Download IRS W-2 Form in PDF

The IRS W-2 form is a crucial document for employees and employers alike, playing a key role in the annual tax filing process. This form reports an employee's annual wages and the taxes withheld from their paycheck throughout the year. Employers are required to send a W-2 to each employee by January 31st, ensuring that workers have the necessary information to complete their tax returns. The W-2 includes important details such as the employee's Social Security number, the employer's identification number, and various tax-related figures, including federal income tax withheld, Social Security tax, and Medicare tax. Understanding the W-2 is essential for anyone who receives one, as it directly impacts tax obligations and potential refunds. Additionally, the form can also provide insights into an individual's earnings and help them track their financial history. For those who are self-employed or work as independent contractors, the W-2 serves as a reminder of the importance of accurate reporting and compliance with tax laws.

Document Data

| Fact Name | Description |

|---|---|

| Purpose | The W-2 form reports an employee's annual wages and the taxes withheld from their paycheck. |

| Filing Deadline | Employers must provide W-2 forms to employees by January 31 of the following year. |

| Recipient Copies | Employees receive copies of the W-2 for their records and to file their income tax returns. |

| State-Specific Forms | Some states require a state-specific version of the W-2. For example, California uses the DE 6 form, governed by the California Unemployment Insurance Code. |

| Tax Reporting | The W-2 form is essential for reporting income to the IRS, ensuring compliance with federal tax laws. |

| Employee Information | The form includes details such as the employee's name, address, Social Security number, and earnings for the year. |

How to Write IRS W-2

After receiving your IRS W-2 form, it's essential to ensure that all information is accurate before submitting it to the IRS. Completing the form correctly helps avoid delays in processing your tax return. Follow these steps to fill out the W-2 form efficiently.

- Gather necessary information: Collect your personal details, including your name, address, and Social Security number, as well as your employer's information.

- Fill in your employer's information: Enter your employer's name, address, and Employer Identification Number (EIN) in the designated boxes.

- Complete your personal information: In the employee section, write your name, address, and Social Security number accurately.

- Report wages and tips: Fill in the total wages, tips, and other compensation you received in Box 1.

- Include federal income tax withheld: Enter the total federal income tax withheld from your paychecks in Box 2.

- Document Social Security wages: Record your total Social Security wages in Box 3 and the amount of Social Security tax withheld in Box 4.

- Provide Medicare wages: Fill in your total Medicare wages in Box 5 and the amount of Medicare tax withheld in Box 6.

- Report state and local tax information: If applicable, complete Boxes 15-20 with your state and local wages and taxes withheld.

- Double-check for accuracy: Review all entries for correctness to ensure there are no mistakes before submitting.

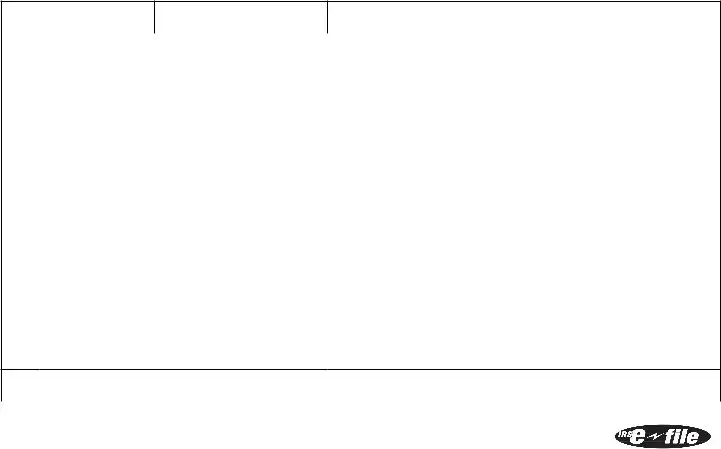

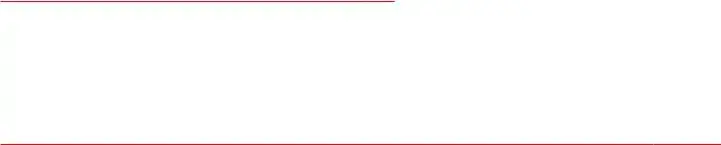

IRS W-2 Example

Attention:

