Valid Deed in Lieu of Foreclosure Form for the State of New York

In the realm of real estate, particularly for homeowners facing financial difficulties, the New York Deed in Lieu of Foreclosure form serves as a significant tool. This legal instrument allows a property owner to voluntarily transfer ownership of their property back to the lender, effectively avoiding the lengthy and often stressful foreclosure process. By signing this document, the homeowner relinquishes their rights to the property, and in return, the lender typically agrees to release the borrower from the mortgage debt. This arrangement can provide a more graceful exit for those struggling with mortgage payments, as it helps to mitigate the negative impact on credit scores compared to a traditional foreclosure. It also streamlines the process of property transfer, allowing both parties to avoid the costs and complications associated with court proceedings. However, it is essential for homeowners to understand the implications of this decision, including potential tax consequences and the necessity of negotiating terms with the lender. The New York Deed in Lieu of Foreclosure form is not merely a legal document; it represents a critical juncture for individuals seeking to regain control over their financial situation while minimizing the fallout from an impending foreclosure.

PDF Specifics

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Governing Law | This process is governed by New York Real Property Actions and Proceedings Law (RPAPL) and the New York State Banking Law. |

| Benefits | It can help borrowers avoid the lengthy and costly foreclosure process, and it may be less damaging to their credit score than a foreclosure. |

| Considerations | Borrowers should be aware that they may still be liable for any remaining debt after the deed is executed unless the lender agrees to forgive it. |

How to Write New York Deed in Lieu of Foreclosure

After completing the New York Deed in Lieu of Foreclosure form, the next step involves submitting it to the appropriate county clerk's office for recording. It is essential to ensure that all parties involved understand their rights and obligations moving forward.

- Obtain the New York Deed in Lieu of Foreclosure form from a reliable source or legal professional.

- Fill in the names of the grantor (current property owner) and grantee (the lender or bank). Make sure the names are spelled correctly.

- Provide the property address, including the city, state, and zip code. This information should be accurate to avoid any issues.

- Include the legal description of the property. This may be found on the original deed or property tax documents.

- Indicate the date of the transfer. This is the date when the deed is signed.

- Sign the form in the designated area. The grantor must sign in front of a notary public.

- Have the signature notarized. The notary will complete their section, confirming the identity of the signer.

- Make copies of the completed and notarized form for your records.

- Submit the original form to the county clerk's office where the property is located. There may be a recording fee, so check in advance.

