Free Promissory Note Document

A Promissory Note is a crucial financial document that serves as a written promise to pay a specified amount of money to a designated party at a future date or on demand. This form typically includes essential elements such as the names of the borrower and lender, the principal amount, interest rate, payment schedule, and any conditions under which the note may be considered in default. Clarity is vital; thus, the terms should be straightforward to avoid misunderstandings. Additionally, a Promissory Note can be secured or unsecured, depending on whether the borrower offers collateral. Understanding the implications of each aspect is essential for both parties involved. When executed correctly, this document can provide legal protection and establish clear expectations, making it an invaluable tool in personal and business finance.

State-specific Guidelines for Promissory Note Documents

Promissory Note Categories

PDF Specifics

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specific amount of money to a designated person at a specified time. |

| Parties Involved | It involves two main parties: the maker (the person who promises to pay) and the payee (the person who receives the payment). |

| Governing Law | The laws governing promissory notes can vary by state. For example, in California, the California Commercial Code applies. |

| Interest Rates | Promissory notes may include an interest rate, which specifies how much extra money will be paid in addition to the principal amount. |

| Types of Notes | There are different types of promissory notes, including secured and unsecured notes, depending on whether collateral is involved. |

| Enforceability | For a promissory note to be enforceable, it must be signed by the maker and include essential terms like amount, interest, and due date. |

| Transferability | Promissory notes can often be transferred to another party, allowing the new holder to collect the payment. |

| Default Consequences | If the maker fails to pay, the payee may take legal action to recover the owed amount, depending on state laws. |

How to Write Promissory Note

Once you have the Promissory Note form in front of you, it’s time to fill it out accurately. This document is essential for establishing the terms of a loan between two parties. Ensure you have all necessary information at hand before you begin.

- Title the Document: At the top of the form, write "Promissory Note" to clearly identify the purpose of the document.

- Identify the Borrower: Fill in the full name and address of the person or entity borrowing the money.

- Identify the Lender: Provide the full name and address of the person or entity lending the money.

- State the Loan Amount: Clearly write the total amount of money being borrowed, both in numbers and words to avoid any confusion.

- Specify the Interest Rate: Indicate the interest rate that will apply to the loan, if any. Make sure this is clearly defined.

- Set the Payment Terms: Outline how and when the borrower will repay the loan. Include details such as the payment schedule (monthly, quarterly, etc.) and the due date.

- Include Late Fees: If applicable, specify any late fees that will be charged if payments are not made on time.

- Signatures: Both the borrower and lender must sign and date the document to make it legally binding. Ensure that all signatures are clear and legible.

After filling out the Promissory Note, keep copies for both parties. It’s advisable to store these copies in a safe place, as they serve as a record of the agreement. If you have any questions about the terms or need further assistance, consider consulting a professional for guidance.

