Download IRS 1099-MISC Form in PDF

The IRS 1099-MISC form plays a crucial role in the tax reporting process for various types of income that are not classified as wages. Designed primarily for independent contractors, freelancers, and other non-employees, this form is essential for reporting payments made to individuals or businesses for services rendered. It covers a range of payments, including rents, prizes, awards, and other income types exceeding $600 in a calendar year. Businesses must issue this form to recipients and submit a copy to the IRS, ensuring compliance with tax regulations. Understanding the requirements and deadlines associated with the 1099-MISC is vital for both payers and recipients to avoid potential penalties. As tax season approaches, familiarity with this form can help streamline the filing process and ensure that all income is accurately reported.

Document Data

| Fact Name | Details |

|---|---|

| Purpose | The IRS 1099-MISC form is used to report various types of income other than wages, salaries, and tips. |

| Who Receives It | Individuals or businesses that have received $600 or more in payments for services, rents, or other specific types of income must receive a 1099-MISC. |

| Filing Deadline | The deadline for filing the 1099-MISC with the IRS is typically January 31 of the year following the tax year in which the payments were made. |

| State-Specific Forms | Some states require their own versions of the 1099-MISC, governed by state tax laws. For example, California requires Form 1099-MISC to be filed according to California Revenue and Taxation Code. |

| Penalties | Failure to file the 1099-MISC on time can result in penalties, which can vary based on how late the form is submitted. |

| Changes in 2020 | Starting in tax year 2020, the IRS introduced Form 1099-NEC for reporting non-employee compensation, changing how some income is reported. |

How to Write IRS 1099-MISC

After gathering the necessary information, the next step is to accurately fill out the IRS 1099-MISC form. This form is used to report various types of income other than wages, salaries, and tips. Ensuring that all details are correct will help avoid any issues with the IRS.

- Obtain the IRS 1099-MISC form. This can be done online or through a local IRS office.

- Enter your name, address, and taxpayer identification number (TIN) in the "Payer" section at the top of the form.

- Fill in the recipient's name, address, and TIN in the "Recipient" section.

- Identify the type of payment made to the recipient. Use the appropriate box to indicate the payment type, such as rents, royalties, or other income.

- Enter the total amount paid to the recipient in the corresponding box.

- If applicable, provide any federal income tax withheld in the designated box.

- Review the form for accuracy, ensuring all information is complete and correct.

- Sign and date the form as the payer.

- Make copies for your records and send the original form to the IRS and the recipient by the specified deadline.

IRS 1099-MISC Example

Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of Copy A of this IRS form is scannable, but the online version of it, printed from this website, is not. Do not print and file copy A downloaded from this website; a penalty may be imposed for filing with the IRS information return forms that can’t be scanned. See part O in the current General Instructions for Certain Information Returns, available at IRS.gov/Form1099, for more information about penalties.

Please note that Copy B and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient.

If you have 10 or more information returns to file, you may be required to file

If you have fewer than 10 information returns to file, we strongly encourage you to

See Publications 1141, 1167, and 1179 for more information about printing these forms.

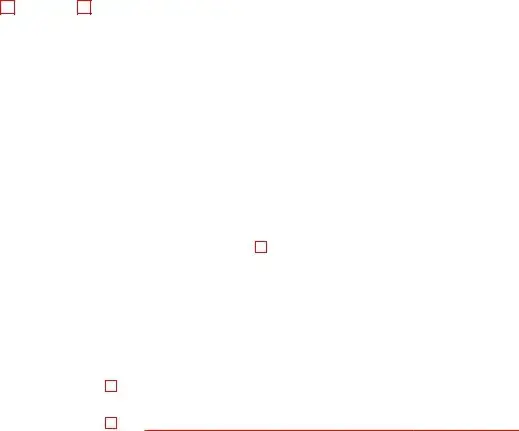

9595 |

|

VOID |

CORRECTED |

|

|

|

|

|

|

|||

PAYER’S name, street address, city or town, state or province, country, ZIP |

1 |

Rents |

OMB No. |

|

|

|||||||

or foreign postal code, and telephone no. |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

