Download IRS Schedule C 1040 Form in PDF

The IRS Schedule C (Form 1040) is a critical document for self-employed individuals and small business owners, serving as a key tool for reporting income and expenses related to their businesses. This form allows taxpayers to detail their earnings, which can include sales revenue, commissions, and other sources of income. Additionally, it provides a structured way to outline business expenses, such as costs for supplies, advertising, and vehicle use, which can significantly impact taxable income. Understanding how to accurately complete Schedule C is essential, as it not only affects the amount of tax owed but also plays a role in determining eligibility for various deductions and credits. Moreover, the information reported on this form can influence future financial opportunities, including loans and credit applications. Given the complexities involved, it is crucial for taxpayers to approach this form with diligence, ensuring that all figures are precise and reflective of actual business activities. As the tax season approaches, being well-informed about the nuances of Schedule C can empower business owners to navigate their tax obligations confidently and effectively.

Document Data

| Fact Name | Description |

|---|---|

| Purpose | The IRS Schedule C (Form 1040) is used by sole proprietors to report income or loss from their business. |

| Eligibility | Any individual who operates a business as a sole proprietorship can file Schedule C. |

| Filing Deadline | Schedule C must be filed by the tax return due date, typically April 15, unless an extension is granted. |

| Income Reporting | Business income, including cash, checks, and credit card payments, must be reported on this form. |

| Expense Deductions | Eligible business expenses can be deducted, reducing the overall taxable income from the business. |

| State-Specific Forms | Some states require additional forms for reporting business income. Check your state's Department of Revenue for specifics. |

How to Write IRS Schedule C 1040

Filling out the IRS Schedule C (Form 1040) is an important step for self-employed individuals to report income and expenses from their business. Completing this form accurately will help ensure that your tax return reflects your financial situation correctly.

- Start by entering your name and Social Security number at the top of the form.

- Provide your business name, if applicable. If you operate under your own name, you can leave this blank.

- Fill in your business address. This should be the location where you conduct your business activities.

- Indicate your business's principal activity. Choose the category that best describes what you do.

- Enter your business code. You can find this code in the IRS instructions for Schedule C, which corresponds to your business type.

- In the income section, report your gross receipts or sales. This is the total amount you earned before any expenses.

- Deduct any returns or allowances to calculate your net income from sales.

- List your business expenses in the appropriate categories, such as advertising, car and truck expenses, and supplies. Be sure to keep receipts for all expenses.

- Calculate your total expenses and subtract them from your gross income to determine your net profit or loss.

- Transfer the net profit or loss amount to the appropriate line on your Form 1040.

Once you have completed Schedule C, review all entries for accuracy. Ensure that your calculations are correct and that you have included all necessary documentation. This will help you avoid issues with your tax return.

