Free Single-Member Operating Agreement Document

When starting a single-member limited liability company (LLC), one of the most crucial documents to consider is the Single-Member Operating Agreement. This form serves as a foundational blueprint for the operation and management of your LLC, outlining essential aspects such as ownership, decision-making processes, and financial arrangements. By detailing the rights and responsibilities of the sole member, the agreement helps establish clear guidelines that can prevent misunderstandings in the future. It also addresses how profits and losses will be distributed, ensuring that the member knows how their contributions will impact their financial standing. Additionally, the agreement can include provisions for the dissolution of the LLC, providing a roadmap for what happens if the business needs to close. In essence, while it may seem like a simple document, the Single-Member Operating Agreement is a vital tool that not only protects your interests but also enhances the credibility of your business in the eyes of banks and potential investors.

PDF Specifics

| Fact Name | Details |

|---|---|

| Definition | A Single-Member Operating Agreement is a document that outlines the management structure and operating procedures of a single-member limited liability company (LLC). |

| Purpose | This agreement serves to clarify the member's rights and responsibilities, protecting personal assets from business liabilities. |

| State-Specific Forms | Each state may have specific requirements for Single-Member Operating Agreements, reflecting local laws. |

| Governing Laws | The governing law for the agreement is typically based on the state where the LLC is formed, such as Delaware LLC Act or California Corporations Code. |

| Flexibility | The agreement allows the member to set custom rules for the operation of the LLC, including management, profit distribution, and decision-making processes. |

| Tax Treatment | Single-member LLCs are generally treated as disregarded entities for tax purposes, meaning profits and losses are reported on the member's personal tax return. |

| Legal Protection | Having an operating agreement can enhance the legal protection of the member's personal assets by demonstrating the separation between personal and business affairs. |

| Not Mandatory | While not legally required in all states, it is highly recommended to have an operating agreement to avoid disputes and clarify operations. |

How to Write Single-Member Operating Agreement

Filling out the Single-Member Operating Agreement form is an important step in establishing the framework for your business. This document outlines the management structure and operational guidelines for your single-member LLC. Carefully completing this form will help clarify your business's operations and protect your personal assets.

- Obtain the form: Start by downloading the Single-Member Operating Agreement form from a reliable source or your state’s business website.

- Provide your name: Enter your full legal name as the sole member of the LLC at the top of the form.

- Business name: Fill in the name of your LLC as registered with your state. Ensure it matches the official documents.

- Principal office address: Write the physical address where your business operates. This should not be a P.O. Box.

- Effective date: Indicate the date when the agreement will take effect. This is typically the date you sign the document.

- Management structure: Specify that the LLC is managed by you as the sole member. You may want to include any specific management practices you intend to follow.

- Capital contributions: Document any initial contributions you are making to the LLC, such as cash, property, or services.

- Profit and loss distribution: State how profits and losses will be allocated. Typically, this will be 100% to you as the sole member.

- Signature: Sign and date the form. If required, consider having a witness or notary public to validate the document.

After completing the form, review it carefully to ensure all information is accurate. Once satisfied, keep a copy for your records and consider filing it with your state if required. This will help solidify your LLC's legal standing and operational guidelines.

