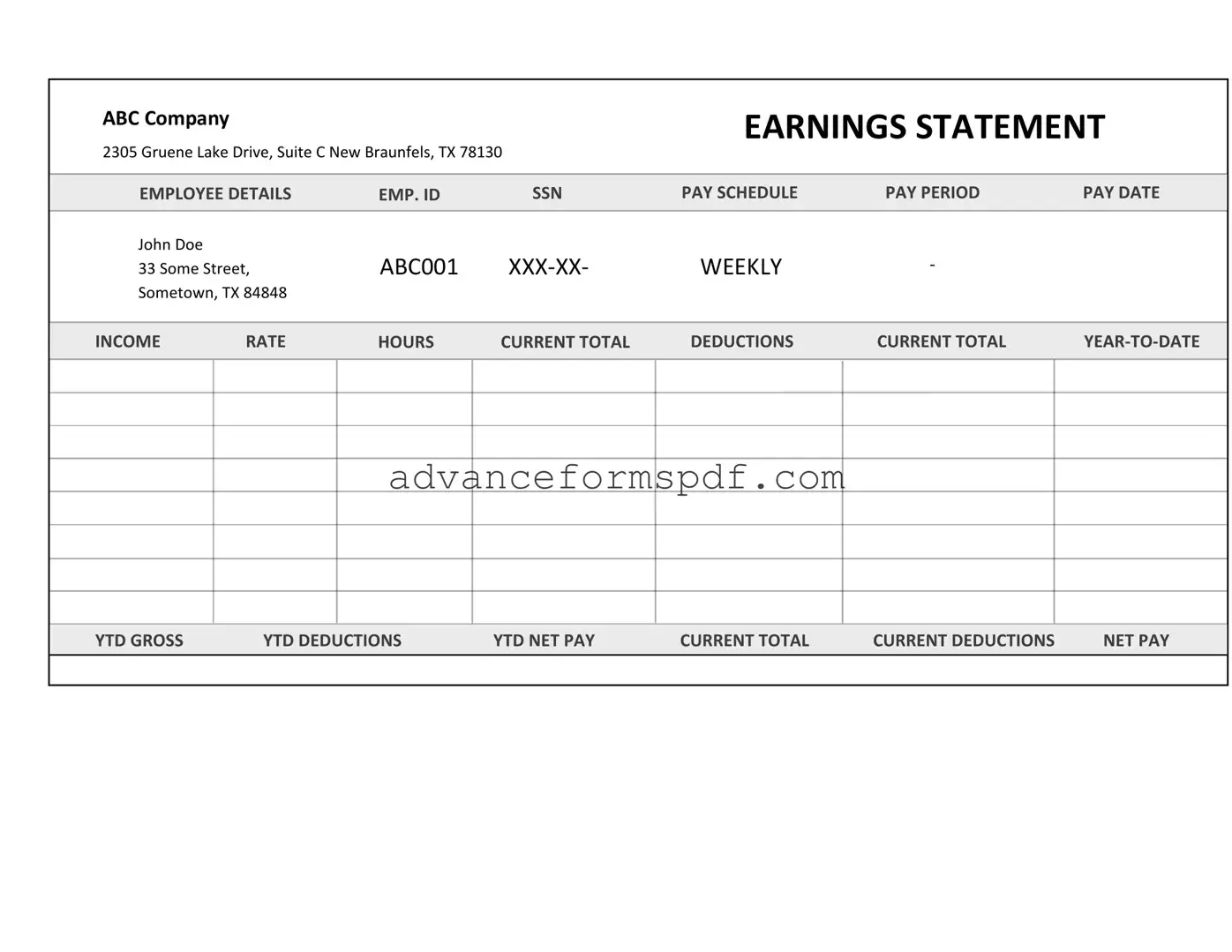

Independent Contractor Pay Stub Example

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |

Common PDF Documents

Get Drivers License Online - The form requires both your mailing address and physical address if they differ.

Before signing any rental agreement, it is crucial to familiarize yourself with the terms outlined in the Arizona Residential Lease Agreement. This document not only defines the obligations of landlords and tenants but also ensures that both parties are aware of their rights. For detailed guidance on this important legal form, you can refer to Arizona PDF Forms.

I 864 Step by Step Instructions - Children of the sponsor can also be counted when calculating household size.