$ |

|

Form |

|

Miscellaneous |

||||

|

|

|

|

2 |

Royalties |

(Rev. January 2024) |

|

Information |

||||

|

|

|

|

|

|

For calendar year |

|

|

||||

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Other income |

4 |

Federal income tax withheld |

Copy A |

||||

|

|

|

|

$ |

|

$ |

|

|

|

|

For |

|

PAYER’S TIN |

RECIPIENT’S TIN |

|

5 |

Fishing boat proceeds |

6 |

Medical and health care |

Internal Revenue |

|||||

|

|

|

|

|

|

|

payments |

Service Center |

||||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

File with Form 1096. |

|

RECIPIENT’S name |

|

|

7 |

Payer made direct sales |

8 |

Substitute payments in lieu |

For Privacy Act |

|||||

|

|

|

|

|

totaling $5,000 or more of |

|

of dividends or interest |

and Paperwork |

||||

|

|

|

|

|

consumer products to |

$ |

|

|

|

|

||

|

|

|

|

|

recipient for resale |

|

|

|

|

Reduction Act |

||

Street address (including apt. no.) |

|

|

9 |

Crop insurance proceeds |

10 |

Gross proceeds paid to an |

Notice, see the |

|||||

|

|

|

|

|

|

|

attorney |

current General |

||||

|

|

|

|

$ |

|

$ |

|

|

|

|

Instructions for |

|

|

|

|

|

|

|

|

|

|

Certain |

|||

City or town, state or province, country, and ZIP or foreign postal code |

11 |

Fish purchased for resale |

12 |

Section 409A deferrals |

||||||||

Information |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

$ |

|

$ |

|

|

|

|

Returns. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

13 FATCA filing |

14 |

Excess golden parachute |

15 |

Nonqualified deferred |

|

||||

|

|

|

requirement |

|

payments |

|

compensation |

|

||||

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

Account number (see instructions) |

|

|

2nd TIN not. |

16 |

State tax withheld |

17 |

State/Payer’s state no. |

18 State income |

||||

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

Form |

Cat. No. 14425J |

www.irs.gov/Form1099MISC |

|

Department of the Treasury - Internal Revenue Service |

||||||||

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page

|

VOID |

CORRECTED |

|

|

|

|

|

|

|

||

PAYER’S name, street address, city or town, state or province, country, ZIP |

1 |

Rents |

OMB No. |

|

|

|

|||||

or foreign postal code, and telephone no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

Form |

|

Miscellaneous |

||||

|

|

|

2 |

Royalties |

(Rev. January 2024) |

|

|

Information |

|||

|

|

|

|

|

For calendar year |

|

|

|

|||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Other income |

4 |

Federal income tax withheld |

|

Copy 1 |

|||

|

|

|

$ |

|

$ |

|

|

|

|

|

For State Tax |

PAYER’S TIN |

RECIPIENT’S TIN |

|

5 |

Fishing boat proceeds |

6 |

Medical and health care |

|

Department |

|||

|

|

|

|

|

|

payments |

|

|

|||

|

|

|

$ |

|

$ |

|

|

|

|

|

|

RECIPIENT’S name |

|

|

7 |

Payer made direct sales |

8 |

Substitute payments in lieu |

|

|

|||

|

|

|

|

totaling $5,000 or more of |

|

of dividends or interest |

|

|

|||

|

|

|

|

consumer products to |

$ |

|

|

|

|

|

|

|

|

|

|

recipient for resale |

|

|

|

|

|

|

|

Street address (including apt. no.) |

|

|

9 |

Crop insurance proceeds |

10 |

Gross proceeds paid to an |

|

|

|||

|

|

|

|

|

|

attorney |

|

|

|||

|

|

|

$ |

|

$ |

|

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

11 |

Fish purchased for resale |

12 |

Section 409A deferrals |

|

|

|||||

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

13 FATCA filing |

14 |

Excess golden parachute |

15 |

Nonqualified deferred |

|

|

|||

|

|

requirement |

|

payments |

|

compensation |

|

|

|||

|

|

|

$ |

|

$ |

|

|

|

|

|

|

Account number (see instructions) |

|

|

16 |

State tax withheld |

17 |

State/Payer’s state no. |

|

18 State income |

|||

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

$ |

Form |

|

www.irs.gov/Form1099MISC |

|

Department of the Treasury - Internal Revenue Service |

|||||||

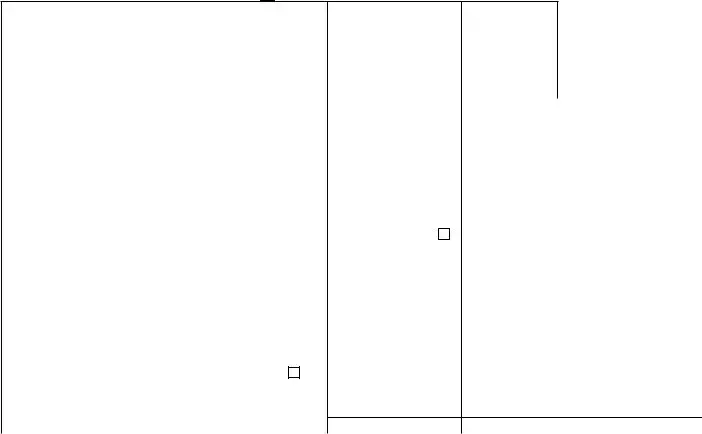

CORRECTED (if checked)