You may file Forms

The maximum amount of dependent care assistance benefits excludable from income may be increased for 2021. The American Rescue Plan Act of 2021 permits employers to increase the amount of dependent care benefits under their plans that can be excluded from an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately). See section C of Notice

Internal Revenue Bulletin:

Note: Copy A of this form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of this IRS form is scannable, but the online version of it, printed from this website, is not. Do not print and file Copy A downloaded from this website with the SSA; a penalty may be imposed for filing forms that can’t be scanned. See the penalties section in the current General Instructions for Forms

Please note that Copy B and other copies of this form, which appear in black, may be downloaded, filled in, and printed and used to satisfy the requirement to provide the information to the recipient.

To order official IRS information returns such as Forms

See IRS Publications 1141, 1167, and 1179 for more information about printing these tax forms.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22222 |

VOID |

|

|

a |

Employee’s social security number |

For Official Use Only ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

OMB No. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

b Employer identification number (EIN) |

|

|

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

4 Social security tax withheld |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

8 |

Allocated tips |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

d Control number |

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

10 |

Dependent care benefits |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e Employee’s first name and initial |

|

Last name |

|

Suff. |

11 |

Nonqualified plans |

|

|

|

12a See instructions for box 12 |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

12b |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

employee |

plan |

sick pay |

|

C |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

12c |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

15 State Employer’s state ID number |

|

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

|

20 Locality name |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2022 |

|

|

Department of the |

||||||||||||||||||||||

|

|

|

|

|

For Privacy Act and Paperwork Reduction |

||||||||||||||||||||||

|

Copy |

|

|

|

|

|

Act Notice, see the separate instructions. |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Form |

|

|

|

|

|

|

|

|

|

|

Cat. No. 10134D |

|||||||||||||||

Do Not Cut, Fold, or Staple Forms on This Page

22222 |

a Employee’s social security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

OMB No. |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b Employer identification number (EIN) |

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

4 Social security tax withheld |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

8 |

Allocated tips |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d Control number |

|

|

|

9 |

|

|

|

|

|

|

|

10 |

Dependent care benefits |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e Employee’s first name and initial |

Last name |

Suff. |

11 |

Nonqualified plans |

|

|

|

12a |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

12b |

|

|

|

||||

|

|

|

|

|

|

|

employee |

plan |

sick pay |

|

C |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

12c |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

15 State Employer’s state ID number |

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

20 Locality name |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2022 |

|

|

Department of the |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

Copy

|

|

a |

Employee’s social security number |

|

|

|

Safe, accurate, |

|

|

|

|

|

Visit the IRS website at |

|

|||||

|

|

|

|

|

OMB No. |

FAST! Use |

|

|

|

|

|

www.irs.gov/efile |

|

||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

b Employer identification number (EIN) |

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

4 Social security tax withheld |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

8 |

Allocated tips |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

d Control number |

|

|

|

9 |

|

|

|

|

|

|

|

10 |

Dependent care benefits |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

e Employee’s first name and initial |

Last name |

Suff. |

11 |

Nonqualified plans |

|

|

|

12a See instructions for box 12 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

12b |

|

|

|

|

|

||||

|

|

|

|

|

|

|

employee |

plan |

sick pay |

|

C |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

12c |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

15 State Employer’s state ID number |

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

20 Locality name |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2022 |

|

|

Department of the |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Copy

This information is being furnished to the Internal Revenue Service.

Notice to Employee

Do you have to file? Refer to the Form 1040 instructions to determine if you are required to file a tax return. Even if you don’t have to file a tax return, you may be eligible for a refund if box 2 shows an amount or if you are eligible for any credit.

Earned income credit (EIC). You may be able to take the EIC for 2022 if your adjusted gross income (AGI) is less than a certain amount. The amount of the credit is based on income and family size. Workers without children could qualify for a smaller credit. You and any qualifying children must have valid social security numbers (SSNs). You can’t take the EIC if your investment income is more than the specified amount for 2022 or if income is earned for services provided while you were an inmate at a penal institution. For 2022 income limits and more information, visit www.irs.gov/EITC. See also Pub. 596, Earned Income Credit. Any EIC that is more than your tax liability is refunded to you, but only if you file a tax return.

