Free Loan Agreement Document

When navigating the world of borrowing and lending, a Loan Agreement form serves as a vital document that outlines the terms and conditions of a loan between a lender and a borrower. This form typically includes key elements such as the loan amount, interest rate, repayment schedule, and any collateral involved. It also specifies the rights and responsibilities of both parties, ensuring clarity and protection in the transaction. Additional provisions may cover late fees, default consequences, and the process for resolving disputes. By detailing these aspects, the Loan Agreement form not only helps prevent misunderstandings but also fosters trust between the parties involved. Understanding the nuances of this document can empower individuals and businesses alike to make informed financial decisions, paving the way for successful lending experiences.

State-specific Guidelines for Loan Agreement Documents

Loan Agreement Categories

PDF Specifics

| Fact Name | Description |

|---|---|

| Definition | A Loan Agreement is a legal document outlining the terms under which a borrower receives funds from a lender. |

| Parties Involved | The agreement typically involves two main parties: the borrower and the lender. |

| Interest Rates | Loan Agreements specify the interest rate, which can be fixed or variable, affecting the total repayment amount. |

| Repayment Terms | Details regarding repayment schedules, including the frequency and amount of payments, are included in the agreement. |

| Governing Law | The agreement is subject to state laws, which vary by location. For example, in California, it is governed by the California Civil Code. |

| Default Provisions | Consequences of defaulting on the loan, including late fees and legal actions, are clearly outlined in the document. |

How to Write Loan Agreement

To complete the Loan Agreement form, it is important to follow a series of steps to ensure that all necessary information is accurately provided. This process will guide you through the required sections of the form, allowing for a clear and organized submission.

- Begin by entering the date at the top of the form.

- Provide the names and addresses of both the lender and the borrower in the designated fields.

- Specify the loan amount in the appropriate section.

- Indicate the interest rate that will apply to the loan.

- Fill in the loan term, including the start and end dates.

- Outline the repayment schedule, detailing how often payments will be made (e.g., monthly, quarterly).

- Include any additional terms or conditions that may apply to the loan.

- Both parties should sign and date the form at the bottom.

After completing these steps, review the form for accuracy before submission. Ensure all signatures are present and that the document is legible.