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, country, ZIP 1 Rents |

OMB No. |

or foreign postal code, and telephone no. |

|

|

|

|

$ |

Form |

Miscellaneous |

|||||

|

|

|

2 Royalties |

(Rev. January 2024) |

|

|

Information |

|||

|

|

|

|

For calendar year |

|

|

||||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

3 Other income |

4 Federal income tax withheld |

Copy B |

|||||

|

|

|

$ |

$ |

|

|

|

|

|

For Recipient |

PAYER’S TIN |

RECIPIENT’S TIN |

5 Fishing boat proceeds |

6 |

Medical and health care |

|

|

||||

|

|

|

|

|

payments |

|

|

|||

|

|

|

$ |

$ |

|

|

|

|

|

|

RECIPIENT’S name |

|

|

7 Payer made direct sales |

8 |

Substitute payments in lieu |

|

This is important tax |

|||

|

|

|

totaling $5,000 or more of |

|

of dividends or interest |

|

||||

|

|

|

consumer products to |

$ |

|

|

|

|

|

information and is |

|

|

|

recipient for resale |

|

|

|

|

|

being furnished to |

|

Street address (including apt. no.) |

|

|

9 Crop insurance proceeds |

10 |

Gross proceeds paid to an |

|

the IRS. If you are |

|||

|

|

|

|

|

attorney |

|

required to file a |

|||

|

|

|

$ |

$ |

|

|

|

|

|

return, a negligence |

|

|

|

|

|

|

|

|

penalty or other |

||

City or town, state or province, country, and ZIP or foreign postal code |

11 Fish purchased for resale |

12 |

Section 409A deferrals |

|

sanction may be |

|||||

|

|

|

|

|

|

|

|

|

|

imposed on you if |

|

|

|

$ |

$ |

|

|

|

|

|

this income is |

|

|

|

|

|

|

|

|

taxable and the IRS |

||

|

|

13 FATCA filing 14 Excess golden parachute |

15 |

Nonqualified deferred |

|

determines that it |

||||

|

|

requirement |

payments |

|

compensation |

|

has not been |

|||

|

|

|

$ |

$ |

|

|

|

|

|

reported. |

|

|

|

|

|

|

|

|

|

||

Account number (see instructions) |

|

|

16 State tax withheld |

17 |

State/Payer’s state no. |

|

18 State income |

|||

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

$ |

Form |

(keep for your records) |

www.irs.gov/Form1099MISC |

|

Department of the Treasury - Internal Revenue Service |

||||||

Instructions for Recipient

Recipient’s taxpayer identification number (TIN). For your protection, this form may show only the last four digits of your social security number (SSN), individual taxpayer identification number (ITIN), adoption taxpayer identification number (ATIN), or employer identification number (EIN). However, the payer has reported your complete TIN to the IRS.

Account number. May show an account or other unique number the payer assigned to distinguish your account.

Amounts shown may be subject to

Form

Box 1. Report rents from real estate on Schedule E (Form 1040). However, report rents on Schedule C (Form 1040) if you provided significant services to the tenant, sold real estate as a business, or rented personal property as a business. See Pub. 527.

Box 2. Report royalties from oil, gas, or mineral properties; copyrights; and patents on Schedule E (Form 1040). However, report payments for a working interest as explained in the Schedule E (Form 1040) instructions. For royalties on timber, coal, and iron ore, see Pub. 544.

Box 3. Generally, report this amount on the “Other income” line of Schedule 1 (Form 1040) and identify the payment. The amount shown may be payments received as the beneficiary of a deceased employee, prizes, awards, taxable damages, Indian gaming profits, or other taxable income. See Pub. 525. If it is trade or business income, report this amount on Schedule C or F (Form 1040).

Box 4. Shows backup withholding or withholding on Indian gaming profits. Generally, a payer must backup withhold if you did not furnish your TIN. See Form

Box 5. Shows the amount paid to you as a fishing boat crew member by the operator, who considers you to be

Box 6. For individuals, report on Schedule C (Form 1040).