Employee’s social security number (SSN). For your protection, this form may show only the last four digits of your SSN. However, your employer has reported your complete SSN to the IRS and the Social Security Administration (SSA).

Clergy and religious workers. If you aren’t subject to social security and Medicare taxes, see Pub. 517, Social Security and Other Information for Members of the Clergy and Religious Workers.

Corrections. If your name, SSN, or address is incorrect, correct Copies B, C, and 2 and ask your employer to correct your employment record. Be sure to ask the employer to file Form

Cost of

Credit for excess taxes. If you had more than one employer in 2022 and more than $9,114 in social security and/or Tier 1 railroad retirement (RRTA) taxes were withheld, you may be able to claim a credit for the excess against your federal income tax. See the Form 1040 instructions. If you had more than one railroad employer and more than $5,350.80 in Tier 2 RRTA tax was withheld, you may be able to claim a refund on Form 843. See the Instructions for Form 843.

(See also Instructions for Employee on the back of Copy C.)

aEmployee’s social security number

|

This information is being furnished to the Internal Revenue Service. If you |

|

OMB No. |

are required to file a tax return, a negligence penalty or other sanction |

|

may be imposed on you if this income is taxable and you fail to report it. |

||

|

b Employer identification number (EIN) |

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

4 Social security tax withheld |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

8 |

Allocated tips |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d Control number |

|

|

|

9 |

|

|

|

|

|

|

|

10 |

Dependent care benefits |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e Employee’s first name and initial |

Last name |

Suff. |

11 |

Nonqualified plans |

|

|

|

12a See instructions for box 12 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

12b |

|

|

|

||||

|

|

|

|

|

|

employee |

plan |

sick pay |

|

C |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

12c |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 State Employer’s state ID number |

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

20 Locality name |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2022 |

|

|

Department of the |

||||||||||||

|

|

|

|

Safe, accurate, |

|

|||||||||||

Copy |

|

|

|

|

|

|

|

FAST! Use |

|

|||||||

(See Notice to Employee on the back of Copy B.)

Instructions for Employee

(See also Notice to Employee on the back of Copy B.)

Box 1. Enter this amount on the wages line of your tax return.

Box 2. Enter this amount on the federal income tax withheld line of your tax return.

Box 5. You may be required to report this amount on Form 8959, Additional Medicare Tax. See the Form 1040 instructions to determine if you are required to complete Form 8959.

Box 6. This amount includes the 1.45% Medicare Tax withheld on all Medicare wages and tips shown in box 5, as well as the 0.9% Additional Medicare Tax on any of those Medicare wages and tips above $200,000.

Box 8. This amount is not included in box 1, 3, 5, or 7. For information on how to report tips on your tax return, see the Form 1040 instructions.

You must file Form 4137, Social Security and Medicare Tax on Unreported Tip Income, with your income tax return to report at least the allocated tip amount unless you can prove with adequate records that you received a smaller amount. If you have records that show the actual amount of tips you received, report that amount even if it is more or less than the allocated tips. Use Form 4137 to figure the social security and Medicare tax owed on tips you didn’t report to your employer. Enter this amount on the wages line of your tax return. By filing Form 4137, your social security tips will be credited to your social security record (used to figure your benefits).

Box 10. This amount includes the total dependent care benefits that your employer paid to you or incurred on your behalf (including amounts from a section 125 (cafeteria) plan). Any amount over your employer’s plan limit is also included in box 1. See Form 2441.

