Valid Loan Agreement Form for the State of New York

When navigating the world of personal or business financing in New York, understanding the nuances of the Loan Agreement form is essential. This document serves as a binding contract between the lender and borrower, outlining the terms and conditions of the loan. Key elements typically include the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, it addresses the rights and responsibilities of both parties, ensuring clarity and protection throughout the lending process. The form may also specify default terms, which are crucial in determining what happens if the borrower fails to meet their obligations. By familiarizing oneself with the intricacies of the New York Loan Agreement form, individuals can make informed decisions and foster positive lending relationships, whether for personal needs or business ventures.

PDF Specifics

| Fact Name | Details |

|---|---|

| Purpose | The New York Loan Agreement form is used to outline the terms of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by New York State laws. |

| Loan Amount | The form specifies the exact amount of money being loaned. |

| Interest Rate | The interest rate applied to the loan is clearly defined in the agreement. |

| Repayment Terms | Repayment terms, including the schedule and method of payment, are outlined in the document. |

| Default Conditions | Conditions under which the borrower would default on the loan are included. |

| Signatures | Both parties must sign the agreement to make it legally binding. |

How to Write New York Loan Agreement

Completing the New York Loan Agreement form is an important step in securing a loan. The information provided on this form will help establish the terms of the loan and protect the rights of both the lender and the borrower. To ensure accuracy and compliance, follow these steps carefully.

- Begin by reading the form thoroughly to understand all required sections.

- Fill in the date at the top of the form. This should be the date you are completing the agreement.

- Enter the full name of the borrower. Make sure to include any middle names or initials.

- Provide the borrower's address, including street, city, state, and zip code.

- Next, fill in the lender's name and address in the designated section.

- Specify the loan amount in numbers and words to avoid any confusion.

- Detail the interest rate and any applicable fees associated with the loan.

- Indicate the repayment terms, including the schedule for payments and the total duration of the loan.

- Review any clauses regarding late payments or default to ensure understanding.

- Sign and date the form at the bottom. If applicable, have a witness sign as well.

- Make copies of the completed form for both the lender and borrower for future reference.