Loan Agreement Example

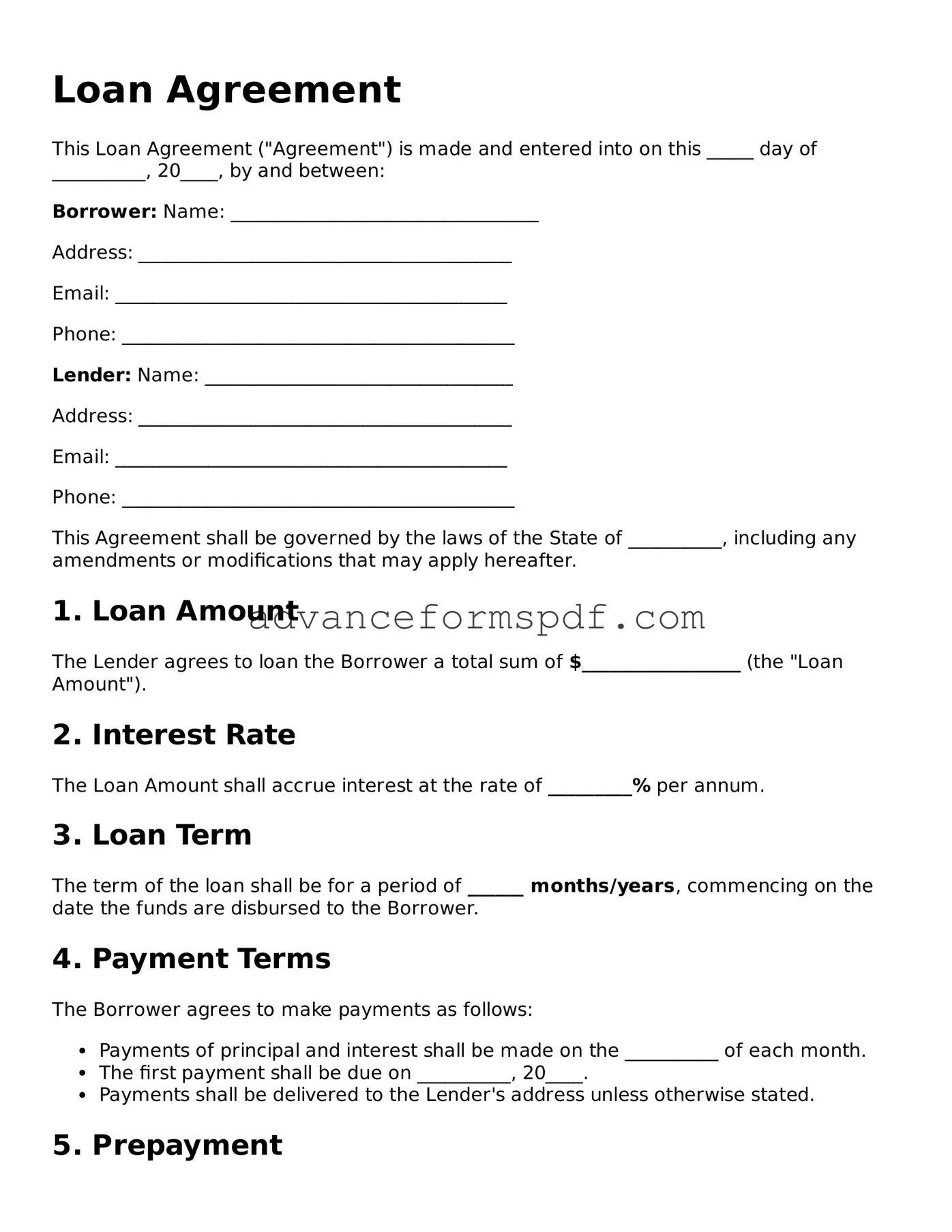

Loan Agreement

This Loan Agreement ("Agreement") is made and entered into on this _____ day of __________, 20____, by and between:

Borrower: Name: _________________________________

Address: ________________________________________

Email: __________________________________________

Phone: __________________________________________

Lender: Name: _________________________________

Address: ________________________________________

Email: __________________________________________

Phone: __________________________________________

This Agreement shall be governed by the laws of the State of __________, including any amendments or modifications that may apply hereafter.

1. Loan Amount

The Lender agrees to loan the Borrower a total sum of $_________________ (the "Loan Amount").

2. Interest Rate

The Loan Amount shall accrue interest at the rate of _________% per annum.

3. Loan Term

The term of the loan shall be for a period of ______ months/years, commencing on the date the funds are disbursed to the Borrower.

4. Payment Terms

The Borrower agrees to make payments as follows:

- Payments of principal and interest shall be made on the __________ of each month.

- The first payment shall be due on __________, 20____.

- Payments shall be delivered to the Lender's address unless otherwise stated.

5. Prepayment

The Borrower may prepay the Loan Amount in whole or in part without any penalties. Such prepayments will reduce the remaining balance accordingly.

6. Default

In the event of default, which includes failure to make payments as specified, the Lender may pursue remedies available under state law.

7. Governing Law

This Agreement shall be interpreted according to the laws of the State of __________. Any disputes arising from this Agreement must be filed in the appropriate court of that state.

8. Signatures

By signing below, both parties agree to the terms of this Loan Agreement.

___________________________ ___________________________

Borrower Signature Lender Signature

Date: ______________________ Date: ______________________

9. Additional Provisions

Any additional terms or agreements should be listed here:

_______________________________________________________

_______________________________________________________

Popular Documents

Batting Order - Use A for available and N/A for not available to avoid confusion.

When engaging in a transaction involving a trailer, it's important to use the appropriate documentation to ensure clarity and legality. The Arizona Trailer Bill of Sale form is designed for this purpose and should be filled out meticulously to reflect the details of the sale. For those looking for a reliable template, you can find it on Arizona PDF Forms, which provides the necessary legal framework to protect both buyers and sellers during the ownership transfer process.

Partial Lien Waiver Form - A Partial Release of Lien encourages timely payment and completion of projects by providing clear milestones.