Free Vehicle Repayment Agreement Document

The Vehicle Repayment Agreement form is a crucial document for anyone involved in financing a vehicle. This form outlines the terms and conditions of the loan, ensuring that both the borrower and lender have a clear understanding of their responsibilities. Key aspects of the agreement include the total amount financed, the interest rate, and the repayment schedule. Additionally, it specifies the consequences of defaulting on the loan, which can include repossession of the vehicle. This document serves as a protective measure for both parties, providing clarity and security throughout the financing process. Understanding the details of this agreement is essential for making informed decisions and avoiding potential pitfalls.

PDF Specifics

| Fact Name | Details |

|---|---|

| Purpose | The Vehicle Repayment Agreement form outlines the terms for repayment of a vehicle loan. |

| Parties Involved | The form typically involves the borrower and the lender, detailing their respective responsibilities. |

| Governing Law | The agreement is subject to state-specific laws, which may vary by jurisdiction. |

| Payment Terms | The form specifies the amount to be repaid, payment schedule, and interest rates, if applicable. |

| Default Consequences | It outlines the consequences of defaulting on the repayment, including potential repossession of the vehicle. |

| Modification Clause | The agreement may include provisions for modifying the terms, should both parties agree. |

| Signatures | Both parties must sign the form for it to be legally binding. |

| State-Specific Forms | Some states may have specific forms or additional requirements under their laws. |

| Record Keeping | It is advisable for both parties to keep a copy of the signed agreement for their records. |

How to Write Vehicle Repayment Agreement

Filling out the Vehicle Repayment Agreement form is a straightforward process. Once completed, you will have a clear understanding of your repayment terms. Follow these steps carefully to ensure that all necessary information is provided accurately.

- Begin by entering your full name in the designated field.

- Provide your current address, including city, state, and ZIP code.

- Fill in your contact information, including your phone number and email address.

- Enter the details of the vehicle, including make, model, year, and VIN (Vehicle Identification Number).

- Specify the total amount being financed for the vehicle.

- Indicate the repayment terms, including the payment amount, frequency (weekly, bi-weekly, or monthly), and the total number of payments.

- Include the date of the agreement.

- Sign the form to confirm your agreement to the terms outlined.

Once you have completed these steps, review the form for accuracy before submitting it. This ensures that everything is correct and helps avoid any delays in processing your agreement.