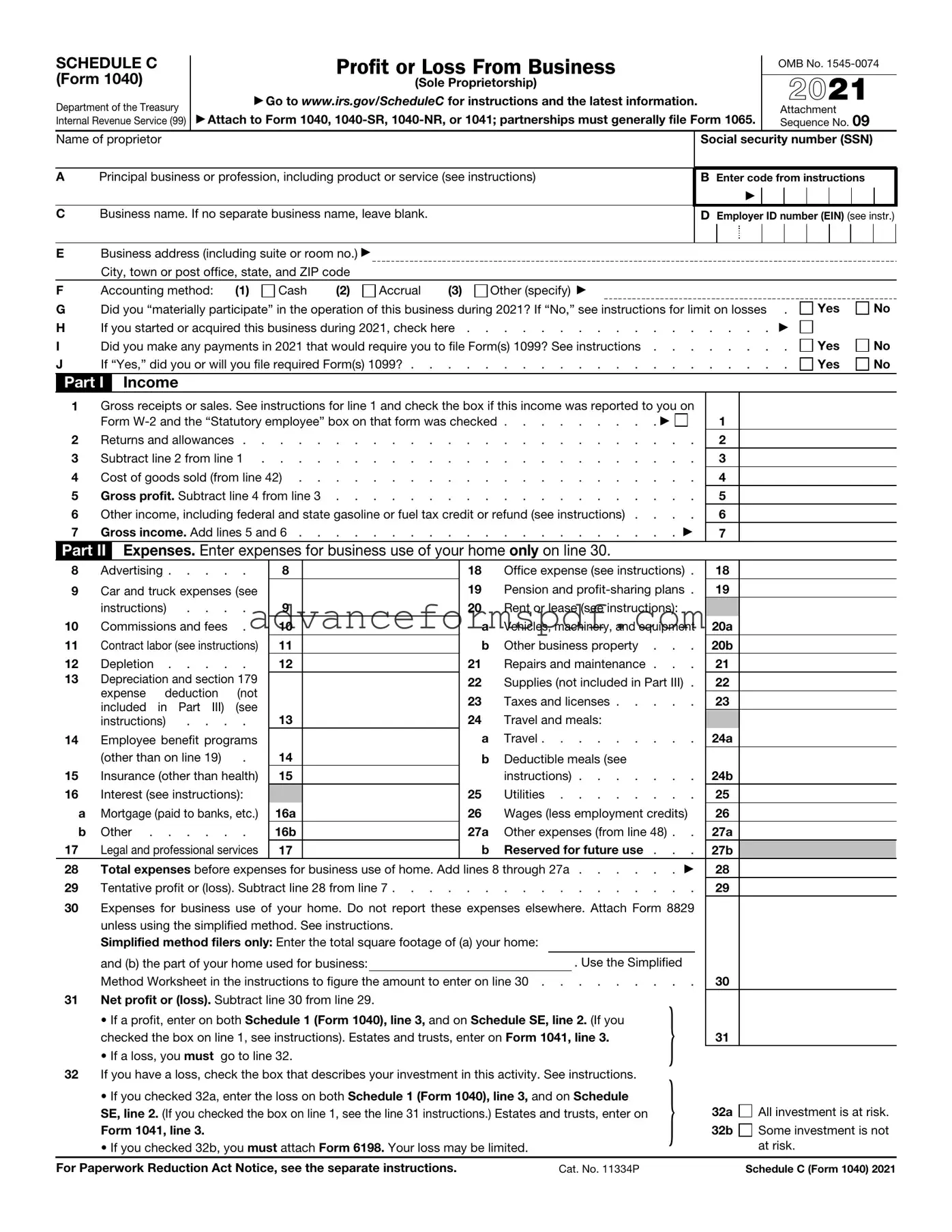

IRS Schedule C 1040 Example

SCHEDULE C (Form 1040)

Department of the Treasury Internal Revenue Service (99)

Profit or Loss From Business

(Sole Proprietorship)

▶Go to www.irs.gov/ScheduleC for instructions and the latest information.

▶Attach to Form 1040,

OMB No.

2021

Attachment Sequence No. 09

Name of proprietor

APrincipal business or profession, including product or service (see instructions)

CBusiness name. If no separate business name, leave blank.

Social security number (SSN)

BEnter code from instructions

▶

DEmployer ID number (EIN) (see instr.)

EBusiness address (including suite or room no.) ▶

City, town or post office, state, and ZIP code

F |

Accounting method: |

(1) |

Cash |

(2) |

|

Accrual |

(3) |

Other (specify) ▶ |

|

|

|

|

|

|

|

||||||

G |

Did you “materially participate” in the operation of this business during 2021? If “No,” see instructions for limit on losses |

. |

Yes |

No |

|||||||||||||||||

H |

If you started or acquired this business during 2021, check here |

. . |

. . |

▶ |

|

|

|||||||||||||||

I |

Did you make any payments in 2021 that would require you to file Form(s) 1099? See instructions . . . |

