Free Promissory Note for a Car Document

When purchasing a car, many individuals find themselves in need of financing options to make their dream vehicle a reality. A Promissory Note for a Car serves as a crucial legal document that outlines the terms of the loan agreement between the buyer and the lender. This form typically includes essential details such as the total amount borrowed, the interest rate, the repayment schedule, and the consequences of defaulting on the loan. By clearly stating these terms, the promissory note helps protect both parties involved, ensuring that the buyer understands their financial obligations while providing the lender with a formal record of the agreement. Additionally, it may include provisions regarding collateral, which in this case would be the car itself, giving the lender a claim to the vehicle should the borrower fail to meet their payment obligations. Understanding the components of this form is vital for anyone considering financing a vehicle, as it not only establishes a legal framework for the transaction but also fosters transparency and trust between the buyer and the lender.

PDF Specifics

| Fact Name | Description |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount for the purchase of a vehicle. |

| Parties Involved | The note typically involves two parties: the borrower (buyer) and the lender (seller or financial institution). |

| Governing Law | The laws governing promissory notes vary by state. For example, in California, the relevant laws can be found in the California Commercial Code. |

| Payment Terms | Payment terms usually include the total amount, interest rate, payment schedule, and due dates. |

| Security Interest | Often, the car serves as collateral for the loan, giving the lender a security interest in the vehicle. |

| Default Consequences | If the borrower defaults, the lender may have the right to repossess the vehicle. |

| Signatures Required | Both parties must sign the promissory note for it to be legally binding. |

How to Write Promissory Note for a Car

After obtaining the Promissory Note for a Car form, the next steps involve carefully filling it out to ensure all necessary information is accurately provided. This document will serve as a formal agreement between the borrower and the lender regarding the loan for the vehicle.

- Obtain the Form: Make sure you have the correct Promissory Note for a Car form. This can usually be found online or through your lender.

- Fill in the Date: Start by writing the date on which the note is being created at the top of the form.

- Borrower's Information: Enter the full name and address of the borrower. Ensure that this information is accurate and up-to-date.

- Lender's Information: Provide the full name and address of the lender. Double-check for accuracy.

- Loan Amount: Clearly state the total amount of the loan being taken out for the car.

- Interest Rate: Specify the interest rate applicable to the loan. This should be expressed as a percentage.

- Payment Schedule: Indicate how often payments will be made (e.g., monthly, bi-weekly) and the due date for each payment.

- Loan Term: Write the duration of the loan, specifying how many months or years the borrower has to repay the loan.

- Late Payment Penalties: Outline any penalties for late payments, including the amount or percentage that may be charged.

- Signatures: Both the borrower and lender must sign and date the document at the bottom of the form. Ensure both parties receive a copy.

