Free Owner Financing Contract Document

In real estate transactions, securing financing can often be a challenging hurdle for buyers, especially those who may not qualify for traditional loans. Owner financing presents a viable alternative, allowing sellers to act as lenders and directly finance the sale of their property. The Owner Financing Contract form plays a crucial role in this process, outlining the terms and conditions under which the seller will provide financing to the buyer. Key components of this form include the purchase price, down payment, interest rate, repayment schedule, and the duration of the loan. It also specifies the consequences of default, ensuring both parties understand their rights and obligations. By clearly detailing these aspects, the contract helps facilitate a smoother transaction, promoting transparency and reducing the potential for disputes. Understanding the intricacies of this form is essential for both buyers and sellers as they navigate the complexities of owner financing in the real estate market.

PDF Specifics

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract allows the seller of a property to finance the purchase for the buyer, bypassing traditional mortgage lenders. |

| Benefits | This type of financing can offer more flexible terms for buyers and sellers, making it easier to negotiate payment plans and interest rates. |

| Governing Laws | Each state has specific laws governing owner financing. For example, in California, the California Civil Code applies, while Texas follows the Texas Property Code. |

| Common Terms | Typically, the contract will outline the purchase price, down payment, interest rate, repayment schedule, and consequences of default. |

| Legal Considerations | It is crucial to ensure that the contract complies with state laws and federal regulations to avoid potential legal issues. |

How to Write Owner Financing Contract

Filling out the Owner Financing Contract form is a straightforward process that requires accurate information from both the buyer and the seller. Ensure you have all necessary details at hand before starting. Follow these steps to complete the form correctly.

- Gather Information: Collect all relevant details about the property, buyer, and seller.

- Property Description: Clearly describe the property, including the address, type, and any identifying features.

- Buyer Information: Enter the full name and contact information of the buyer. Make sure it is accurate.

- Seller Information: Provide the full name and contact details of the seller. Double-check for correctness.

- Financing Terms: Specify the purchase price, down payment, interest rate, and repayment terms.

- Signatures: Ensure both parties sign and date the contract at the designated areas.

- Review: Go through the completed form to confirm all information is correct and complete.

- Distribute Copies: Make copies of the signed contract for both the buyer and seller for their records.