Single-Member Operating Agreement Example

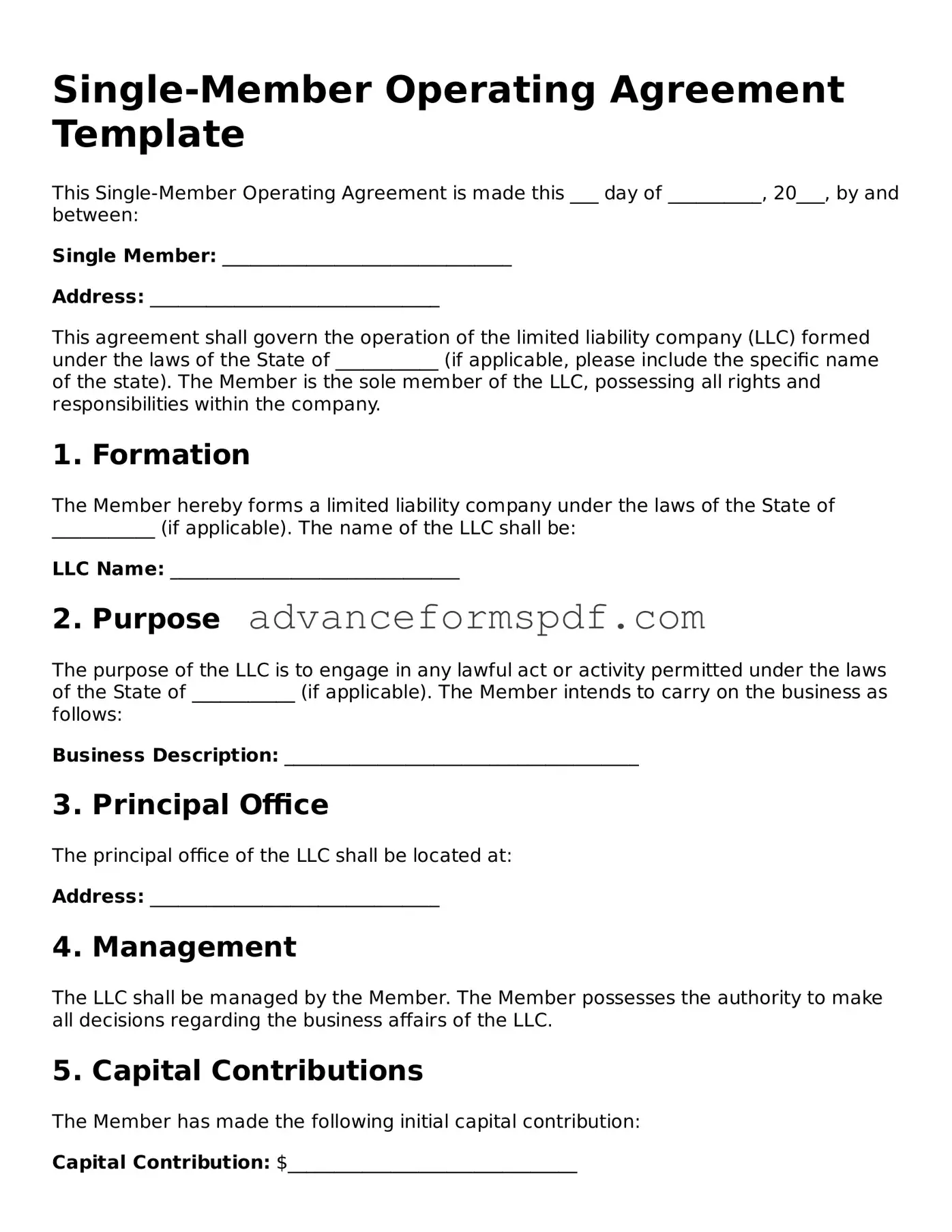

Single-Member Operating Agreement Template

This Single-Member Operating Agreement is made this ___ day of __________, 20___, by and between:

Single Member: _______________________________

Address: _______________________________

This agreement shall govern the operation of the limited liability company (LLC) formed under the laws of the State of ___________ (if applicable, please include the specific name of the state). The Member is the sole member of the LLC, possessing all rights and responsibilities within the company.

1. Formation

The Member hereby forms a limited liability company under the laws of the State of ___________ (if applicable). The name of the LLC shall be:

LLC Name: _______________________________

2. Purpose

The purpose of the LLC is to engage in any lawful act or activity permitted under the laws of the State of ___________ (if applicable). The Member intends to carry on the business as follows:

Business Description: ______________________________________

3. Principal Office

The principal office of the LLC shall be located at:

Address: _______________________________

4. Management

The LLC shall be managed by the Member. The Member possesses the authority to make all decisions regarding the business affairs of the LLC.

5. Capital Contributions

The Member has made the following initial capital contribution:

Capital Contribution: $_______________________________

6. Distributions

All profits and losses of the LLC shall be allocated to the Member. Distributions shall occur at the discretion of the Member.

7. Books and Records

The LLC shall maintain books and records at the principal office. The Member can inspect these records at any reasonable time.

8. Indemnification

The LLC shall indemnify the Member to the fullest extent allowed under the laws of the State of ___________ (if applicable). This includes liability arising from acts performed in good faith on behalf of the LLC.

9. Amendments

This Operating Agreement can only be amended by a written agreement signed by the Member.

10. Governing Law

This agreement shall be governed by and construed under the laws of the State of ___________ (if applicable).

In witness whereof, the undersigned has executed this Single-Member Operating Agreement as of the date first above written:

Signature of Single Member: ___________________________

Date: _______________________