Box 11. This amount is (a) reported in box 1 if it is a distribution made to you from a nonqualified deferred compensation or nongovernmental section 457(b) plan, or (b) included in box 3 and/or box 5 if it is a prior year deferral under a nonqualified or section 457(b) plan that became taxable for social security and Medicare taxes this year because there is no longer a substantial risk of forfeiture of your right to the deferred amount. This box shouldn’t be used if you had a deferral and a distribution in the same calendar year. If you made a deferral and

received a distribution in the same calendar year, and you are or will be age 62 by the end of the calendar year, your employer should file Form

Box 12. The following list explains the codes shown in box 12. You may need this information to complete your tax return. Elective deferrals (codes D, E, F, and S) and designated Roth contributions (codes AA, BB, and EE) under all plans are generally limited to a total of $20,500 ($14,000 if you only have SIMPLE plans; $23,500 for section 403(b) plans if you qualify for the

However, if you were at least age 50 in 2022, your employer may have allowed an additional deferral of up to $6,500 ($3,000 for section 401(k)(11) and 408(p) SIMPLE plans). This additional deferral amount is not subject to the overall limit on elective deferrals. For code G, the limit on elective deferrals may be higher for the last 3 years before you reach retirement age. Contact your plan administrator for more information. Amounts in excess of the overall elective deferral limit must be included in income. See the Form 1040 instructions.

Note: If a year follows code D through H, S, Y, AA, BB, or EE, you made a

(continued on back of Copy 2)

|

|

a Employee’s social security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

OMB No. |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b Employer identification number (EIN) |

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

4 Social security tax withheld |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

8 |

Allocated tips |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d Control number |

|

|

|

9 |

|

|

|

|

|

|

|

10 |

Dependent care benefits |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e Employee’s first name and initial |

Last name |

Suff. |

11 |

Nonqualified plans |

|

|

|

12a |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

12b |

|

|

|

||||

|

|

|

|

|

|

|

employee |

plan |

sick pay |

|

C |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

12c |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

15 State Employer’s state ID number |

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

20 Locality name |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2022 |

|

|

Department of the |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

Copy

Income Tax Return

Instructions for Employee (continued from back of

Copy C)

Box 12 (continued)

Box 13. If the “Retirement plan” box is checked, special limits may apply to the amount of traditional IRA contributions you may deduct. See Pub.

Box 14. Employers may use this box to report information such as state disability insurance taxes withheld, union dues, uniform payments, health insurance premiums deducted, nontaxable income, educational assistance payments, or a member of the clergy’s parsonage allowance and utilities. Railroad employers use this box to report railroad retirement (RRTA) compensation, Tier 1 tax, Tier 2 tax, Medicare tax, and Additional Medicare Tax. Include tips reported by the employee to the employer in railroad retirement (RRTA) compensation.

Note: Keep Copy C of Form

|

VOID |

|

|

a Employee’s social security number |

OMB No. |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

b Employer identification number (EIN) |

|

|

|

1 Wages, tips, other compensation |

|

2 Federal income tax withheld |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

|

|

4 Social security tax withheld |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Medicare wages and tips |

|

6 |

Medicare tax withheld |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Social security tips |

|

|

|

8 |

Allocated tips |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

d Control number |

|

|

|

9 |

|

|

|

|

|

|

|

10 |

Dependent care benefits |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

e Employee’s first name and initial |

Last name |

Suff. |

11 |

Nonqualified plans |

|

|

|

12a See instructions for box 12 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

13 |

Statutory |

Retirement |

|

12b |

|

|

|

||||

|

|

|

|

|

|

|

|

|

employee |

plan |

sick pay |

|

C |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Other |

|

|

|

|

|

12c |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

15 State Employer’s state ID number |

|

16 State wages, tips, etc. |

17 State income tax |

|

18 Local wages, tips, etc. |

19 Local income tax |

20 Locality name |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

2022 |

|

|

Department of the |

|||||||||||||||

|

|

|

|

For Privacy Act and Paperwork Reduction |

|||||||||||||||

Copy |

|

|

|

|

|

|

|

|

|

|

Act Notice, see separate instructions. |

||||||||

Common PDF Documents

Cancel Melaleuca Membership - Requests received after the 25th will be handled the following month.

When preparing for unforeseen medical scenarios, it's important to have a clear plan in place, and a Medical Power of Attorney form is a crucial component of that plan. This document enables you to appoint someone you trust to make vital healthcare decisions on your behalf if you are unable to do so. To ensure your preferences are communicated effectively, you can access the necessary resources through Arizona PDF Forms, where guidance on completing this important document can be found.

Broker Price Opinion Letter Pdf - The Broker Price Opinion assesses both the subject property and comparable properties.