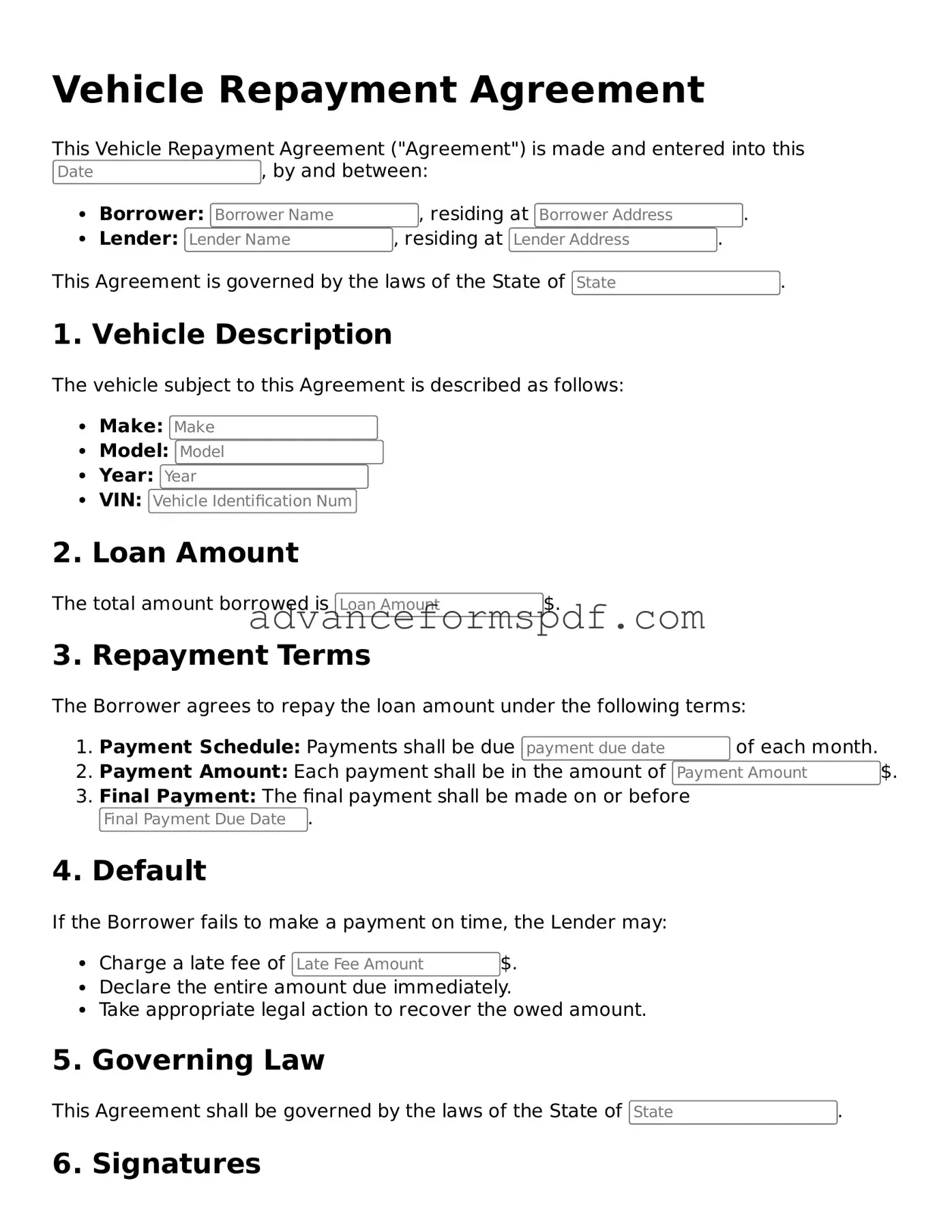

Vehicle Repayment Agreement Example

Vehicle Repayment Agreement

This Vehicle Repayment Agreement ("Agreement") is made and entered into this , by and between:

- Borrower: , residing at .

- Lender: , residing at .

This Agreement is governed by the laws of the State of .

1. Vehicle Description

The vehicle subject to this Agreement is described as follows:

- Make:

- Model:

- Year:

- VIN:

2. Loan Amount

The total amount borrowed is $.

3. Repayment Terms

The Borrower agrees to repay the loan amount under the following terms:

- Payment Schedule: Payments shall be due of each month.

- Payment Amount: Each payment shall be in the amount of $.

- Final Payment: The final payment shall be made on or before .

4. Default

If the Borrower fails to make a payment on time, the Lender may:

- Charge a late fee of $.

- Declare the entire amount due immediately.

- Take appropriate legal action to recover the owed amount.

5. Governing Law

This Agreement shall be governed by the laws of the State of .

6. Signatures

By signing below, both parties agree to the terms set forth in this Vehicle Repayment Agreement.

Borrower: _______________________ Date: _______________

Lender: _______________________ Date: _______________

Popular Documents

Waiver of Liability Form - Allows individuals to freely engage without future claims.

In order to create a clear understanding between landlords and tenants, it's crucial to utilize documents such as the Arizona Residential Lease Agreement, which provides a comprehensive outline of rental terms. Details like the rent amount, lease duration, and maintenance responsibilities are essential components of this agreement. For those interested in accessing the necessary forms for this process, you can refer to Arizona PDF Forms, which offers a reliable source for these legal documents.

How to Write Letter of Intent for Job - This form often includes essential details such as job title and start dates.