Download Mortgage Statement Form in PDF

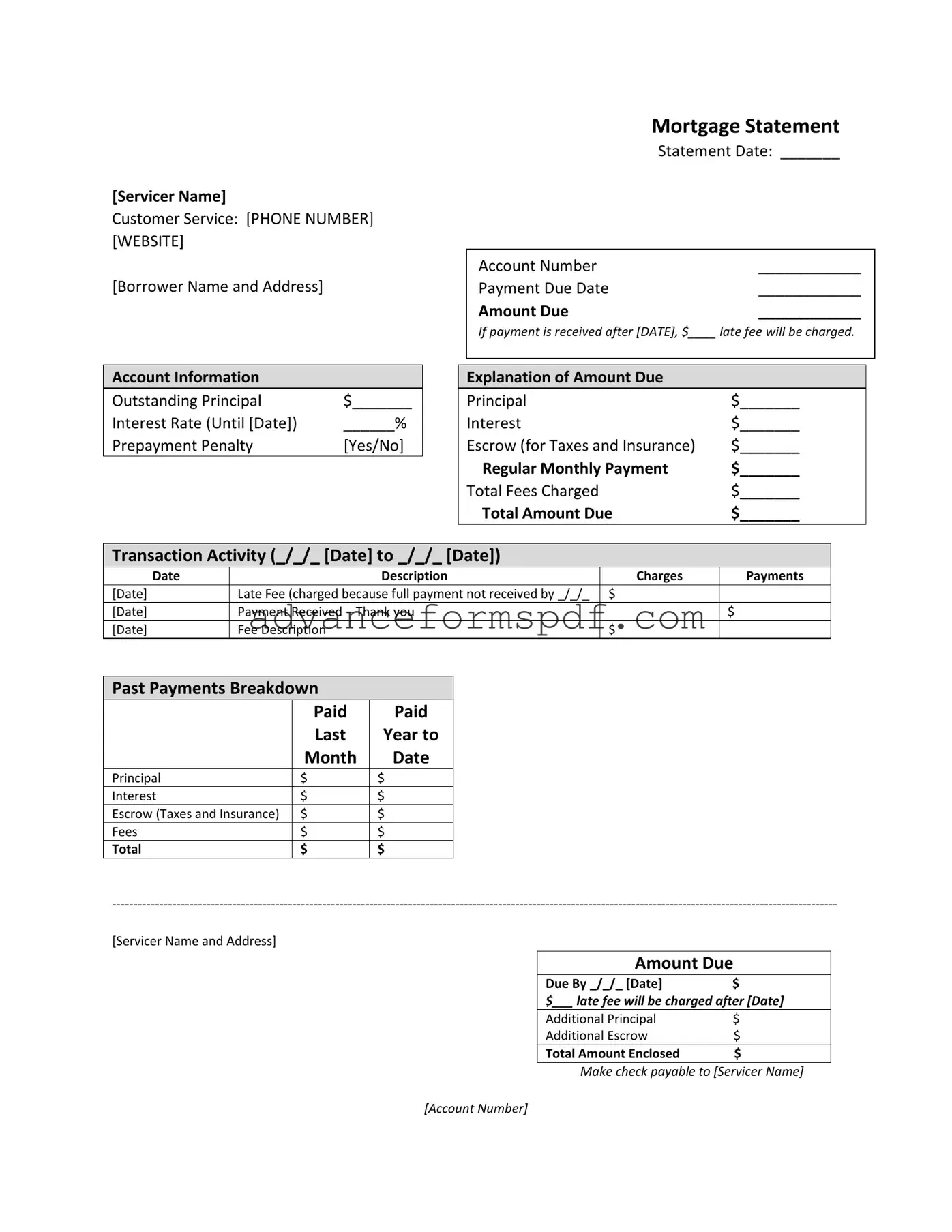

The Mortgage Statement form serves as a vital communication tool between mortgage servicers and borrowers, encapsulating essential details regarding the mortgage account. At the top of the form, the servicer's name, customer service contact information, and the borrower’s name and address create a personalized touch, ensuring that the document is relevant and easily identifiable. Key dates, such as the statement date and payment due date, are prominently displayed, allowing borrowers to stay on top of their financial obligations. The form outlines the amount due, including any potential late fees if payments are not received by the specified date. In addition to the basic payment information, the statement provides a breakdown of the account's financial status, detailing outstanding principal, interest rates, and any applicable prepayment penalties. A clear explanation of the amount due is also included, itemizing principal, interest, escrow for taxes and insurance, and total fees charged. Furthermore, transaction activity is meticulously documented, showcasing a timeline of charges and payments, which helps borrowers track their payment history. Important messages highlight critical information regarding partial payments and potential consequences of delinquency, emphasizing the urgency of maintaining timely payments. The statement also offers resources for those experiencing financial difficulties, guiding them toward mortgage counseling or assistance. Overall, the Mortgage Statement form is designed to facilitate transparency and understanding, empowering borrowers to manage their mortgage responsibilities effectively.

Document Data

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for borrower inquiries. |

| Payment Details | It specifies the payment due date, amount due, and any late fees that may apply if the payment is not received on time. |

| Account Information | The statement provides details such as outstanding principal, interest rate, and whether a prepayment penalty applies. |

| Transaction Activity | It lists recent transactions, including dates, descriptions, charges, and payments made by the borrower. |

| Delinquency Notice | A notice alerts borrowers if they are late on payments and outlines potential consequences, including fees and foreclosure risks. |

| Financial Assistance Information | The statement may include resources for mortgage counseling or assistance for borrowers experiencing financial difficulties. |

How to Write Mortgage Statement