New York Loan Agreement Example

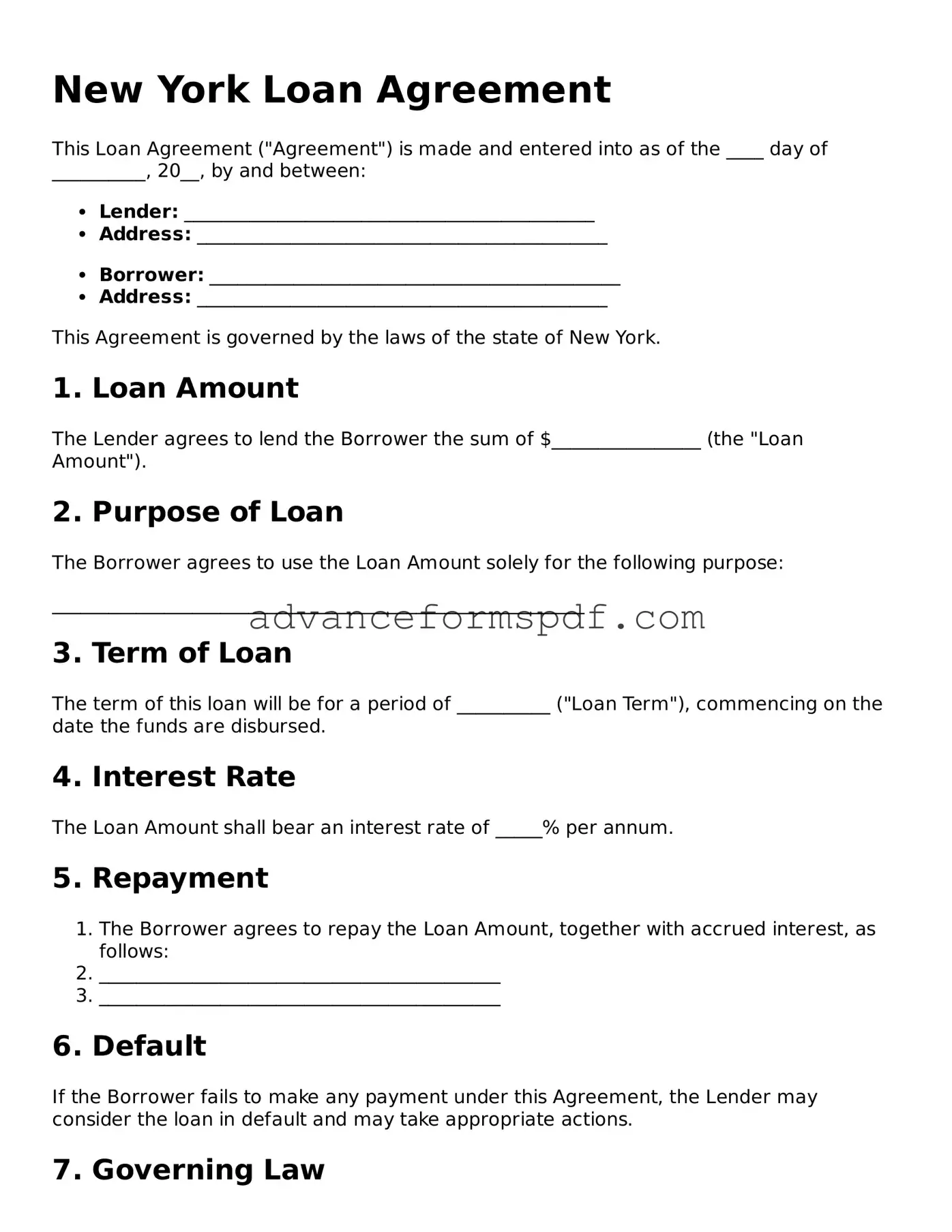

New York Loan Agreement

This Loan Agreement ("Agreement") is made and entered into as of the ____ day of __________, 20__, by and between:

- Lender: ____________________________________________

- Address: ____________________________________________

- Borrower: ____________________________________________

- Address: ____________________________________________

This Agreement is governed by the laws of the state of New York.

1. Loan Amount

The Lender agrees to lend the Borrower the sum of $________________ (the "Loan Amount").

2. Purpose of Loan

The Borrower agrees to use the Loan Amount solely for the following purpose:

_________________________________________________________

3. Term of Loan

The term of this loan will be for a period of __________ ("Loan Term"), commencing on the date the funds are disbursed.

4. Interest Rate

The Loan Amount shall bear an interest rate of _____% per annum.

5. Repayment

- The Borrower agrees to repay the Loan Amount, together with accrued interest, as follows:

- ___________________________________________

- ___________________________________________

6. Default

If the Borrower fails to make any payment under this Agreement, the Lender may consider the loan in default and may take appropriate actions.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of New York.

8. Entire Agreement

This document constitutes the entire Agreement between the parties. No modifications or amendments shall be effective unless made in writing and signed by both parties.

IN WITNESS WHEREOF

The parties have executed this Loan Agreement as of the date first above written.

- ______________________________ (Lender)

- ______________________________ (Borrower)

Other Loan Agreement State Forms

Free Promissory Note Template Florida - Details such as the loan amount, interest rate, and repayment schedule are included.

Creating a Medical Power of Attorney form is vital for ensuring that your healthcare preferences are communicated and respected when you cannot advocate for yourself; for those in Arizona, resources such as Arizona PDF Forms can simplify the process of obtaining and filling out this important document.

California Promissory Note - The Loan Agreement might outline the procedures for resolving disputes.

Illinois Promissory Note - A Loan Agreement is commonly used in real estate, auto loans, and personal loans.