Download Payroll Check Form in PDF

Understanding the Payroll Check form is essential for both employers and employees. This document serves as a vital tool in the payroll process, detailing the amount earned by an employee during a specific pay period. It typically includes key information such as the employee's name, identification number, and the pay date. Additionally, the form breaks down earnings, taxes withheld, and any deductions, providing a clear picture of take-home pay. Accuracy is crucial, as errors can lead to confusion or financial discrepancies. By familiarizing yourself with this form, you can ensure smooth payroll operations and maintain trust in the employer-employee relationship.

Document Data

| Fact Name | Description |

|---|---|

| Definition | A Payroll Check form is a document used by employers to pay employees for their work, detailing the amount earned, deductions, and net pay. |

| Components | The form typically includes the employee's name, pay period, gross pay, deductions, and net pay. |

| Frequency | Employers may issue payroll checks weekly, bi-weekly, or monthly, depending on company policy and state law. |

| State Regulations | Different states have specific laws governing payroll practices. For example, California's Labor Code mandates timely payment of wages. |

| Record Keeping | Employers must maintain records of payroll checks issued for a minimum of three years, as required by the Fair Labor Standards Act. |

| Electronic Alternatives | Many employers now offer direct deposit options, allowing employees to receive their pay electronically instead of through physical checks. |

| Tax Implications | Payroll checks must reflect appropriate federal, state, and local taxes withheld, which are governed by IRS regulations and state tax laws. |

How to Write Payroll Check

Filling out the Payroll Check form is a straightforward process that ensures employees receive their due compensation accurately and on time. Follow these steps carefully to complete the form correctly.

- Begin by entering the date in the designated field. This is typically the date the check is being issued.

- In the payee section, write the name of the employee receiving the payment. Make sure to spell the name correctly.

- Next, fill in the amount of the check. Write the numerical amount in the appropriate box and spell out the amount in words below it.

- Indicate the pay period for which the payment is being made. This could be weekly, bi-weekly, or monthly, depending on your payroll schedule.

- Provide a brief description of the payment, such as "salary" or "overtime," in the designated area.

- Sign the check in the signature field. This should be done by the authorized person responsible for issuing payroll checks.

- Finally, make a copy of the completed Payroll Check form for your records before handing it to the employee.

Payroll Check Example

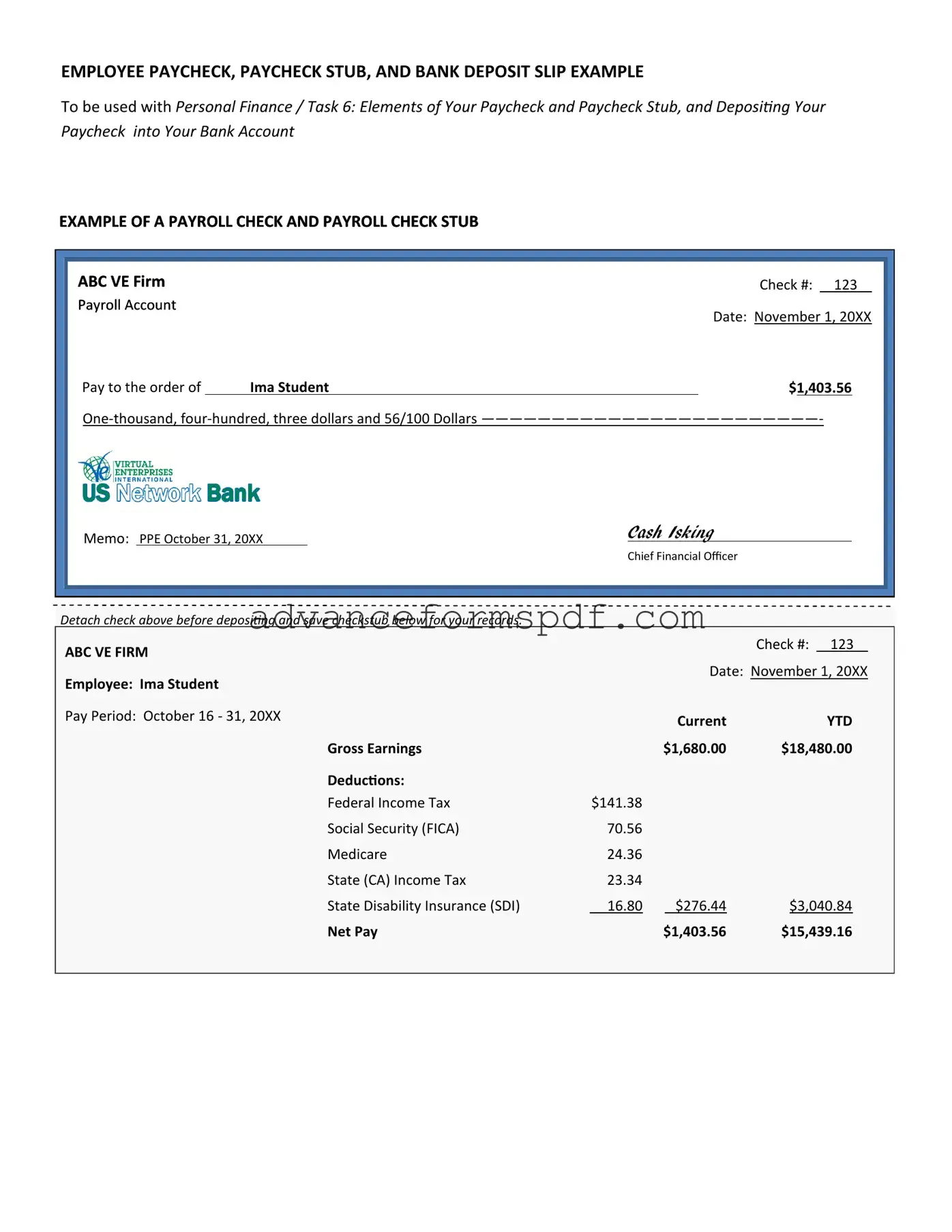

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account

Common PDF Documents

Hub Certification Texas - Each certificate number links back to specific membership interests for clarity.

When engaging in property sales in Texas, it is crucial to have a thorough understanding of the Texas Real Estate Purchase Agreement form, which serves as the legal foundation for the transaction. This essential document details pivotal terms such as purchase price and deadlines, ensuring clarity between the buyer and seller. For those looking to familiarize themselves further, the Real Estate Purchase Agreement form is an invaluable resource.

Fedex Signature Release - Each package requires its own Release Authorization form.

Oakland Marriage License - It provides a record of the marriage date and location.