Completing the Mortgage Statement form accurately is crucial to ensure that your mortgage account remains in good standing. Following the steps below will help you fill out the form correctly, allowing you to keep track of your payments and any outstanding amounts. Take your time to gather all necessary information before you begin.

- Start by entering the Servicer Name and their Customer Service Phone Number and Website at the top of the form.

- Fill in your Borrower Name and Address in the designated section.

- Record the Statement Date, Account Number, and Payment Due Date in the appropriate fields.

- Indicate the Amount Due and the date after which a late fee will be charged.

- In the Account Information section, enter the Outstanding Principal and Interest Rate until the specified date.

- Specify if there is a Prepayment Penalty by selecting Yes or No.

- Break down the Amount Due by filling in the amounts for Principal, Interest, Escrow (for Taxes and Insurance), Regular Monthly Payment, Total Fees Charged, and Total Amount Due.

- Document the Transaction Activity by entering the relevant dates, descriptions, charges, and payments.

- Review the Past Payments Breakdown and fill in the amounts for Principal, Interest, Escrow, Fees, and Total for the last year.

- At the bottom of the form, confirm the Amount Due and the Due By Date, including any late fee information.

- Lastly, indicate the Additional Principal and Additional Escrow if applicable, and write the Total Amount Enclosed if you are sending a payment.

After completing the form, make sure to review all entries for accuracy. If you have any questions or need assistance, consider reaching out to the customer service number provided. Taking prompt action will help you stay on top of your mortgage obligations and avoid potential penalties.

Mortgage Statement Example

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.

Common PDF Documents

Corrective Deed California - A Scrivener's Affidavit can clarify misunderstandings related to the document's contents.

When engaging in the purchase or sale of an RV, it is important to utilize the Arizona RV Bill of Sale form, as it not only provides a clear outline of the transaction but also includes vital information about both parties involved. For easy access to this essential document, you can find it through Arizona PDF Forms, ensuring that your transaction adheres to state regulations and avoids any potential misunderstandings.

Temporary Guardianship Form California Pdf - This form can prevent disputes over custody by providing clear guidelines during temporary arrangements.

Printable Editable Blank Utility Bill Template - Required for reporting utility service outages or issues.