Valid Promissory Note Form for the State of New York

The New York Promissory Note form is an essential financial document that outlines the terms of a loan agreement between a borrower and a lender. This form serves as a written promise from the borrower to repay a specified amount of money, often with interest, by a predetermined date. Key elements of the form include the principal amount, interest rate, payment schedule, and any provisions for late fees or default. Additionally, the document typically requires the signatures of both parties, ensuring that the agreement is legally binding. Understanding the intricacies of this form can help individuals and businesses navigate their financial obligations more effectively, providing clarity and protection in lending transactions.

PDF Specifics

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specific amount of money to a designated person at a specified time. |

| Governing Law | The New York Uniform Commercial Code (UCC) governs promissory notes in New York. |

| Parties Involved | There are typically two parties: the maker (who promises to pay) and the payee (who receives the payment). |

| Interest Rate | The note can specify an interest rate, which may be fixed or variable, depending on the agreement. |

| Payment Terms | It must clearly state the payment terms, including the amount due and the due date. |

| Signatures | The maker must sign the note to make it legally binding. |

| Transferability | Promissory notes can often be transferred to another party, making them negotiable instruments. |

| Default Consequences | If the maker fails to pay, the payee has the right to take legal action to recover the owed amount. |

How to Write New York Promissory Note

After obtaining the New York Promissory Note form, you will need to fill it out carefully to ensure all necessary information is included. This document will be crucial for outlining the terms of the loan agreement between the parties involved.

- Start by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Write the full name and address of the borrower. Ensure accuracy to avoid any confusion later.

- Next, include the lender's full name and address. This identifies who is providing the funds.

- Specify the principal amount being borrowed. Clearly state the dollar amount in both numbers and words.

- Indicate the interest rate. Make sure to specify whether it is fixed or variable.

- Outline the repayment terms. Include the payment schedule, such as monthly or quarterly payments, and the due date for the final payment.

- Include any late fees or penalties for missed payments. Be clear about the amounts and conditions.

- Sign and date the form. The borrower must sign, and if applicable, the lender should also sign.

- Consider having the document notarized for added legal protection. This step may not be required but can be beneficial.

Once completed, keep a copy for your records and provide a copy to the other party involved. This ensures both parties have the same understanding of the agreement.

New York Promissory Note Example

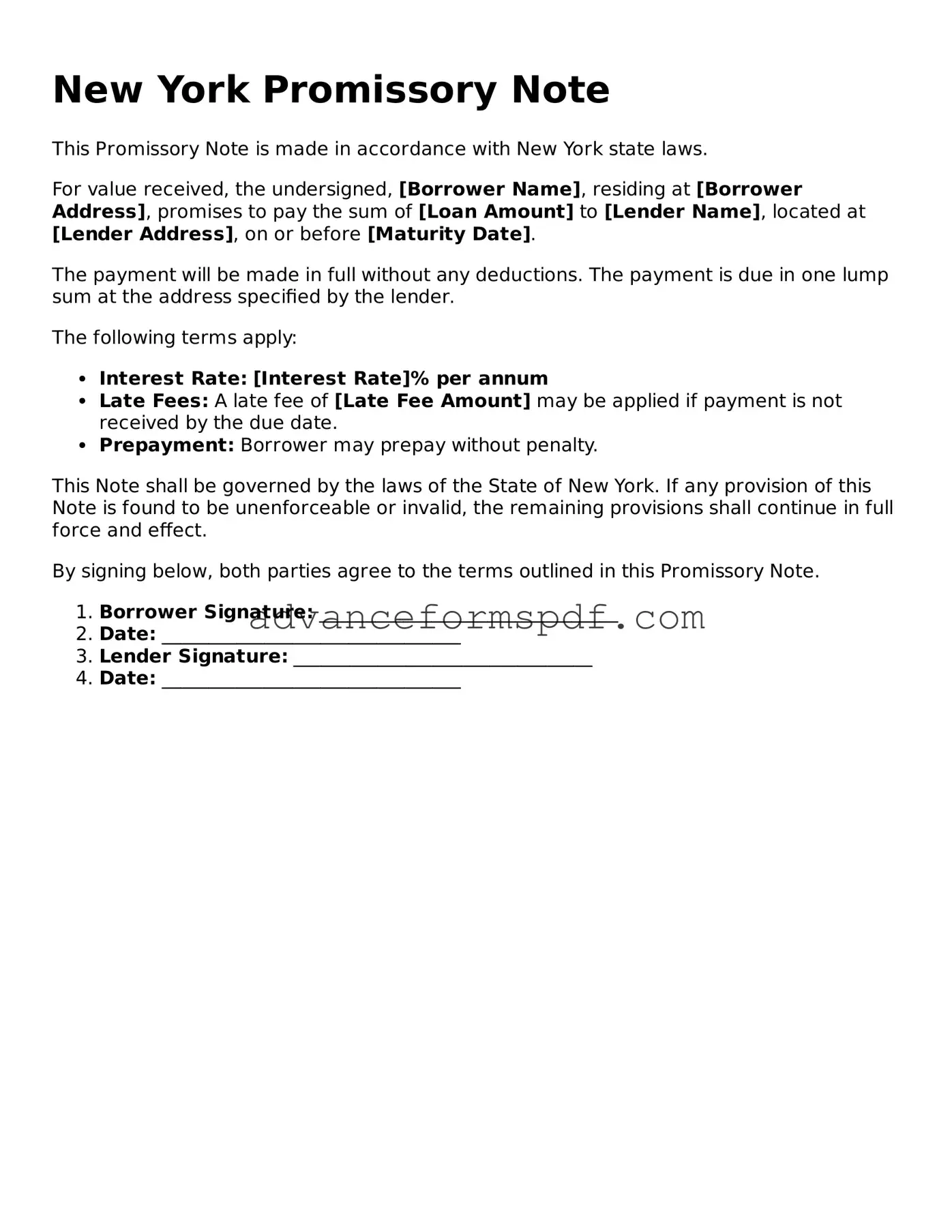

New York Promissory Note

This Promissory Note is made in accordance with New York state laws.

For value received, the undersigned, [Borrower Name], residing at [Borrower Address], promises to pay the sum of [Loan Amount] to [Lender Name], located at [Lender Address], on or before [Maturity Date].

The payment will be made in full without any deductions. The payment is due in one lump sum at the address specified by the lender.

The following terms apply:

- Interest Rate: [Interest Rate]% per annum

- Late Fees: A late fee of [Late Fee Amount] may be applied if payment is not received by the due date.

- Prepayment: Borrower may prepay without penalty.

This Note shall be governed by the laws of the State of New York. If any provision of this Note is found to be unenforceable or invalid, the remaining provisions shall continue in full force and effect.

By signing below, both parties agree to the terms outlined in this Promissory Note.

- Borrower Signature: ________________________________

- Date: ________________________________

- Lender Signature: ________________________________

- Date: ________________________________

Other Promissory Note State Forms

Illinois Promissory Note - It provides a written record of the agreement for both parties to reference later.

A Power of Attorney form in Arizona is a legal document that allows one person to act on behalf of another in financial or legal matters. This form is essential for ensuring that your wishes are honored when you cannot make decisions for yourself. For more resources on this important document, you can refer to Arizona PDF Forms, as understanding its use and implications can provide peace of mind and security for you and your loved ones.