Promissory Note for a Car Example

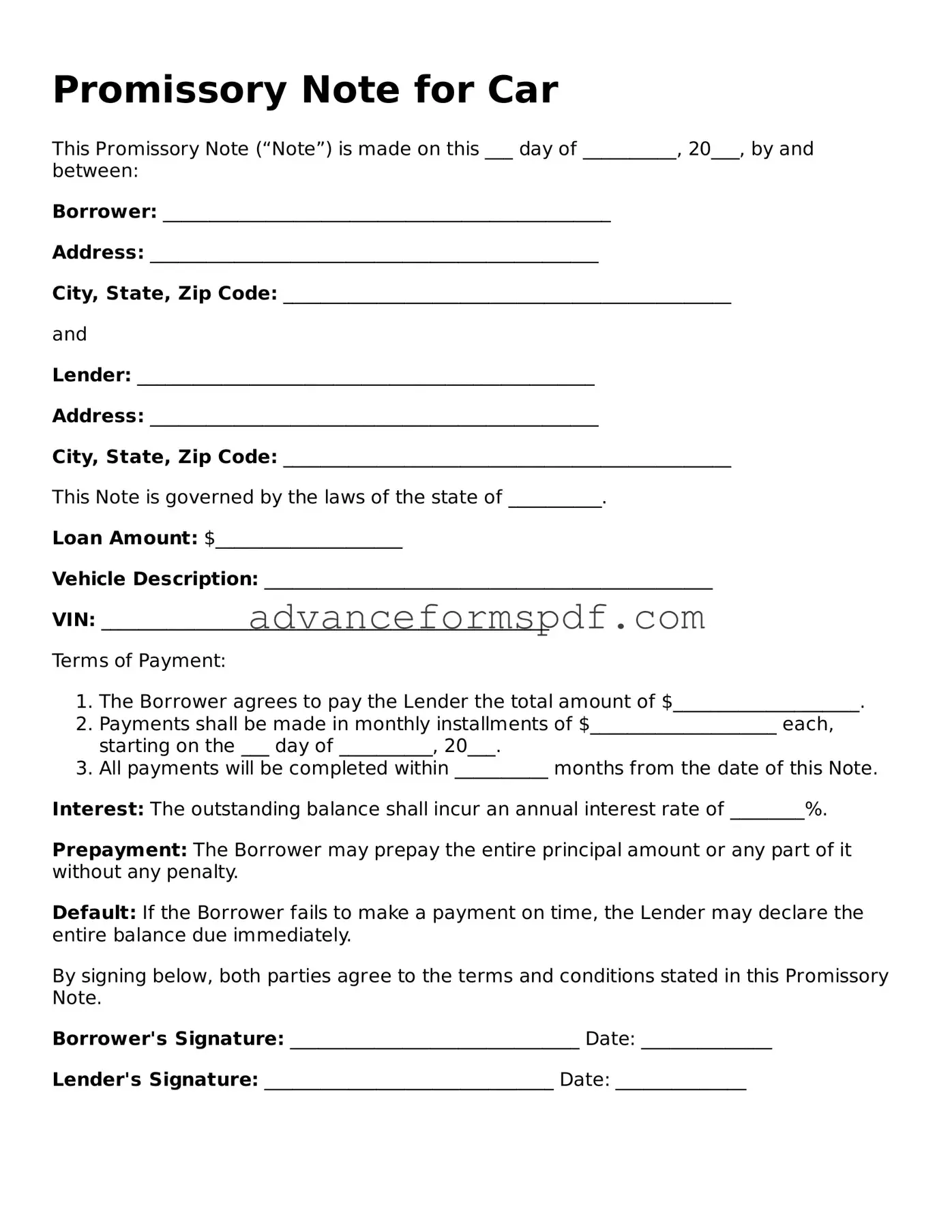

Promissory Note for Car

This Promissory Note (“Note”) is made on this ___ day of __________, 20___, by and between:

Borrower: ________________________________________________

Address: ________________________________________________

City, State, Zip Code: ________________________________________________

and

Lender: _________________________________________________

Address: ________________________________________________

City, State, Zip Code: ________________________________________________

This Note is governed by the laws of the state of __________.

Loan Amount: $____________________

Vehicle Description: ________________________________________________

VIN: ________________________________________________

Terms of Payment:

- The Borrower agrees to pay the Lender the total amount of $____________________.

- Payments shall be made in monthly installments of $____________________ each, starting on the ___ day of __________, 20___.

- All payments will be completed within __________ months from the date of this Note.

Interest: The outstanding balance shall incur an annual interest rate of ________%.

Prepayment: The Borrower may prepay the entire principal amount or any part of it without any penalty.

Default: If the Borrower fails to make a payment on time, the Lender may declare the entire balance due immediately.

By signing below, both parties agree to the terms and conditions stated in this Promissory Note.

Borrower's Signature: _______________________________ Date: ______________

Lender's Signature: _______________________________ Date: ______________

Discover Common Types of Promissory Note for a Car Forms

Promissory Note Release - It is essential for both borrowers and lenders to understand the importance of this form.

When engaging in financial transactions, it is crucial to understand the significance of a Promissory Note, as it serves as a legally binding agreement that ensures all parties are clear on the terms and conditions of the loan, thus safeguarding their interests effectively.