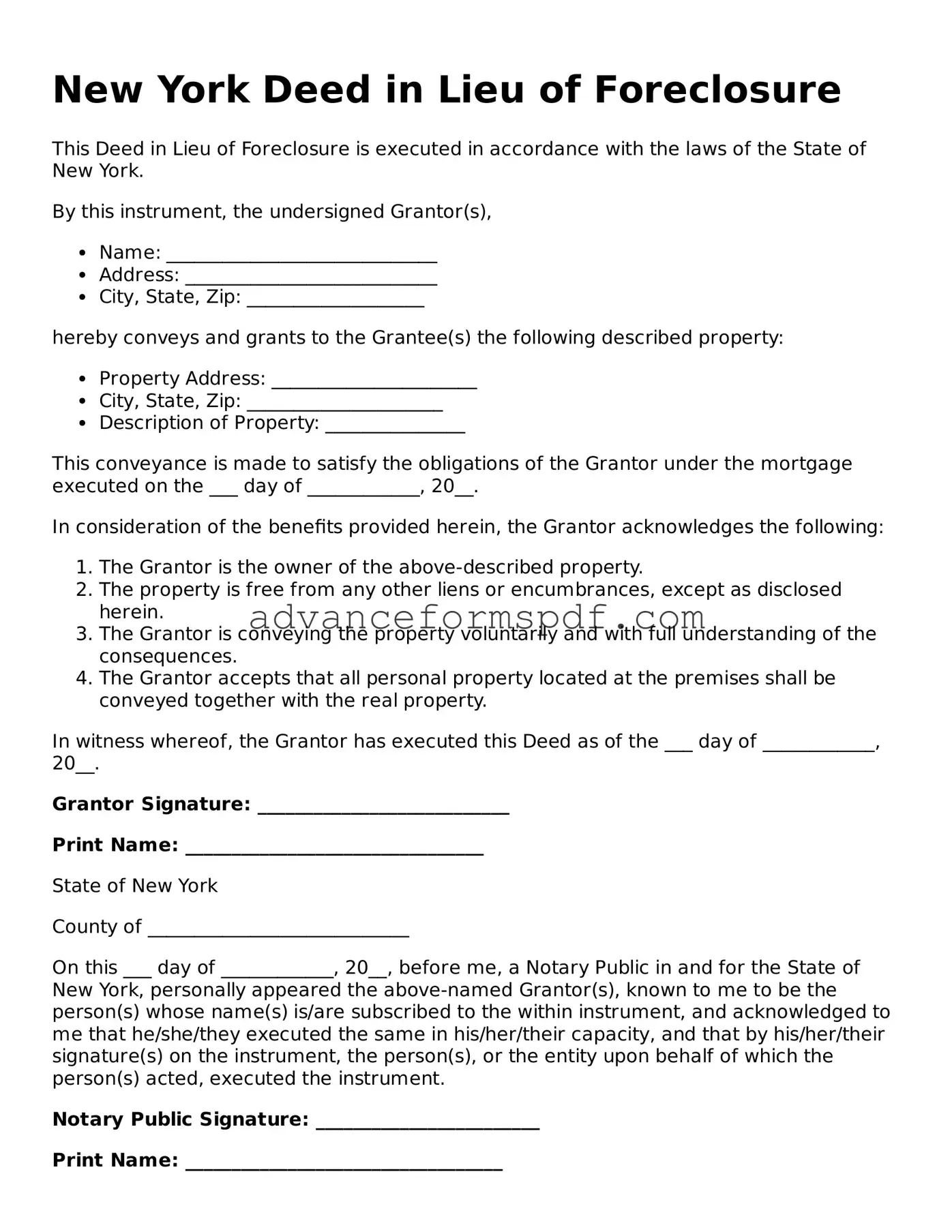

New York Deed in Lieu of Foreclosure Example

New York Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is executed in accordance with the laws of the State of New York.

By this instrument, the undersigned Grantor(s),

- Name: _____________________________

- Address: ___________________________

- City, State, Zip: ___________________

hereby conveys and grants to the Grantee(s) the following described property:

- Property Address: ______________________

- City, State, Zip: _____________________

- Description of Property: _______________

This conveyance is made to satisfy the obligations of the Grantor under the mortgage executed on the ___ day of ____________, 20__.

In consideration of the benefits provided herein, the Grantor acknowledges the following:

- The Grantor is the owner of the above-described property.

- The property is free from any other liens or encumbrances, except as disclosed herein.

- The Grantor is conveying the property voluntarily and with full understanding of the consequences.

- The Grantor accepts that all personal property located at the premises shall be conveyed together with the real property.

In witness whereof, the Grantor has executed this Deed as of the ___ day of ____________, 20__.

Grantor Signature: ___________________________

Print Name: ________________________________

State of New York

County of ____________________________

On this ___ day of ____________, 20__, before me, a Notary Public in and for the State of New York, personally appeared the above-named Grantor(s), known to me to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged to me that he/she/they executed the same in his/her/their capacity, and that by his/her/their signature(s) on the instrument, the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

Notary Public Signature: ________________________

Print Name: __________________________________

My commission expires: _______________________

Other Deed in Lieu of Foreclosure State Forms

California Property Surrender Deed - In most cases, homeowners are able to negotiate their move-out date under a Deed in Lieu agreement.

In addition to the essential aspects of the Arizona Motorcycle Bill of Sale, it's important for buyers and sellers to consider the accessibility of this document, which can be conveniently obtained through Arizona PDF Forms. This helps streamline the process and ensures that all necessary details are accurately recorded, further solidifying the agreement between the parties involved.