Promissory Note Example

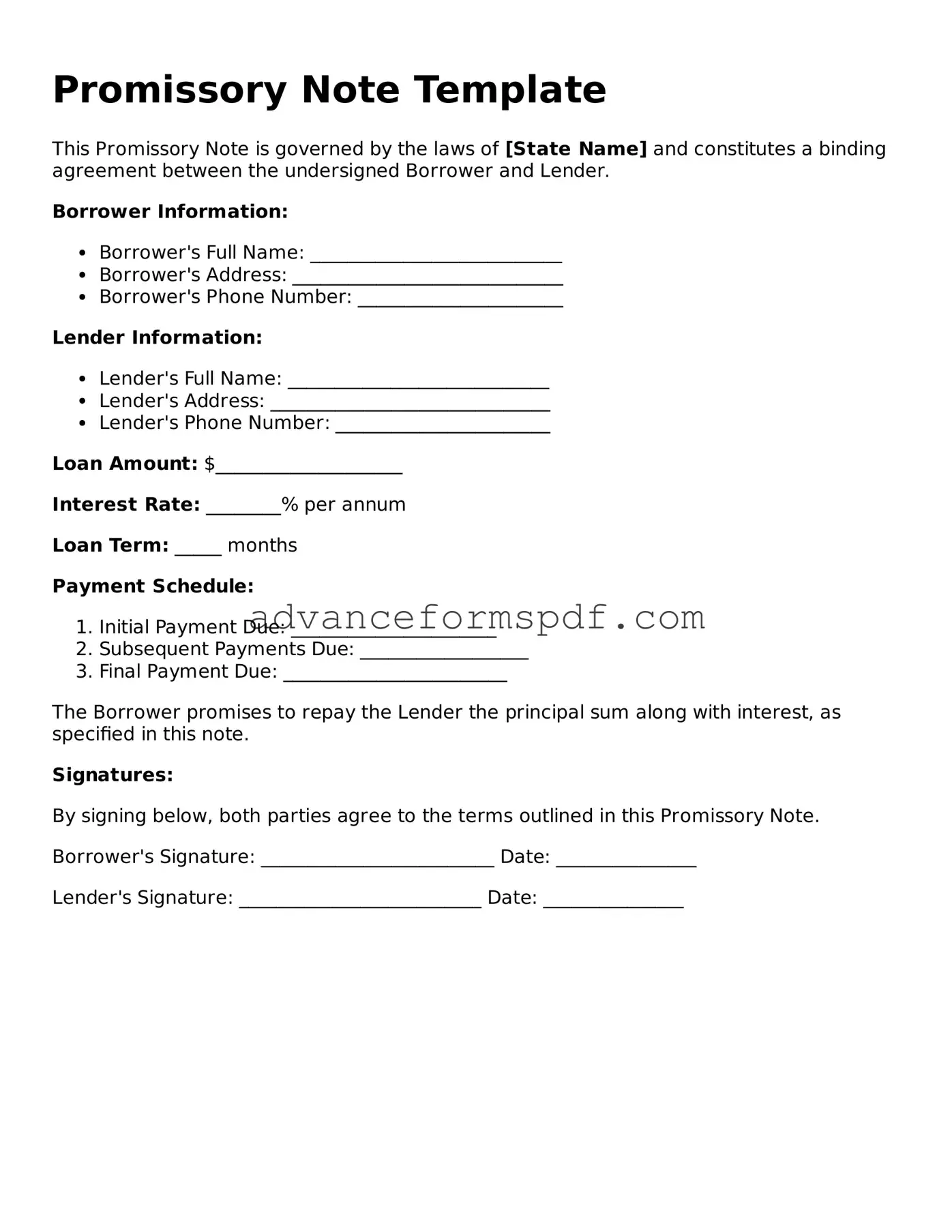

Promissory Note Template

This Promissory Note is governed by the laws of [State Name] and constitutes a binding agreement between the undersigned Borrower and Lender.

Borrower Information:

- Borrower's Full Name: ___________________________

- Borrower's Address: _____________________________

- Borrower's Phone Number: ______________________

Lender Information:

- Lender's Full Name: ____________________________

- Lender's Address: ______________________________

- Lender's Phone Number: _______________________

Loan Amount: $____________________

Interest Rate: ________% per annum

Loan Term: _____ months

Payment Schedule:

- Initial Payment Due: ______________________

- Subsequent Payments Due: __________________

- Final Payment Due: ________________________

The Borrower promises to repay the Lender the principal sum along with interest, as specified in this note.

Signatures:

By signing below, both parties agree to the terms outlined in this Promissory Note.

Borrower's Signature: _________________________ Date: _______________

Lender's Signature: __________________________ Date: _______________

Popular Documents

Share Sale Agreement - Explains the role of any third parties involved in the share transfer, if applicable.

A Power of Attorney form in Arizona is a legal document that allows one person to act on behalf of another in financial or legal matters. This form is essential for ensuring that your wishes are honored when you cannot make decisions for yourself. Understanding its use and implications can provide peace of mind and security for you and your loved ones. For more details, you can refer to Arizona PDF Forms.

Ca Dmv Reg 262 - The form cannot be used as an ownership certificate and must accompany the appropriate titling document.