Box 7. If checked, consumer products totaling $5,000 or more were sold to you for resale, on a

Box 8. Shows substitute payments in lieu of dividends or

Box 9. Report this amount on Schedule F (Form 1040).

Box 10. Shows gross proceeds paid to an attorney in connection with legal services. Report only the taxable part as income on your return.

Box 11. Shows the amount of cash you received for the sale of fish if you are in the trade or business of catching fish.

Box 12. May show current year deferrals as a nonemployee under a nonqualified deferred compensation (NQDC) plan that is subject to the requirements of section 409A plus any earnings on current and prior year deferrals.

Box 13. If the FATCA filing requirement box is checked, the payer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code. You may also have a filing requirement. See the Instructions for Form 8938.

Box 14. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. See your tax return instructions for where to report.

Box 15. Shows income as a nonemployee under an NQDC plan that does not meet the requirements of section 409A. Any amount included in box 12 that is currently taxable is also included in this box. Report this amount as income on your tax return. This income is also subject to a substantial additional tax to be reported on Form 1040,

Boxes

Future developments. For the latest information about developments related to Form

Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for

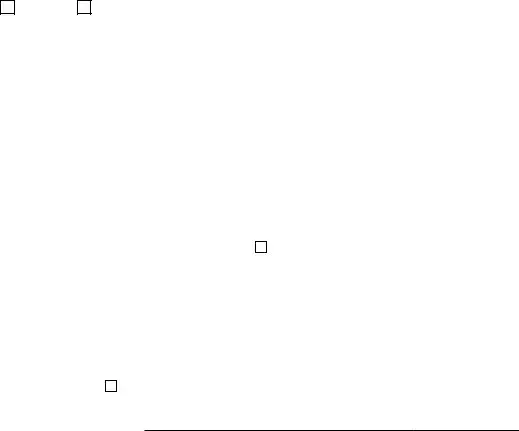

CORRECTED (if checked)

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, country, ZIP 1 Rents |

OMB No. |

or foreign postal code, and telephone no. |

|

|

|

|

$ |

|

Form |

Miscellaneous |

|||||

|

|

|

2 Royalties |

|

(Rev. January 2024) |

|

|

Information |

|||

|

|

|

|

|

For calendar year |

|

|

||||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

3 Other income |

4 |

Federal income tax withheld |

|

Copy 2 |

||||

|

|

|

$ |

$ |

|

|

|

|

|

To be filed with |

|

PAYER’S TIN |

RECIPIENT’S TIN |

5 Fishing boat proceeds |

6 |

Medical and health care |

|

recipient’s state |

|||||

|

|

|

|

|

|

payments |

|

income tax return, |

|||

|

|

|

|

|

|

|

|

|

|

|

when required. |

|

|

|

$ |

$ |

|

|

|

|

|

|

|

RECIPIENT’S name |

|

|

7 Payer made direct sales |

8 |

Substitute payments in lieu |

|

|

||||

|

|

|

totaling $5,000 or more of |

|

|

of dividends or interest |

|

|

|||

|

|

|

consumer products to |

$ |

|

|

|

|

|

|

|

|

|

|

recipient for resale |

|

|

|

|

|

|

||

Street address (including apt. no.) |

|

|

9 Crop insurance proceeds |

10 |

Gross proceeds paid to an |

|

|

||||

|

|

|

|

|

|

attorney |

|

|

|||

|

|

|

$ |

$ |

|

|

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

11 Fish purchased for resale |

12 |

Section 409A deferrals |

|

|

||||||

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

13 FATCA filing 14 Excess golden parachute |

15 |

Nonqualified deferred |

|

|

|||||

|

|

requirement |

payments |

|

|

compensation |

|

|

|||

|

|

|

$ |

$ |

|

|

|

|

|

|

|

Account number (see instructions) |

|

|

16 State tax withheld |

17 |

State/Payer’s state no. |

|

18 State income |

||||

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

$ |

Form |

www.irs.gov/Form1099MISC |

|

|

Department of the Treasury - Internal Revenue Service |

|||||||

Common PDF Documents

Spanish Job Application - Confirm that you are comfortable with background checks.

A Medical Power of Attorney form in Arizona allows individuals to designate a trusted person to make healthcare decisions on their behalf if they become unable to do so. This legal document ensures that your medical preferences are honored, even when you cannot communicate them yourself. Understanding how to create and use this form is essential for anyone looking to safeguard their healthcare choices, and resources like Arizona PDF Forms can help simplify the process.

Australian Passport Renewal Application (pc7) - Complete the Application for Australian Passport form to replace a lost or stolen passport.