Owner Financing Contract Example

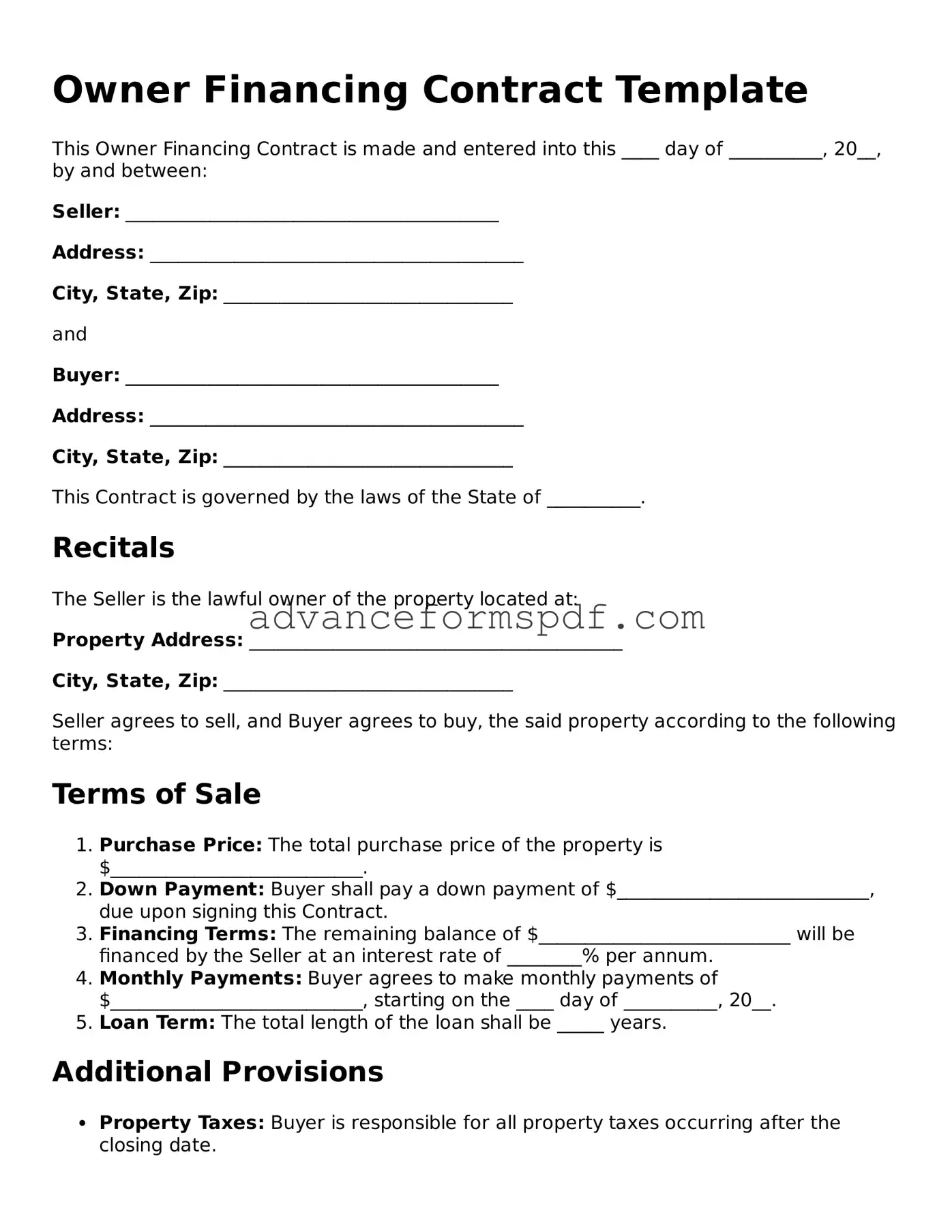

Owner Financing Contract Template

This Owner Financing Contract is made and entered into this ____ day of __________, 20__, by and between:

Seller: ________________________________________

Address: ________________________________________

City, State, Zip: _______________________________

and

Buyer: ________________________________________

Address: ________________________________________

City, State, Zip: _______________________________

This Contract is governed by the laws of the State of __________.

Recitals

The Seller is the lawful owner of the property located at:

Property Address: ________________________________________

City, State, Zip: _______________________________

Seller agrees to sell, and Buyer agrees to buy, the said property according to the following terms:

Terms of Sale

- Purchase Price: The total purchase price of the property is $___________________________.

- Down Payment: Buyer shall pay a down payment of $___________________________, due upon signing this Contract.

- Financing Terms: The remaining balance of $___________________________ will be financed by the Seller at an interest rate of ________% per annum.

- Monthly Payments: Buyer agrees to make monthly payments of $___________________________, starting on the ____ day of __________, 20__.

- Loan Term: The total length of the loan shall be _____ years.

Additional Provisions

- Property Taxes: Buyer is responsible for all property taxes occurring after the closing date.

- Insurance: Buyer shall maintain homeowner’s insurance on the property during the term of financing.

- Default: In the event of default, Seller may enforce the terms of this contract according to state laws.

Signatures

By signing below, both parties agree to the terms set forth in this Owner Financing Contract:

Seller: _______________________________________ Date: ________________________

Buyer: _______________________________________ Date: ________________________

This document serves as a formal agreement between the parties and should be kept in a secure location.

Discover Common Types of Owner Financing Contract Forms

Purchase Agreement Addendum - Helps in formalizing verbal agreements made later.

To ensure clarity and legality in your property transactions, utilizing the Minnesota Real Estate Purchase Agreement form is essential; it formalizes terms and conditions between buyers and sellers. To obtain a copy of this essential document, you can refer to Minnesota PDF Forms to streamline the purchasing process.

Termination of Purchase Agreement - Record for documenting the agreement of all parties to formally end the contract.