. . |

. . |

. |

Yes |

No |

|||||||||||||||

J |

If “Yes,” did you or will you file required Form(s) 1099? |

. . |

. . |

. |

Yes |

No |

|||||||||||||||

Part I |

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on |

|

|

|

|

|

|||||||||||||||

|

Form |

. . . . . . . . . ▶ |

1 |

|

|

|

|

||||||||||||||

2 |

Returns and allowances |

2 |

|

|

|

|

|||||||||||||||

3 |

Subtract line 2 from line 1 |

3 |

|

|

|

|

|||||||||||||||

4 |

Cost of goods sold (from line 42) |

4 |

|

|

|

|

|||||||||||||||

5 |

Gross profit. Subtract line 4 from line 3 |

5 |

|

|

|

|

|||||||||||||||

6 |

Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) . . . . |

6 |

|

|

|

|

|||||||||||||||

7 |

Gross income. Add lines 5 and 6 |

. . . . . . . . . |

. ▶ |

7 |

|

|

|

|

|||||||||||||

Part II |

Expenses. Enter expenses for business use of your home only on line 30. |

|

|

|

|

|

|

|

|||||||||||||

8 |

Advertising |

8 |

|

|

|

|

|

|

18 |

Office expense (see instructions) . |

18 |

|

|

|

|

||||||

9 |

Car and truck expenses (see |

|

|

|

|

|

|

|

19 |

Pension and |

19 |

|

|

|

|

||||||

|

instructions) . . . . |

9 |

|

|

|

|

|

|

20 |

Rent or lease (see instructions): |

|

|

|

|

|

||||||

10 |

Commissions and fees . |

10 |

|

|

|

|

|

|

a |

Vehicles, machinery, and equipment |

20a |

|

|

|

|

||||||

11 |

Contract labor (see instructions) |

11 |

|

|

|

|

|

|

b |

Other business property . . . |

20b |

|

|

|

|

||||||

12 |

Depletion |

12 |

|

|

|

|

|

|

21 |

Repairs and maintenance . . . |

21 |

|

|

|

|

||||||

13 |

Depreciation and section 179 |

|

|

|

|

|

|

|

22 |

Supplies (not included in Part III) . |

22 |

|

|

|

|

||||||

|

expense deduction |

(not |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

23 |

Taxes and licenses |

23 |

|

|

|

|

|||||||

|

included in Part III) (see |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

instructions) . . . . |

13 |

|

|

|

|

|

|

24 |

Travel and meals: |

|

|

|

|

|

|

|

||||

14 |

Employee benefit programs |

|

|

|

|

|

|

|

a |

Travel |

24a |

|

|

|

|

||||||

|

(other than on line 19) |

. |

14 |

|

|

|

|

|

|

b |

Deductible meals (see |

|

|

|

|

|

|

|

|||

15 |

Insurance (other than health) |

15 |

|

|

|

|

|

|

|

instructions) |

24b |

|

|

|

|

||||||

16 |

Interest (see instructions): |

|

|

|

|

|

|

|

25 |

Utilities |

25 |

|

|

|

|

||||||

a |

Mortgage (paid to banks, etc.) |

16a |

|

|

|

|

|

|

26 |

Wages (less employment credits) |

26 |

|

|

|

|

||||||

b |

Other |

16b |

|

|

|

|

|

|

27a |

Other expenses (from line 48) . . |

27a |

|

|

|

|

||||||

17 |

Legal and professional services |

17 |

|

|

|

|

|

|

b |

Reserved for future use . . . |

27b |

|

|

|

|

||||||

28 |

Total expenses before expenses for business use of home. Add lines 8 through 27a |

. ▶ |

28 |

|

|

|

|

||||||||||||||

29 |

Tentative profit or (loss). Subtract line 28 from line 7 |

29 |

|

|

|

|

|||||||||||||||

30 |

Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 |

|

|

|

|

|

|||||||||||||||

|

unless using the simplified method. See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Simplified method filers only: Enter the total square footage of (a) your home: |

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

and (b) the part of your home used for business: |

|

|

|

|

|

|

|

. Use the Simplified |

|

|

|

|

|

|||||||

|

Method Worksheet in the instructions to figure the amount to enter on line 30 |

30 |

|

|

|

|

|||||||||||||||

31 |

Net profit or (loss). Subtract line 30 from line 29. |

|

|

|

|

|

|

|

} |

|

|

|

|

|

|

||||||

|

• If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you |

|

|

|

|

|

|

||||||||||||||

|

checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. |

|

31 |

|

|

|

|

||||||||||||||

|

• If a loss, you must go to line 32. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

32 |

If you have a loss, check the box that describes your investment in this activity. See instructions. |

