Download Stock Transfer Ledger Form in PDF

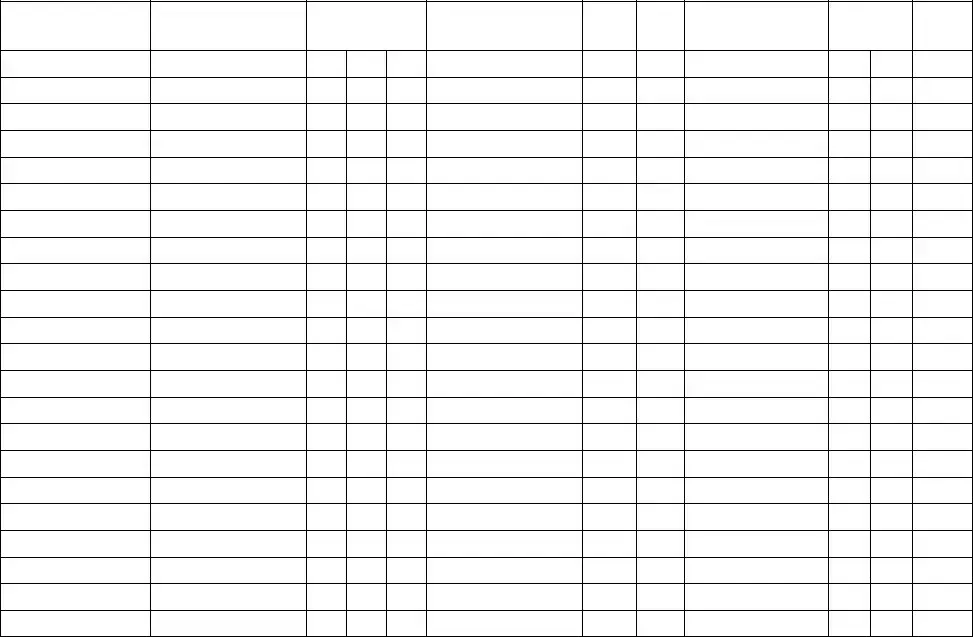

The Stock Transfer Ledger form serves as a crucial document for corporations managing the issuance and transfer of stock. This form captures essential information about each stockholder, including their name and place of residence. It records the details of certificates issued, specifying the certificate number, date of issuance, and the number of shares involved. When shares are transferred, the form requires information about the original issuer, the amount paid for the shares, and the date of transfer. Additionally, it documents the recipient of the shares and indicates whether any certificates were surrendered during the process. Finally, the ledger helps maintain an accurate balance of shares held by each stockholder, providing a clear overview of ownership within the corporation. By organizing this information in a systematic way, the Stock Transfer Ledger form supports transparency and accountability in stock transactions.

Document Data

| Fact Name | Description |

|---|---|

| Purpose | The Stock Transfer Ledger form is used to document the issuance and transfer of stock shares within a corporation. |

| Information Required | Essential details include the corporation's name, stockholder information, certificate numbers, and share amounts. |

| Record Keeping | This form serves as an official record, ensuring that all stock transactions are accurately tracked and maintained. |

| Governing Law | In many states, the use of a Stock Transfer Ledger is governed by corporate laws, such as the Delaware General Corporation Law. |

| Transfer Process | The form outlines the process for transferring shares, including details on the transferor and transferee, along with dates and amounts. |

How to Write Stock Transfer Ledger

Completing the Stock Transfer Ledger form is an essential step in documenting the transfer of stock ownership. This process ensures that all relevant details are accurately recorded, facilitating transparency and compliance with corporate governance. Follow the steps below to fill out the form correctly.

- Enter the Corporation’s Name: At the top of the form, write the full legal name of the corporation for which the stock transfer is being recorded.

- Name of Stockholder: In the designated space, provide the full name of the stockholder who currently holds the shares.

- Place of Residence: Fill in the stockholder's address, including the city, state, and zip code.

- Certificates Issued: Indicate the number of stock certificates that have been issued to the stockholder.

- Certificate Number: Write the certificate number associated with the shares being transferred.

- Date: Record the date on which the stock was issued or transferred.

- Number of Shares Issued: Specify the total number of shares that were issued to the stockholder.

- From Whom Shares Were Transferred: If applicable, note the name of the individual or entity from whom the shares were transferred. If this is the original issue, simply write "original issue."

- Amount Paid Thereon: State the amount paid for the shares being transferred.

- Date of Transfer of Shares: Enter the date on which the transfer of shares occurred.

- To Whom Shares Were Transferred: Provide the name of the individual or entity to whom the shares are being transferred.

- Certificates Surrendered: Indicate whether any certificates were surrendered as part of the transfer process.

- Certificate Number of Surrendered Shares: If certificates were surrendered, note the corresponding certificate number.

- Number of Shares Held (Balance): Finally, record the remaining number of shares held by the stockholder after the transfer.

Stock Transfer Ledger Example

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)

Common PDF Documents

Gifting a Car in Louisiana - The act assists in creating a formal record of charitable giving intentions.

A Non-disclosure Agreement (NDA) is a legal contract that establishes a confidential relationship between parties, ensuring that sensitive information remains protected. In Arizona, this form is essential for businesses and individuals who wish to share proprietary information without the risk of it being disclosed to unauthorized entities. For more information, you can refer to Arizona PDF Forms, which offers valuable resources to help you understand the nuances of the Arizona Non-disclosure Agreement and safeguard your intellectual property to maintain your competitive edge.

Roof Warrenty - The warranty is an assurance of quality and service from MCS Roofing.

Profits or Loss From Business - Schedule C is essential for freelancers and independent contractors to report their earnings.