} |

|

|

|

|

|

|

|||||||||||||

|

• If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule |

|

|

|

|

|

|

||||||||||||||

|

SE, line 2. (If you checked the box on line 1, see the line 31 instructions.) Estates and trusts, enter on |

|

32a |

All investment is at risk. |

|||||||||||||||||

|

Form 1041, line 3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

32b |

Some investment is not |

|||||

|

• If you checked 32b, you must attach Form 6198. Your loss may be limited. |

|

|

|

at risk. |

|

|

||||||||||||||

For Paperwork Reduction Act Notice, see the separate instructions. |

|

|

Cat. No. 11334P |

|

|

|

Schedule C (Form 1040) 2021 |

||||||||||||||

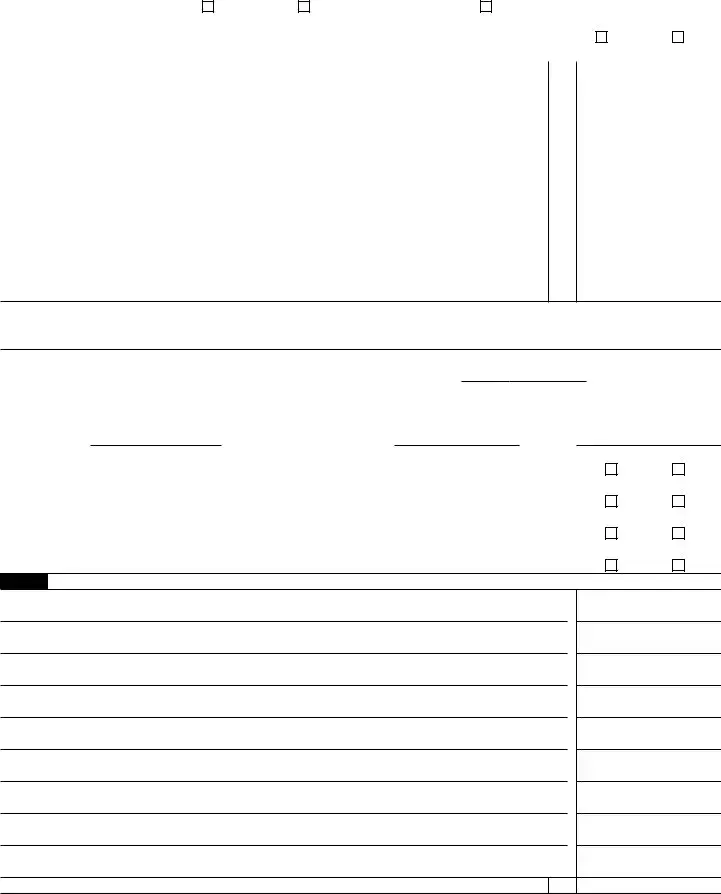

Schedule C (Form 1040) 2021 |

Page 2 |

|

Part III |

Cost of Goods Sold (see instructions) |

|

33 |

Method(s) used to |

|

|

|

|

|

|

|

value closing inventory: |

a |

Cost |

b |

Lower of cost or market |

c |

Other (attach explanation) |

34Was there any change in determining quantities, costs, or valuations between opening and closing inventory?

If “Yes,” attach explanation |

Yes |

No

35 |

Inventory at beginning of year. If different from last year’s closing inventory, attach explanation . . . |

35 |

36 |

Purchases less cost of items withdrawn for personal use |

36 |

37 |

Cost of labor. Do not include any amounts paid to yourself |

37 |

38 |

Materials and supplies |

38 |

39 |

Other costs |

39 |

40 |

Add lines 35 through 39 |

40 |

41 |

Inventory at end of year |

41 |

42 |

Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 |

42 |

Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562.

43 |

When did you place your vehicle in service for business purposes? (month/day/year) |

▶ |

/ |

/ |

44Of the total number of miles you drove your vehicle during 2021, enter the number of miles you used your vehicle for:

a |

Business |

b Commuting (see instructions) |

c Other |

45 |

Was your vehicle available for personal use during |

||

46 |

Do you (or your spouse) have another vehicle available for personal use? |

||

47a |

Do you have evidence to support your deduction? |

||

b |

If “Yes,” is the evidence written? |

||

Yes

Yes

Yes

Yes

No

No

No

No

Part V Other Expenses. List below business expenses not included on lines

48 |

Total other expenses. Enter here and on line 27a |

48

Schedule C (Form 1040) 2021

Common PDF Documents

Stock Transfer Forms - Establish a reliable reference for stock inquiries.

When preparing a Medical Power of Attorney form, it is important to thoroughly understand its implications and functions; for further assistance, you can visit Arizona PDF Forms, which provides valuable resources to help you navigate the process of designating a trusted individual for healthcare decisions.

Dog Vaccination Booster Late - This is a vital record for confirming your dog’s immunization status.